- Germany

- /

- Real Estate

- /

- XTRA:DWNI

Investors in Deutsche Wohnen (ETR:DWNI) have unfortunately lost 48% over the last three years

While it may not be enough for some shareholders, we think it is good to see the Deutsche Wohnen SE (ETR:DWNI) share price up 14% in a single quarter. But that doesn't change the fact that the returns over the last three years have been less than pleasing. In fact, the share price is down 49% in the last three years, falling well short of the market return.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

View our latest analysis for Deutsche Wohnen

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

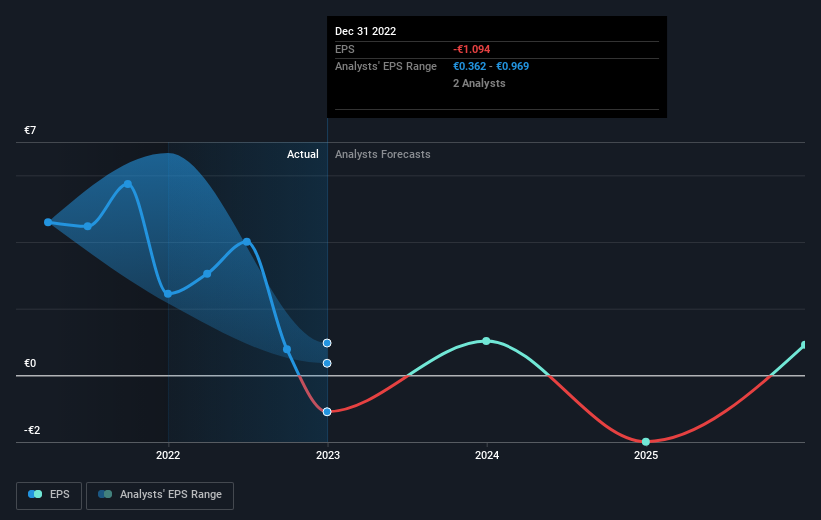

Over the three years that the share price declined, Deutsche Wohnen's earnings per share (EPS) dropped significantly, falling to a loss. Extraordinary items contributed to this situation. Due to the loss, it's not easy to use EPS as a reliable guide to the business. But it's safe to say we'd generally expect the share price to be lower as a result!

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

This free interactive report on Deutsche Wohnen's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

A Different Perspective

Deutsche Wohnen shareholders are down 3.9% for the year (even including dividends), but the market itself is up 8.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 7% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. It's always interesting to track share price performance over the longer term. But to understand Deutsche Wohnen better, we need to consider many other factors. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with Deutsche Wohnen , and understanding them should be part of your investment process.

Of course Deutsche Wohnen may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:DWNI

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives