- Germany

- /

- Life Sciences

- /

- XTRA:SRT3

Sartorius (XTRA:SRT3): Valuation in Focus After Upgraded 2025 Outlook and Profit Surge

Reviewed by Kshitija Bhandaru

Sartorius (XTRA:SRT3) raised its revenue growth outlook for 2025 to 7% and reported improved quarterly results, with net income significantly higher compared to the previous year. The changes reflect resilient performance and benefits from new acquisitions.

See our latest analysis for Sartorius.

Sartorius has seen its share price climb 14.5% over the past month, a notable rebound that comes on the heels of updated guidance and stronger earnings. While the short-term momentum is impressive, it follows a more challenging stretch, with the total shareholder return down nearly 14% over the past year and deeper declines over longer horizons. Recent updates, including visible participation at major industry forums and confidence around the MATTEK acquisition, have renewed interest in the stock and suggest the market is starting to recalibrate its expectations.

Curious what else is picking up steam? This could be the perfect moment to uncover new opportunities via our See the full list for free.

With shares rebounding and fundamentals improving, investors are now weighing whether Sartorius remains undervalued at current levels or if the recent rally means future growth is already reflected in the price. Is a fresh opportunity emerging? Or is the market one step ahead?

Most Popular Narrative: 12.2% Undervalued

With Sartorius closing at €228.4 and its most widely followed narrative estimating a fair value of €260.05, the outlook signals the market may not be capturing the full earnings recovery and growth potential ahead. Here is what is driving the debate about Sartorius’ future upside.

Global healthcare infrastructure development and increased access in emerging markets are broadening Sartorius' customer base, as evidenced by robust consumables growth across all geographies. This is expected to contribute to accelerating international revenue growth and more diversified earnings.

Why do analysts expect margin expansion and a step-change in earnings? The recurring revenue engine, expanding global reach, and ambitious profit targets create a compelling story. Uncover the bold assumptions and key drivers behind this valuation. The details may surprise you.

Result: Fair Value of €260.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent softness in Sartorius' equipment sales and ongoing regulatory challenges could limit the pace of future earnings improvement.

Find out about the key risks to this Sartorius narrative.

Another View: Multiples Tell a Different Story

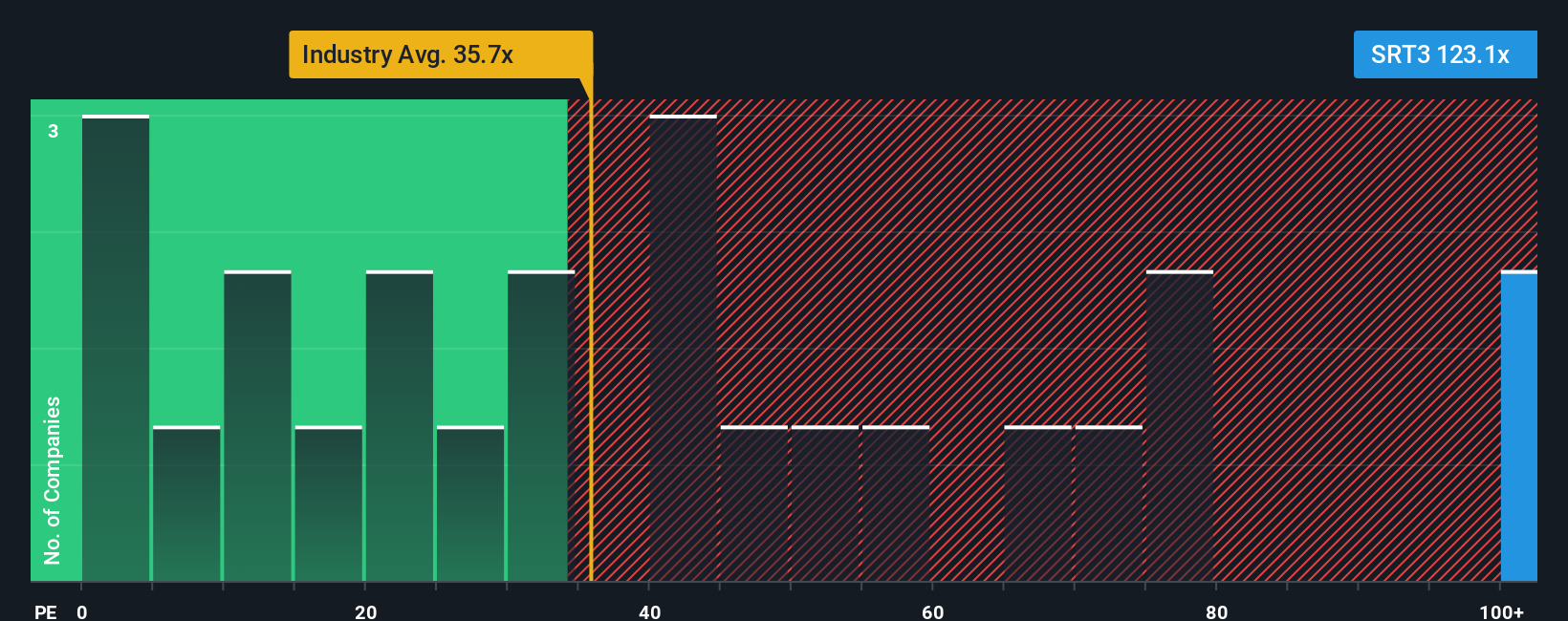

While analysts see Sartorius as undervalued, a closer look at its current price-to-earnings ratio of 118x reveals a much steeper valuation than both the European Life Sciences industry average (35x) and the peer average (22.1x). The fair ratio, based on market trends, is just 26.4x. This raises real concerns about downside risk if market sentiment shifts. Could this premium signal hidden growth potential, or is the stock priced for perfection?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Sartorius Narrative

If you want to dig deeper or feel there's more to the story, you can build your own data-backed view in just a few minutes. Do it your way

A great starting point for your Sartorius research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Opportunities move fast, and the next big win could be closer than you think. Don’t let your best shot at gains pass you by. Visualize your portfolio with new possibilities today.

- Capture market momentum by tracking these 878 undervalued stocks based on cash flows that show strong potential for upside based on solid fundamentals and overlooked valuations.

- Boost your income stream and build resilience with these 18 dividend stocks with yields > 3% offering attractive yields and the consistency investors crave.

- Ride the innovation wave and stay ahead of trends by targeting these 24 AI penny stocks fueling the growth of intelligent technologies worldwide.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SRT3

Sartorius

Provides bioprocess solutions, and lab products and services worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives