- Germany

- /

- Specialty Stores

- /

- XTRA:AG1

AUTO1 Group (XTRA:AG1) Profitability Marks Shift, Challenges Bearish Narratives on Growth Quality

Reviewed by Simply Wall St

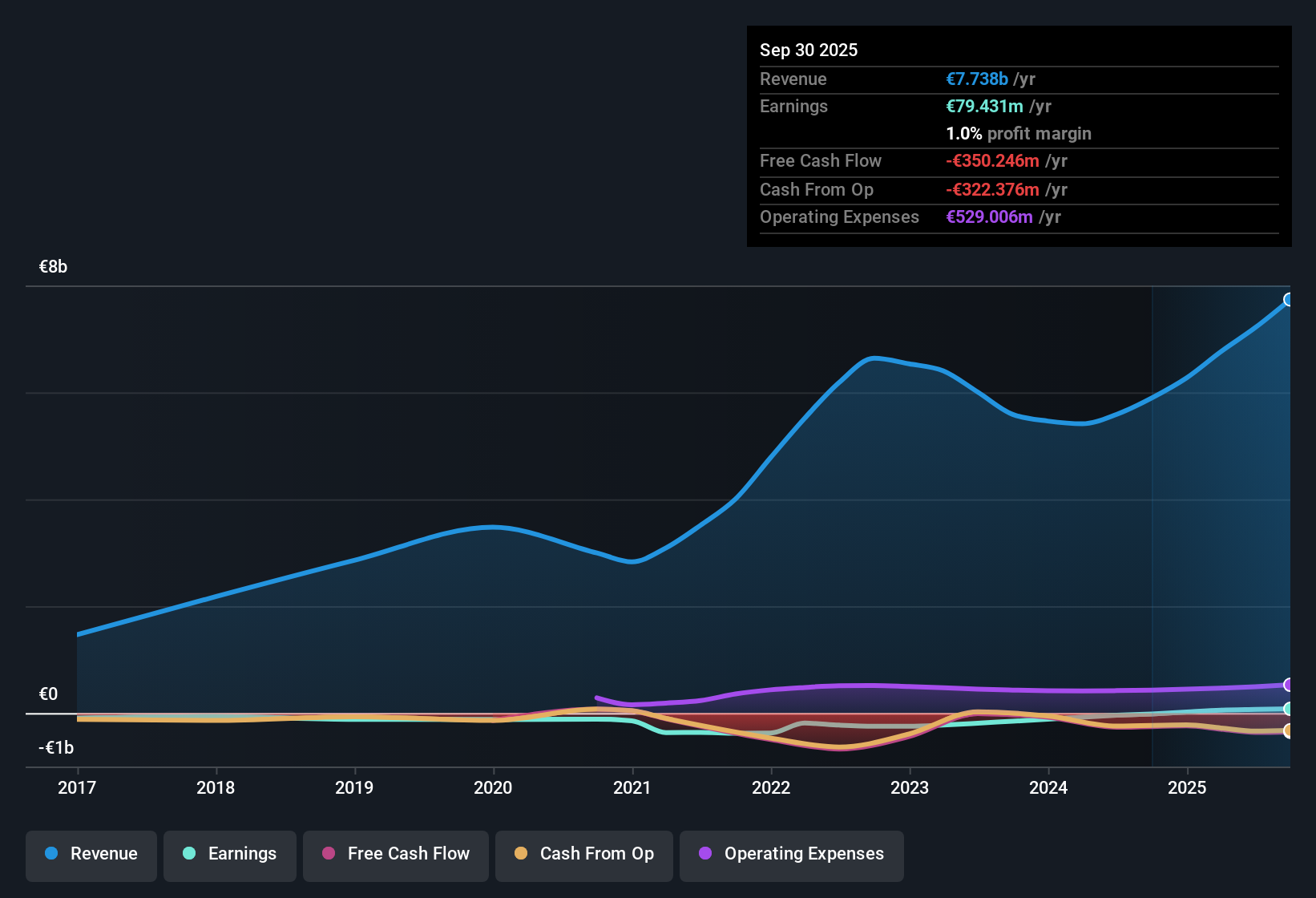

AUTO1 Group (XTRA:AG1) recently achieved profitability, with its net profit margin increasing and earnings growing at an annualized pace of 43.7% over the past five years. Looking ahead, analysts forecast earnings to grow by 42.84% per year and revenue to rise by 10.5% annually, surpassing the German market's 6.1% growth forecast. Since the company’s earnings are projected to expand nearly two and a half times faster than the broader German market, investors are likely to focus on whether these top- and bottom-line gains can continue to support the premium valuation currently reflected in the shares.

See our full analysis for AUTO1 Group.Next, we will examine how these headline numbers compare with prevailing narratives about AUTO1 Group’s outlook to see which stories hold up and which might be challenged by the latest results.

See what the community is saying about AUTO1 Group

Operational Efficiency Target Shifts Margins

- The group's net margin stands at 0.8% today, with management forecasting a jump to 2.1% over the next three years.

- Analysts' consensus narrative notes that AUTO1’s margin progress aligns with its long-term efficiency ambitions, but the path includes volatility:

- Despite achieving segment profitability for Autohero and margin expansion from investment in technology, seasonally strong Q1 results may not be matched in weaker quarters, potentially impacting overall margin trajectory.

- The group’s 5% to 9% margin target requires ongoing cost control and scaling benefits, especially with further operational expenses ramping up in marketing and staffing.

- To see what the community is saying about AUTO1 Group See what the community is saying about AUTO1 Group

Cash Strength Counters Debt Risk

- With €601 million in cash and no corporate debt, AUTO1 maintains exceptional balance sheet flexibility for investments.

- Analysts' consensus narrative suggests this war chest offers a cushion against seasonal downturns and allows funding for expansion:

- Strong liquidity supports the ongoing rollout of new branches and technology investments, reinforcing the group’s growth story even if operations face short-term headwinds.

- However, increased operational spending, especially in Autohero’s higher investment mode, may temporarily erode cash reserves if profitability lags behind ambitious targets.

Valuation Premium Hinges on Future Growth Delivery

- At a price-to-earnings ratio of 71.8x, AUTO1 trades well above both its peer average of 18.2x and the European Specialty Retail sector average of 19.2x, making future delivery of growth critical to justify this premium.

- Analysts' consensus narrative highlights the tension between robust projected growth and the price investors currently pay:

- Although revenue and earnings forecasts signal outperformance versus the broader German market, the current share price of €25.90 sits below the DCF fair value of €27.71 and the consensus price target of €31.08, indicating some room for upside if execution remains solid.

- The gap widens if profit expansion falls short or sector multiples compress, as earnings quality risks and high non-cash components remain top of mind for skeptics.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for AUTO1 Group on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Notice something in the data that stands out? Share your insight and shape your own view in just a few minutes, then Do it your way

A great starting point for your AUTO1 Group research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

See What Else Is Out There

AUTO1 Group’s premium valuation looks risky if its ambitious profit growth targets are missed or if sector multiples fall. Margins remain thin and volatile, which adds to potential downside.

Worried about overpaying? You can use these 848 undervalued stocks based on cash flows to focus on companies trading below fair value and prioritizing more sustainable upside potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:AG1

AUTO1 Group

A technology company, operates a digital automotive platform for buying and selling used cars online in Germany, France, Italy, and internationally.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Title: Market Sentiment Is Dead Wrong — Here's Why PSEC Deserves a Second Look

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion