- Germany

- /

- Specialty Stores

- /

- XTRA:ART

Here's Why We Think artnet AG's (ETR:ART) CEO Compensation Looks Fair for the time being

Performance at artnet AG (ETR:ART) has been reasonably good and CEO Jacob Pabst has done a decent job of steering the company in the right direction. This is something shareholders will keep in mind as they cast their votes on company resolutions such as executive remuneration in the upcoming AGM on 23 December 2021. Here is our take on why we think the CEO compensation looks appropriate.

Check out our latest analysis for artnet

How Does Total Compensation For Jacob Pabst Compare With Other Companies In The Industry?

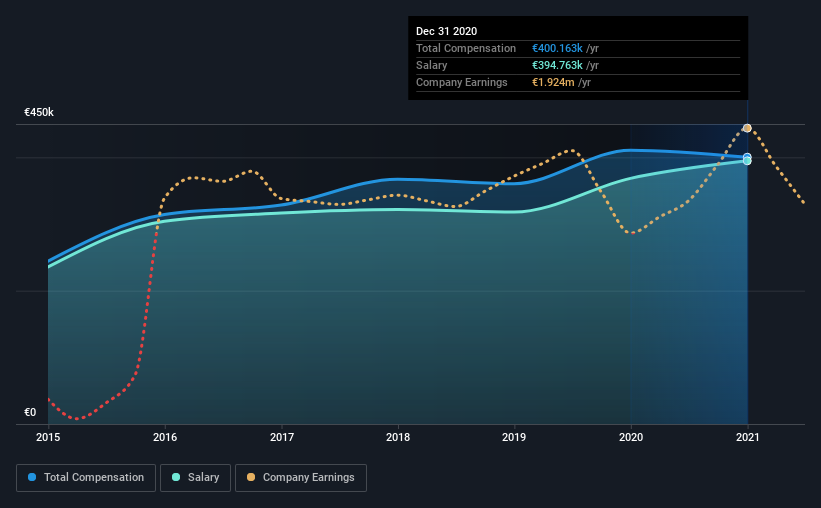

At the time of writing, our data shows that artnet AG has a market capitalization of €64m, and reported total annual CEO compensation of €400k for the year to December 2020. That is, the compensation was roughly the same as last year. In particular, the salary of €394.8k, makes up a huge portion of the total compensation being paid to the CEO.

In comparison with other companies in the industry with market capitalizations under €177m, the reported median total CEO compensation was €333k. From this we gather that Jacob Pabst is paid around the median for CEOs in the industry.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €395k | €368k | 99% |

| Other | €5.4k | €42k | 1% |

| Total Compensation | €400k | €411k | 100% |

On an industry level, roughly 69% of total compensation represents salary and 31% is other remuneration. artnet is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

artnet AG's Growth

Over the past three years, artnet AG has seen its earnings per share (EPS) grow by 2.1% per year. The trailing twelve months of revenue was pretty much the same as the prior period.

We're not particularly impressed by the revenue growth, but it is good to see modest EPS growth. So there are some positives here, but not enough to earn high praise. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has artnet AG Been A Good Investment?

Boasting a total shareholder return of 322% over three years, artnet AG has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

artnet pays its CEO a majority of compensation through a salary. The company's decent performance might have made most shareholders happy, possibly making CEO remuneration the least of the concerns to be discussed in the upcoming AGM. In saying that, any proposed increase to CEO compensation will still be assessed on how reasonable it is based on performance and industry benchmarks.

CEO compensation can have a massive impact on performance, but it's just one element. We did our research and spotted 2 warning signs for artnet that investors should look into moving forward.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

If you're looking to trade Artnet, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:ART

Artnet

Through its subsidiary, operates as an online resource of art in the United States, Germany, and internationally.

Slight with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives