- Germany

- /

- Retail REITs

- /

- XTRA:DKG

Deutsche Konsum REIT-AG's (ETR:DKG) CEO Looks Due For A Compensation Raise

The impressive results at Deutsche Konsum REIT-AG (ETR:DKG) recently will be great news for shareholders. This would be kept in mind at the upcoming AGM on 11 March 2021 which will be a chance for them to hear the board review the financial results, discuss future company strategy and vote on resolutions such as executive remuneration and other matters. Let's take a look at why we think the CEO has done a good job and we'll present the case for a bump in pay.

View our latest analysis for Deutsche Konsum REIT-AG

How Does Total Compensation For Rolf Elgeti Compare With Other Companies In The Industry?

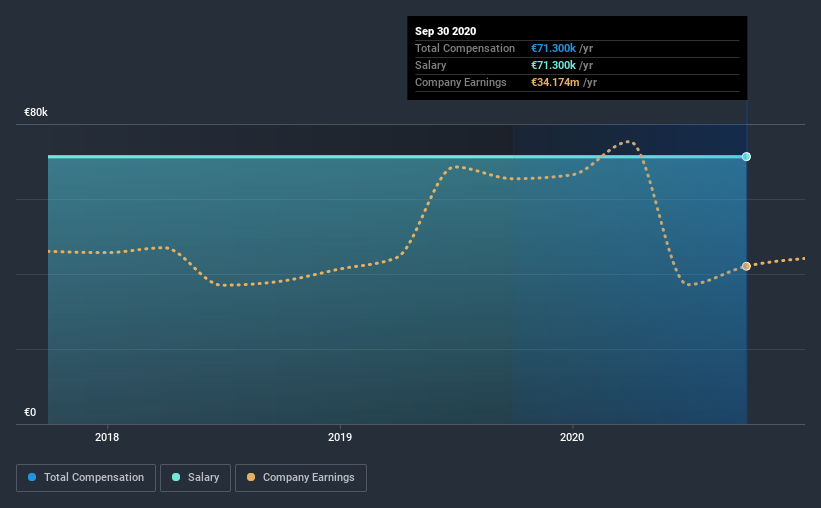

Our data indicates that Deutsche Konsum REIT-AG has a market capitalization of €548m, and total annual CEO compensation was reported as €71k for the year to September 2020. There was no change in the compensation compared to last year. Notably, the salary of €71k is the entirety of the CEO compensation.

On comparing similar companies from the same industry with market caps ranging from €336m to €1.3b, we found that the median CEO total compensation was €522k. That is to say, Rolf Elgeti is paid under the industry median. Moreover, Rolf Elgeti also holds €4.3m worth of Deutsche Konsum REIT-AG stock directly under their own name, which reveals to us that they have a significant personal stake in the company.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €71k | €71k | 100% |

| Other | - | - | - |

| Total Compensation | €71k | €71k | 100% |

Speaking on an industry level, nearly 51% of total compensation represents salary, while the remainder of 49% is other remuneration. At the company level, Deutsche Konsum REIT-AG pays Rolf Elgeti solely through a salary, preferring to go down a conventional route. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

Deutsche Konsum REIT-AG's Growth

Over the past three years, Deutsche Konsum REIT-AG has seen its funds from operations (FFO) grow by 49% per year. In the last year, its revenue is up 42%.

Shareholders would be glad to know that the company has improved itself over the last few years. Most shareholders would be pleased to see strong revenue growth combined with FFO growth. This combo suggests a fast growing business. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Deutsche Konsum REIT-AG Been A Good Investment?

Most shareholders would probably be pleased with Deutsche Konsum REIT-AG for providing a total return of 51% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Deutsche Konsum REIT-AG pays CEO compensation exclusively through a salary, with non-salary compensation completely ignored. Given the company's decent performance, the CEO remuneration policy might not be shareholders' central point of focus in the AGM. In fact, strategic decisions that could impact the future of the business might be a far more interesting topic for investors as it would help them set their longer-term expectations.

CEO pay is simply one of the many factors that need to be considered while examining business performance. That's why we did our research, and identified 4 warning signs for Deutsche Konsum REIT-AG (of which 1 shouldn't be ignored!) that you should know about in order to have a holistic understanding of the stock.

Switching gears from Deutsche Konsum REIT-AG, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

If you’re looking to trade Deutsche Konsum REIT-AG, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:DKG

Deutsche Konsum REIT-AG

A real estate investment trust, engages in the acquisition, leasing and management, and sale of retail properties in Germany.

Fair value with moderate growth potential.

Market Insights

Community Narratives