- Germany

- /

- Real Estate

- /

- XTRA:TEG

TAG Immobilien (XTRA:TEG) Eyes Profitability with Eco-Friendly Launch Despite Rising Losses and Debt

Reviewed by Simply Wall St

Unlock comprehensive insights into our analysis of TAG Immobilien stock here.

Key Assets Propelling TAG Immobilien Forward

TAG Immobilien is poised for a promising future, with expectations of profitability within three years. The company has demonstrated a growth trajectory, achieving a 15% revenue increase year-over-year, as highlighted by CEO Martin Thiel. This growth, driven by strong demand in key markets, showcases effective market penetration and customer acquisition strategies. Additionally, the company's ability to expand margins to 25% reflects improved operational efficiencies and cost management. Strategic partnerships further enhance distribution capabilities, broadening the customer base and bolstering sales and brand visibility.

Vulnerabilities Impacting TAG Immobilien

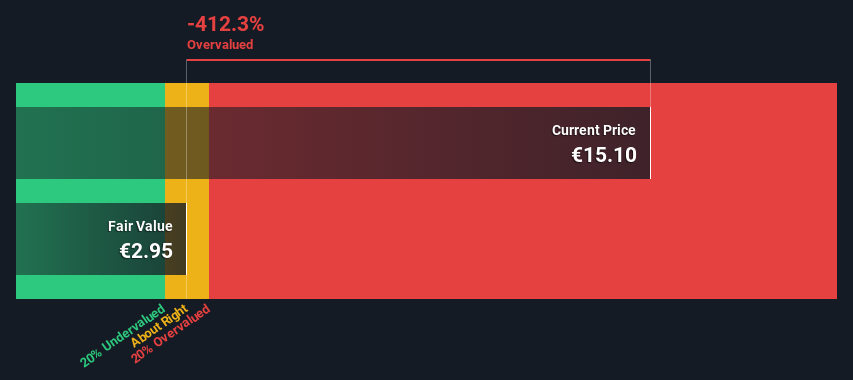

However, challenges persist, with the company currently unprofitable and losses increasing at a rate of 45.3% annually. The high debt level, with a net debt to equity ratio of 100.7%, adds to financial concerns. Supply chain disruptions have impacted production timelines, highlighting vulnerability to external pressures. The slower-than-expected growth in the Asia-Pacific region suggests a need for strategic reassessment to capitalize on growth opportunities. Moreover, the company is trading above its estimated fair value, indicating potential overvaluation despite favorable comparisons with peers and industry averages.

Future Prospects for TAG Immobilien in the Market

Looking ahead, TAG Immobilien is well-positioned to leverage emerging opportunities. The upcoming launch of an eco-friendly product line aligns with consumer trends towards sustainability, potentially capturing a new customer segment and enhancing brand loyalty. Investments in AI technology are set to streamline operations and improve customer engagement, reinforcing the company's commitment to innovation. Furthermore, expanding services into emerging markets could provide new revenue streams, reflecting a forward-thinking approach to growth.

Competitive Pressures and Market Risks Facing TAG Immobilien

Nonetheless, the company must navigate economic headwinds and inflationary pressures, as noted by Martin Thiel. Intense competition requires continuous innovation to maintain market share. Regulatory changes in key markets pose additional risks, necessitating a strategic approach to risk management. Despite these challenges, TAG Immobilien's proactive stance and strategic initiatives position it to capitalize on future growth opportunities.

Conclusion

TAG Immobilien is on a promising path towards profitability within three years, driven by strong market demand and strategic initiatives that have resulted in a 15% increase in revenue and expanded margins. However, the company faces significant challenges, including a 45.3% annual increase in losses and a high net debt to equity ratio of 100.7%, which could hinder financial stability. Despite these hurdles, the upcoming launch of an eco-friendly product line and investments in AI technology position the company to capture new customer segments and streamline operations. While currently trading above its estimated fair value, indicating potential market optimism, TAG Immobilien's proactive strategies and commitment to innovation provide a foundation for future growth, albeit with careful management of financial and market risks.

Seize The Opportunity

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

Valuation is complex, but we're here to simplify it.

Discover if TAG Immobilien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Simply Wall St analyst Simply Wall St and Simply Wall St have no position in any of the companies mentioned. This article is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

About XTRA:TEG

TAG Immobilien

A real estate company, engages in the acquisition, development, and management of residential real estate properties in Germany.

Moderate growth potential and slightly overvalued.