- Germany

- /

- Real Estate

- /

- XTRA:A4Y

ACCENTRO Real Estate AG (ETR:A4Y) Stock's 31% Dive Might Signal An Opportunity But It Requires Some Scrutiny

To the annoyance of some shareholders, ACCENTRO Real Estate AG (ETR:A4Y) shares are down a considerable 31% in the last month, which continues a horrid run for the company. The recent drop completes a disastrous twelve months for shareholders, who are sitting on a 68% loss during that time.

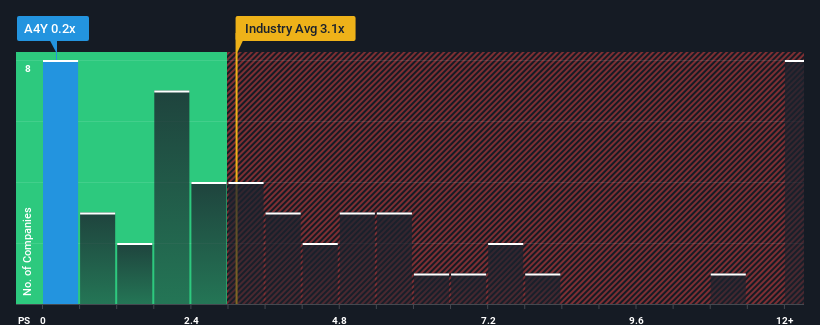

Following the heavy fall in price, ACCENTRO Real Estate may look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 0.2x, considering almost half of all companies in the Real Estate industry in Germany have P/S ratios greater than 3.1x and even P/S higher than 6x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the highly reduced P/S.

View our latest analysis for ACCENTRO Real Estate

What Does ACCENTRO Real Estate's P/S Mean For Shareholders?

ACCENTRO Real Estate's negative revenue growth of late has neither been better nor worse than most other companies. One possibility is that the P/S ratio is low because investors think the company's revenue may begin to slide even faster. You'd much rather the company continue improving its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't fall off a cliff if your plan is to pick up some stock while it's out of favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on ACCENTRO Real Estate.Is There Any Revenue Growth Forecasted For ACCENTRO Real Estate?

In order to justify its P/S ratio, ACCENTRO Real Estate would need to produce anemic growth that's substantially trailing the industry.

Retrospectively, the last year delivered a frustrating 64% decrease to the company's top line. This means it has also seen a slide in revenue over the longer-term as revenue is down 43% in total over the last three years. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Shifting to the future, estimates from the three analysts covering the company suggest revenue growth will be highly resilient over the next three years growing by 14% each year. With the rest of the industry predicted to shrink by 14% each year, that would be a fantastic result.

With this in mind, we find it intriguing that ACCENTRO Real Estate's P/S falls short of its industry peers. It looks like most investors aren't convinced at all that the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Having almost fallen off a cliff, ACCENTRO Real Estate's share price has pulled its P/S way down as well. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that ACCENTRO Real Estate currently trades on a much lower than expected P/S since its growth forecasts are potentially beating a struggling industry. We believe there could be some underlying risks that are keeping the P/S modest in the context of above-average revenue growth. One major risk is whether its revenue trajectory can keep outperforming under these tough industry conditions. It appears many are indeed anticipating revenue instability, because the company's current prospects should normally provide a boost to the share price.

Having said that, be aware ACCENTRO Real Estate is showing 4 warning signs in our investment analysis, and 2 of those are concerning.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:A4Y

ACCENTRO Real Estate

Operates as a real estate company that focuses on residential properties in Germany.

Slight risk and slightly overvalued.

Similar Companies

Market Insights

Community Narratives