- Germany

- /

- Real Estate

- /

- XTRA:LEG

LEG Immobilien (XTRA:LEG): Valuation in Focus Following Strong Earnings and Positive Insider Signals

Reviewed by Simply Wall St

LEG Immobilien (XTRA:LEG) just released its third quarter results, and the numbers are drawing attention. Sales and net income both saw significant growth compared to last year. This performance is sparking conversation among investors about the company’s direction.

See our latest analysis for LEG Immobilien.

Following the strong earnings announcement, LEG Immobilien’s share price has seen a modest bounce, but momentum remains challenged. Its 1-year total shareholder return is still down almost 20%, and its 5-year total return is firmly negative. While the recent surge in sales and insider confidence may hint at improving sentiment, it is clear investors are still weighing long-term risks and valuation against short-term results.

If you’re interested in what else is making waves in the market, now’s a good time to broaden your search and discover fast growing stocks with high insider ownership

With shares still trading well below analyst price targets and results beating expectations, investors now face a crucial question: is LEG Immobilien undervalued at current levels, or is the market already factoring in any future recovery?

Price-to-Earnings of 8.3x: Is it justified?

LEG Immobilien is trading at a price-to-earnings (P/E) ratio of 8.3x, notably higher than the peer average of 6.7x and slightly below the German Real Estate industry average of 10.8x. At the most recent closing price of €65.4, the stock appears somewhat expensive compared to similar companies in the sector.

The price-to-earnings multiple tells investors how much they are paying for each euro of earnings. In real estate, the P/E ratio can reflect market expectations about future profitability, stability, and income growth potential. A higher P/E suggests investors are anticipating stronger results ahead or are willing to pay a premium for perceived quality and resilience.

While LEG’s P/E is above the peer group, it remains well under the broader German market average (17.8x). However, considering LEG’s recent return to profitability and a five-year compound decline in earnings, the premium multiple raises questions about whether the market is too optimistic on a quick recovery. Notably, its current P/E is around half the estimated “fair” ratio of 16x, offering a potential value re-rating if future growth materializes.

Explore the SWS fair ratio for LEG Immobilien

Result: Price-to-Earnings of 8.3x (OVERVALUED)

However, persistent revenue declines and a negative five-year total return remain significant concerns. These factors could derail optimism around recent profitability gains.

Find out about the key risks to this LEG Immobilien narrative.

Another View: Discounted Cash Flow Tells a Different Story

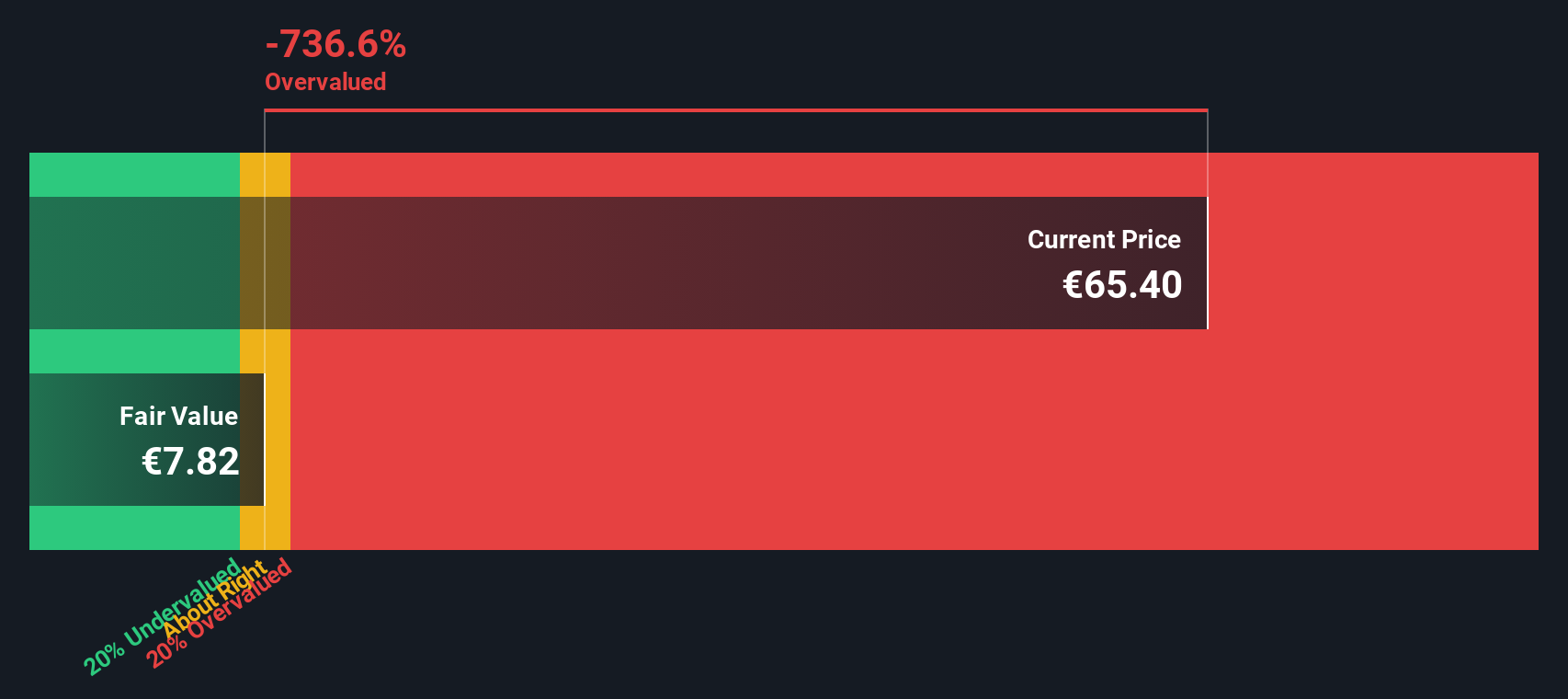

While the P/E ratio hints at some upside, our DCF model suggests a contrasting outlook. The SWS DCF model estimates LEG Immobilien’s fair value at just €7.82 per share, which is dramatically below its current price. This result implies the stock may be considerably overvalued according to cash flow fundamentals. Which valuation should investors trust?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out LEG Immobilien for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 857 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own LEG Immobilien Narrative

If you see things differently or want to dive deeper into the numbers, you can quickly build and share your own take on LEG Immobilien’s story. Do it your way.

A great starting point for your LEG Immobilien research is our analysis highlighting 3 key rewards and 3 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Missed opportunities can cost you, so take charge by seeking out the next big winners. Make your search more effective with these standout stock ideas:

- Boost your income potential and tap into steady payouts with these 15 dividend stocks with yields > 3%, which offers yields above 3%.

- Gain an edge in technology’s hottest frontier by starting with these 25 AI penny stocks, a leader in artificial intelligence innovation.

- Future-proof your portfolio and catch emerging leaders in digital finance by checking out these 82 cryptocurrency and blockchain stocks, a builder of tomorrow’s blockchain economy.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:LEG

Average dividend payer with low risk.

Similar Companies

Market Insights

Community Narratives