- Germany

- /

- Life Sciences

- /

- XTRA:SRT3

Sartorius (XTRA:SRT3) Margin Upswing Reinforces Bullish Narratives Despite Premium Valuation

Reviewed by Simply Wall St

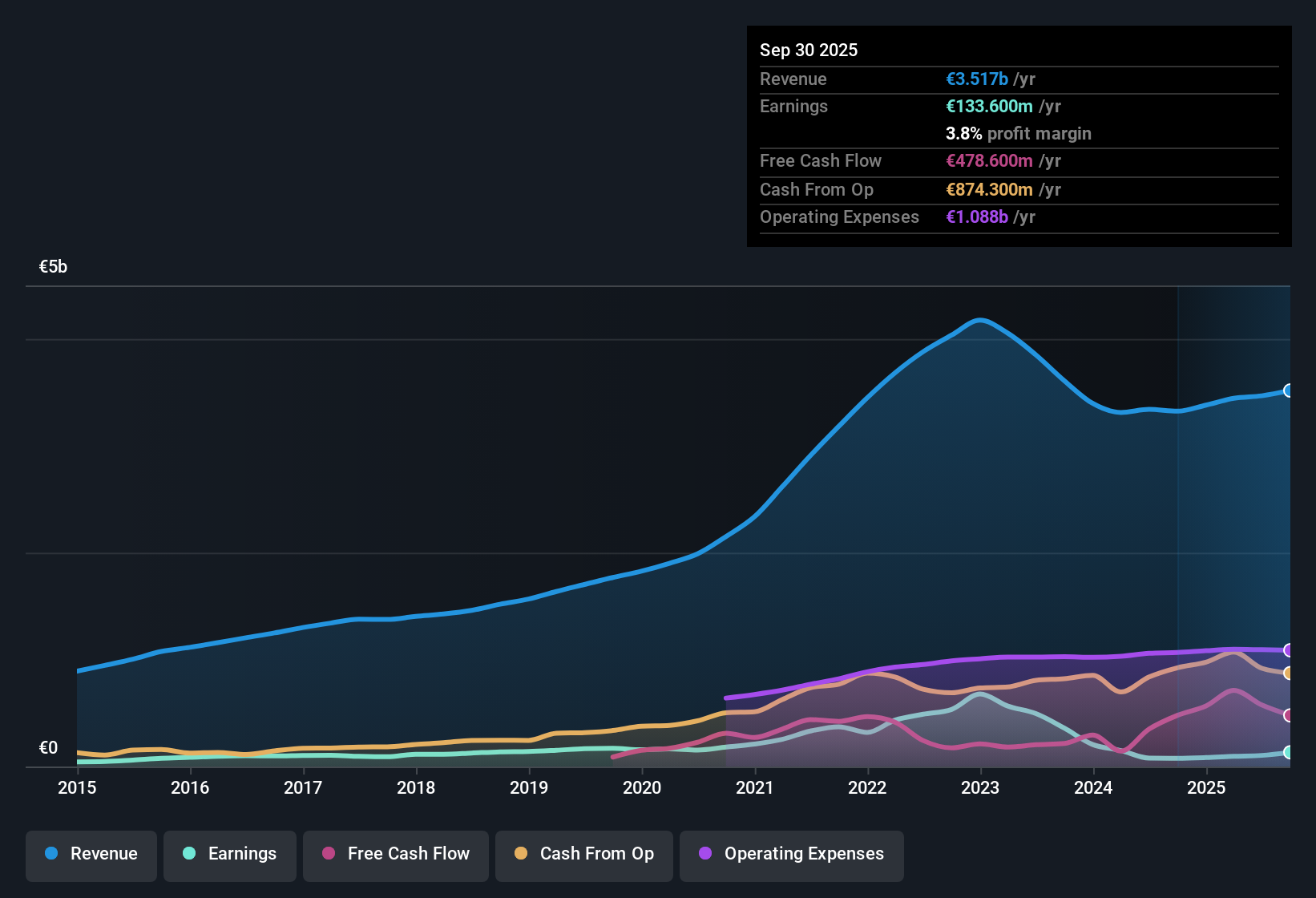

Sartorius (XTRA:SRT3) delivered robust earnings growth this period, with net profit margins rising to 3% from 2.3% a year ago. EPS surged 32.8% over the past year, a sharp rebound after averaging a 16.5% annual decline over the last five years. Looking ahead, analysts forecast annual EPS growth of 22.1% and revenue growth of 9.4%, both outpacing broader German market averages, while investors remain focused on the company’s consistently high quality earnings.

See our full analysis for Sartorius.The next section puts these headline numbers in direct context with the stories and narratives that move the market, outlining where the data confirms or challenges what investors believe about Sartorius.

See what the community is saying about Sartorius

Recurring Revenue Strengthens Margin Stability

- Consumables and services, which are the dominant and fastest-growing part of Sartorius' business, now reduce revenue cyclicality and improve earnings quality as recurring revenues continue to rise.

- Analysts' consensus view highlights that recurring products like advanced biologic drugs and continuous processing solutions are supporting higher-quality margins and reducing exposure to swings in capital equipment cycles.

- Strong product innovation, such as the IncuCyte with confocal imaging and intensified bioprocessing modules, strengthens Sartorius' competitive position and helps maintain premium pricing.

- Rising global healthcare access and robust consumables growth across geographies diversify revenue streams, making future cash flows more predictable.

- Building on resilience in recurring revenue, analysts suggest these business shifts could underpin even faster margin expansion if equipment segment demand revives in the near term.

- Bulls and skeptics agree Sartorius' recurring sales model could be the key to smoother profit growth. See what the consensus expects next in the full narrative.

📊 Read the full Sartorius Consensus Narrative.

LPS Division Faces Growth Roadblocks

- Lab Products & Services (LPS) saw a 4% sales decline at constant currencies, with ongoing demand reluctance for instruments after pandemic-driven overcapacity.

- Analysts' consensus view flags persistent risks: if customer hesitancy on large equipment investments lingers, slower CapEx recovery in LPS could weigh on group-level revenue and net margin trends.

- Elevated inventory write-downs, now about 5% of sales compared to 1.5% pre-pandemic, signal mismatches between production and demand and directly impact operating profit and net income.

- Regulatory volatility and price containment pressures may further challenge the recovery in the LPS division, with negative growth possibly lasting longer than company guidance suggests.

Valuation: High Multiple, Deeper Discount

- Sartorius trades at a Price-To-Sales Ratio of 4.5x, putting it well above the European life sciences average of 3.9x and peer average of 1.4x. Yet the €228.5 share price sits 33.9% below its DCF fair value of €345.91.

- Consensus narrative notes that despite premium multiples, the current price represents a 33.9% discount to intrinsic value, raising the question of whether ongoing growth and margin improvements can eventually justify these higher earnings multiples.

- Analyst price targets cluster around €255.10, implying 11.6% upside from the present share price. Expectations are divided, with the bullish end at €310.00 and the bearish at €175.00.

- To reach consensus targets, Sartorius would need to achieve projected growth and margin expansion, and see its PE ratio normalize from 130.0x currently to 53.5x by 2028, which would still be over double the industry average of 23.7x.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Sartorius on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have a different view on the figures? Take a moment to turn your insight into a personalized narrative and share your perspective in just a few minutes. Do it your way

A great starting point for your Sartorius research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

See What Else Is Out There

Sartorius faces ongoing revenue headwinds in its LPS division, as sluggish equipment sales and elevated inventories threaten consistent group performance.

If you want steadier growth and fewer surprises, use our stable growth stocks screener (2097 results) to spot companies delivering reliable revenue and earnings regardless of market turmoil.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SRT3

Sartorius

Provides bioprocess solutions, and lab products and services worldwide.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Community Narratives