- Germany

- /

- Real Estate

- /

- BST:ABHA

Hasen-Immobilien (BST:ABHA) sheds €12m, company earnings and investor returns have been trending downwards for past five years

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Hasen-Immobilien AG (BST:ABHA) shareholders for doubting their decision to hold, with the stock down 32% over a half decade.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, Hasen-Immobilien moved from a loss to profitability. That would generally be considered a positive, so we are surprised to see the share price is down. Other metrics may better explain the share price move.

The modest 0.6% dividend yield is unlikely to be guiding the market view of the stock. In contrast to the share price, revenue has actually increased by 4.0% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

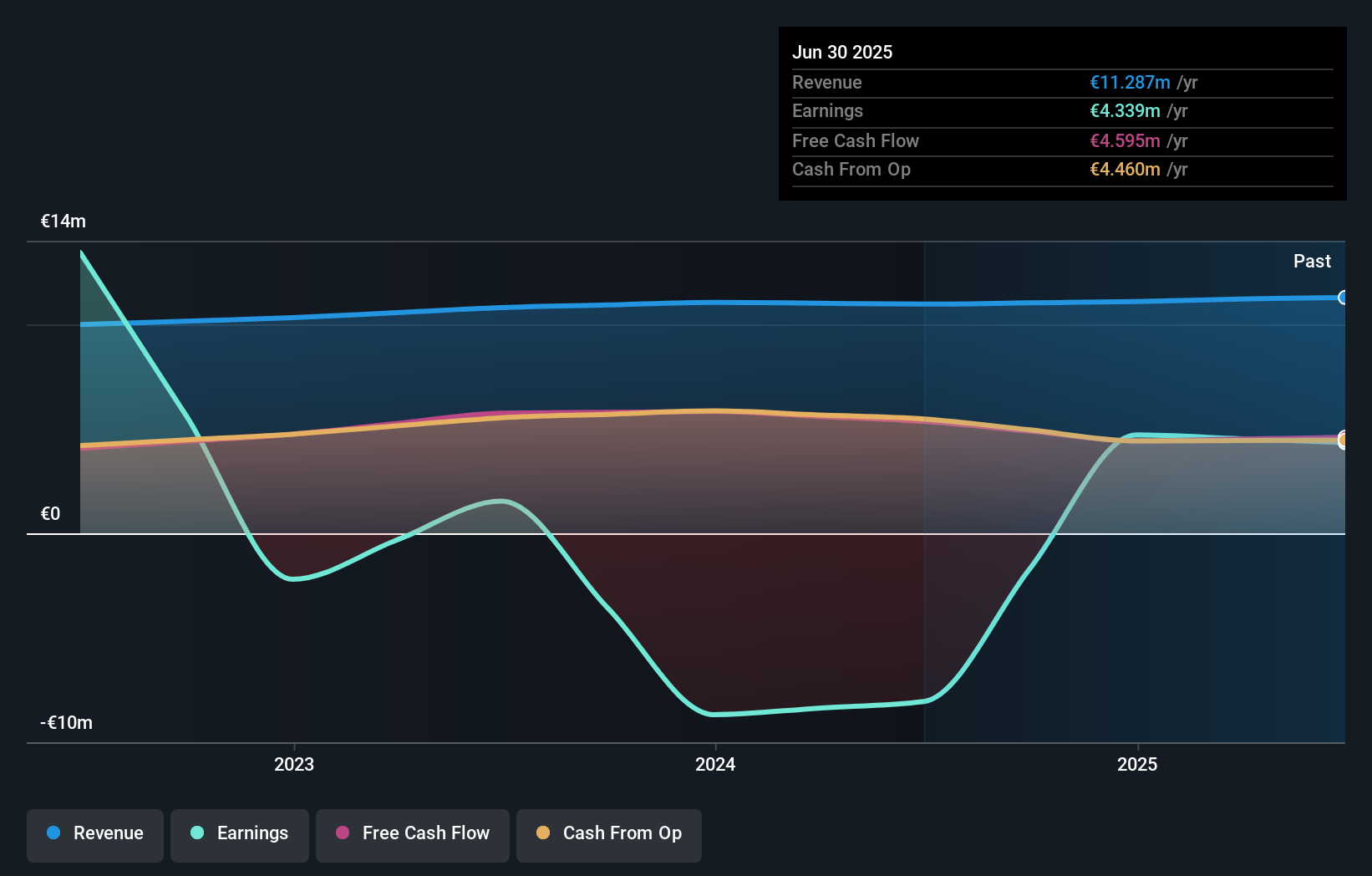

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Hasen-Immobilien shareholders are down 3.2% for the year (even including dividends), but the market itself is up 20%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. However, the loss over the last year isn't as bad as the 5% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Hasen-Immobilien better, we need to consider many other factors. Even so, be aware that Hasen-Immobilien is showing 4 warning signs in our investment analysis , and 1 of those is potentially serious...

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're here to simplify it.

Discover if Hasen-Immobilien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BST:ABHA

Hasen-Immobilien

An investment holding company, engages in the real estate business.

Slight risk with mediocre balance sheet.

Market Insights

Community Narratives