- Germany

- /

- Real Estate

- /

- XTRA:DIC

Here's Why It's Unlikely That Branicks Group AG's (ETR:DIC) CEO Will See A Pay Rise This Year

Key Insights

- Branicks Group will host its Annual General Meeting on 3rd of July

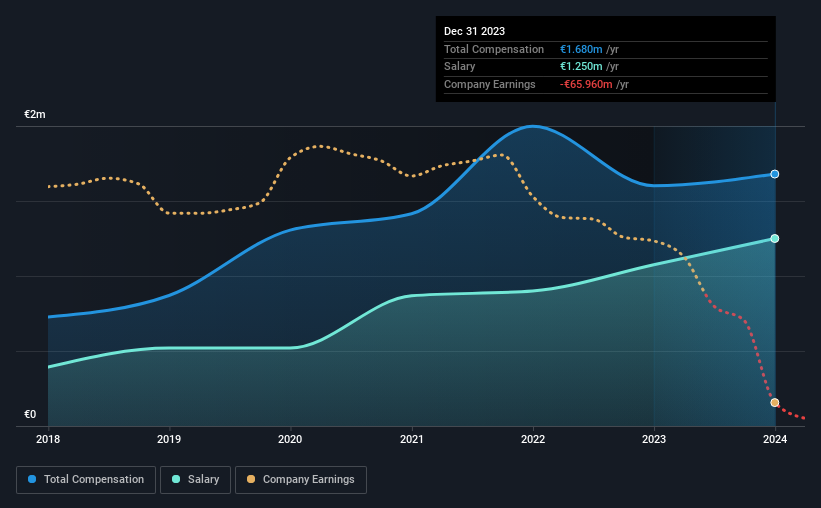

- CEO Sonja Warntges' total compensation includes salary of €1.25m

- The overall pay is 287% above the industry average

- Branicks Group's three-year loss to shareholders was 84% while its EPS was down 103% over the past three years

The results at Branicks Group AG (ETR:DIC) have been quite disappointing recently and CEO Sonja Warntges bears some responsibility for this. Shareholders will be interested in what the board will have to say about turning performance around at the next AGM on 3rd of July. They will also get a chance to influence managerial decision-making through voting on resolutions such as executive remuneration, which may impact firm value in the future. The data we present below explains why we think CEO compensation is not consistent with recent performance.

See our latest analysis for Branicks Group

Comparing Branicks Group AG's CEO Compensation With The Industry

At the time of writing, our data shows that Branicks Group AG has a market capitalization of €167m, and reported total annual CEO compensation of €1.7m for the year to December 2023. That's just a smallish increase of 4.9% on last year. In particular, the salary of €1.25m, makes up a huge portion of the total compensation being paid to the CEO.

On comparing similar companies from the German Real Estate industry with market caps ranging from €93m to €373m, we found that the median CEO total compensation was €434k. Accordingly, our analysis reveals that Branicks Group AG pays Sonja Warntges north of the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | €1.3m | €1.1m | 74% |

| Other | €430k | €527k | 26% |

| Total Compensation | €1.7m | €1.6m | 100% |

On an industry level, around 58% of total compensation represents salary and 42% is other remuneration. According to our research, Branicks Group has allocated a higher percentage of pay to salary in comparison to the wider industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Branicks Group AG's Growth Numbers

Over the last three years, Branicks Group AG has shrunk its earnings per share by 103% per year. Its revenue is down 17% over the previous year.

Few shareholders would be pleased to read that EPS have declined. And the impression is worse when you consider revenue is down year-on-year. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

Has Branicks Group AG Been A Good Investment?

With a total shareholder return of -84% over three years, Branicks Group AG shareholders would by and large be disappointed. Therefore, it might be upsetting for shareholders if the CEO were paid generously.

To Conclude...

Given that shareholders haven't seen any positive returns on their investment, not to mention the lack of earnings growth, this may suggest that few of them would be willing to award the CEO with a pay rise. At the upcoming AGM, they can question the management's plans and strategies to turn performance around and reassess their investment thesis in regards to the company.

CEO compensation is a crucial aspect to keep your eyes on but investors also need to keep their eyes open for other issues related to business performance. That's why we did some digging and identified 2 warning signs for Branicks Group that investors should think about before committing capital to this stock.

Important note: Branicks Group is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

Valuation is complex, but we're here to simplify it.

Discover if Branicks Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:DIC

Branicks Group

Branicks Group AG is Germany’s leading listed specialist for commercial real estate, with more than 25 years of experience in the property market and access to a broad network of investors.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026