- Germany

- /

- Real Estate

- /

- XTRA:VNA

Vonovia (XTRA:VNA) Faces Earnings Challenges with Net Loss Amidst Expansion into Emerging Markets

Reviewed by Simply Wall St

Navigate through the intricacies of Vonovia with our comprehensive report here.

Key Assets Propelling Vonovia Forward

The anticipated profitability within the next three years marks a significant milestone for Vonovia, reflecting a growth trajectory that surpasses market averages. This is complemented by the company's interest coverage ratio of 3.8x, underscoring its financial stability. Shareholders have also benefited from the lack of dilution over the past year, reinforcing confidence in the company's capital management. Furthermore, projected earnings growth of 109.39% annually highlights Vonovia's potential for substantial financial improvement. In terms of valuation, while the Price-To-Sales Ratio of 4x suggests a premium relative to the industry average of 3.8x, it is seen as justified given the company's growth prospects. Explore the current health of Vonovia and how it reflects on its financial stability and growth potential.

Critical Issues Affecting the Performance of Vonovia and Areas for Growth

Despite its promising outlook, Vonovia faces challenges, including a current lack of profitability and a Return on Equity of -10.37%. Revenue is expected to decrease by 19% annually over the next three years, posing a significant hurdle. The volatility in dividend payments over the past decade further complicates its financial situation. Recent earnings reports revealed a net loss of €74 million for the third quarter, contrasting with a net income of €404.5 million in the previous year. Such figures highlight the need for strategic adjustments to enhance financial performance. To gain deeper insights into Vonovia's historical performance, explore our detailed analysis of past performance.

Emerging Markets Or Trends for Vonovia

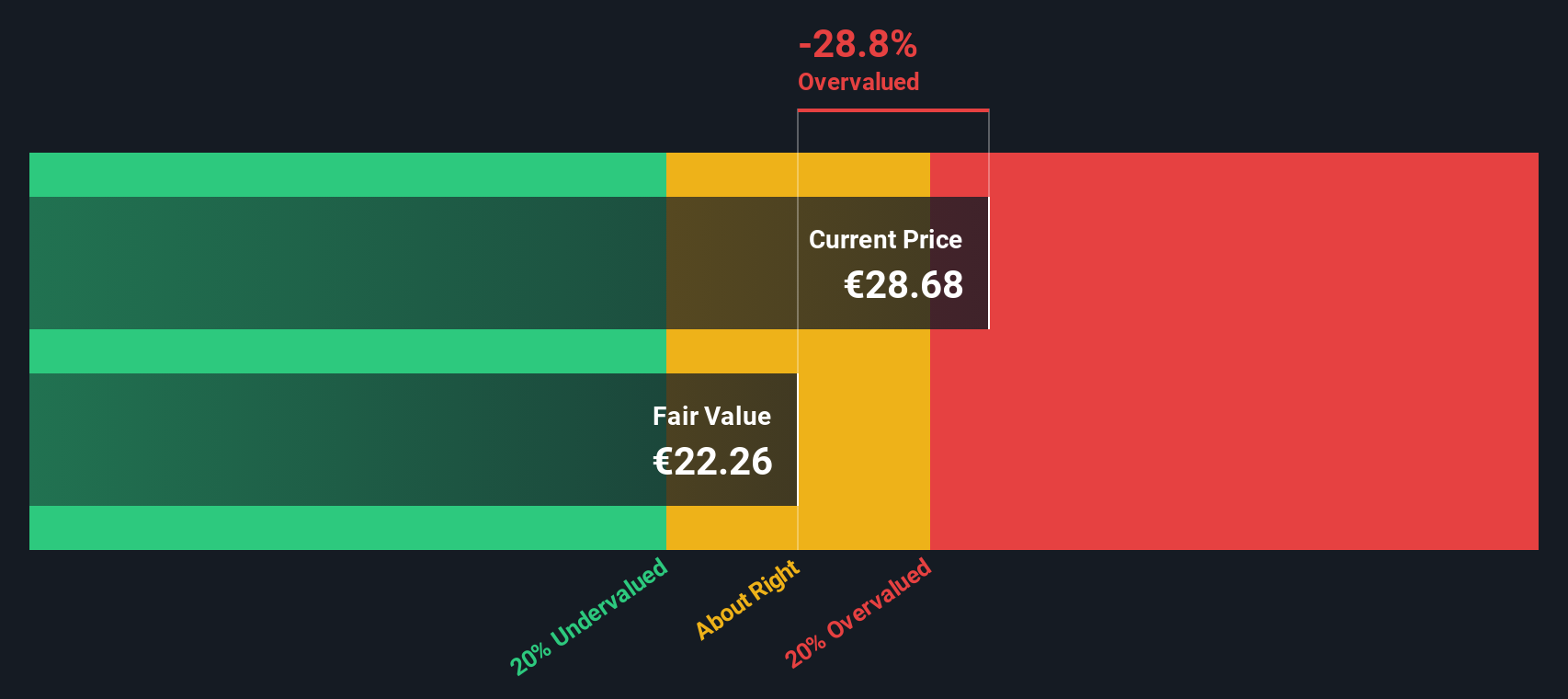

Opportunities abound as Vonovia eyes expansion into emerging markets, potentially driving future growth. The company's digital transformation initiatives aim to bolster operational efficiency and customer engagement, reflecting a proactive approach to leveraging technology. Regulatory changes may also open new avenues, particularly in the healthcare sector, allowing Vonovia to capitalize on evolving market conditions. Analysts have set a target price more than 20% above the current share price, indicating potential for appreciation. See what the latest analyst reports say about Vonovia's future prospects and potential market movements.

Key Risks and Challenges That Could Impact Vonovia's Success

Vonovia's high net debt to equity ratio of 143.9% presents a financial risk that warrants attention. Additionally, the dividend yield of 3.07% is lower than the top 25% of German market payers, which might deter investors seeking higher returns. Economic uncertainties and supply chain disruptions pose further threats, potentially impacting production timelines and consumer spending. Navigating complex regulatory environments remains a challenge, particularly in new markets. Learn about Vonovia's dividend strategy and how it impacts shareholder returns and financial stability.

Conclusion

Vonovia's anticipated profitability and impressive earnings growth potential over the next three years signal a promising trajectory that exceeds market expectations. However, the company faces challenges, such as a negative Return on Equity and declining revenues, which necessitate strategic adjustments for improved financial performance. Despite its high net debt to equity ratio and lower dividend yield, Vonovia's expansion into emerging markets and digital transformation initiatives offer avenues for growth. The company's Price-To-Sales Ratio of 4x, while higher than the industry average, reflects its strong growth prospects and positions it as a compelling investment relative to peers. These factors collectively underscore Vonovia's potential for future success, albeit with the need for careful navigation of financial risks and market challenges.

Summing It All Up

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About XTRA:VNA

Vonovia

Operates as an integrated residential real estate company in Europe.

Moderate growth potential second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives