- Germany

- /

- Real Estate

- /

- XTRA:GYC

The five-year loss for Grand City Properties (ETR:GYC) shareholders likely driven by its shrinking earnings

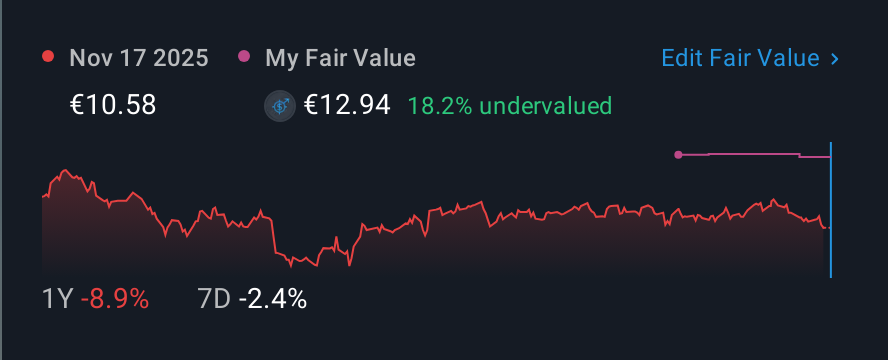

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers At this point some shareholders may be questioning their investment in Grand City Properties S.A. (ETR:GYC), since the last five years saw the share price fall 45%.

While the stock has risen 3.3% in the past week but long term shareholders are still in the red, let's see what the fundamentals can tell us.

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

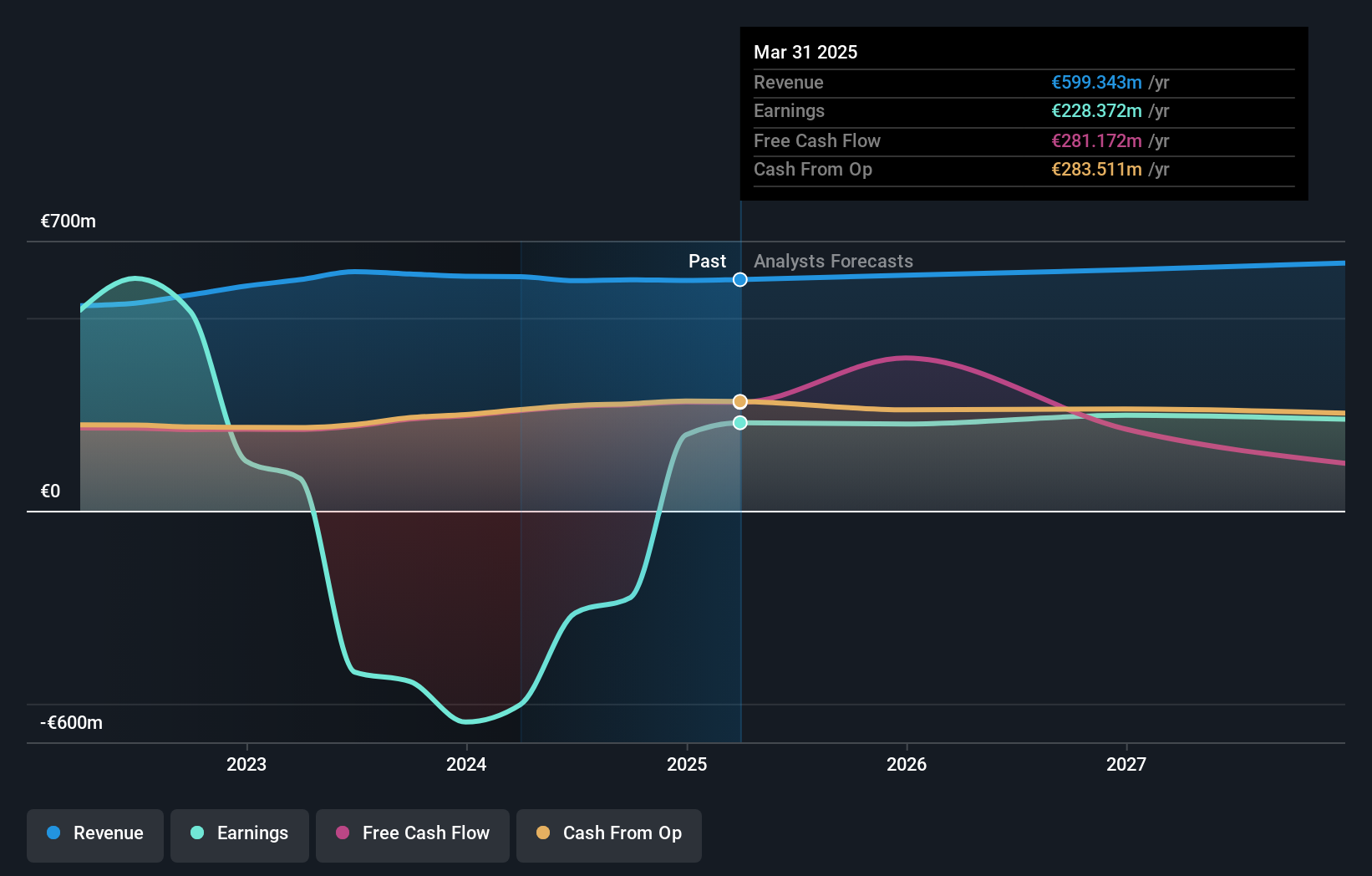

Grand City Properties became profitable within the last five years. Most would consider that to be a good thing, so it's counter-intuitive to see the share price declining. Other metrics might give us a better handle on how its value is changing over time.

Revenue is actually up 3.0% over the time period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

We know that Grand City Properties has improved its bottom line lately, but what does the future have in store? So it makes a lot of sense to check out what analysts think Grand City Properties will earn in the future (free profit forecasts).

What About The Total Shareholder Return (TSR)?

We've already covered Grand City Properties' share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Grand City Properties shareholders, and that cash payout explains why its total shareholder loss of 40%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Grand City Properties shareholders are down 2.6% for the year, but the market itself is up 27%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Take risks, for example - Grand City Properties has 2 warning signs (and 1 which doesn't sit too well with us) we think you should know about.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:GYC

Grand City Properties

Engages in the residential real estate business in Germany, the United Kingdom, and internationally.

Fair value with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives