Could Merck KGaA (XTRA:MRK) Parlay Genome Editing Spotlight Into a Stronger Biotech Leadership Position?

Reviewed by Sasha Jovanovic

- At the Drug Discovery Innovation Programme 2025 held in Barcelona, Merck KGaA presented on digital chemistry and medicinal chemistry, featuring speakers Angelo Lanzilotto and Thomas Fuchss.

- An industry report released around the same time highlighted Merck KGaA as a key player in genome editing technologies such as CRISPR-Cas, TALEN, and ZFN, underscoring its significance across biopharma and agricultural biotech.

- We'll examine how increased industry recognition in genome editing technologies could influence Merck KGaA's broader investment outlook and future growth potential.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Merck KGaA Investment Narrative Recap

To be a shareholder in Merck KGaA, you need to believe in the company’s ability to unlock sustainable growth from life science, healthcare, and advanced biologics, while adapting to digital innovation in drug discovery. The recent industry recognition for Merck KGaA’s genome editing leadership is positive for its reputation, but it does not materially shift the biggest short-term catalyst, continued strong demand in Life Science, or change the key risk of lingering weakness in Semiconductor Solutions and earnings pressure from currency fluctuations.

Of recent announcements, the appointment of David Weinreich as Global Head of R&D and Chief Medical Officer for Healthcare is most relevant. His experience bolsters pipeline development at a time when advances in genome editing are gaining momentum industry-wide, aligning with Merck KGaA’s ambitions in specialized therapeutics and supporting the case for future top-line growth from new launches.

On the other hand, investors should also be aware of the persistent challenges in the Electronics segment and how these...

Read the full narrative on Merck KGaA (it's free!)

Merck KGaA's outlook anticipates €23.2 billion in revenue and €3.5 billion in earnings by 2028. This implies a 3.1% annual revenue growth rate and a €0.6 billion increase in earnings from the current €2.9 billion.

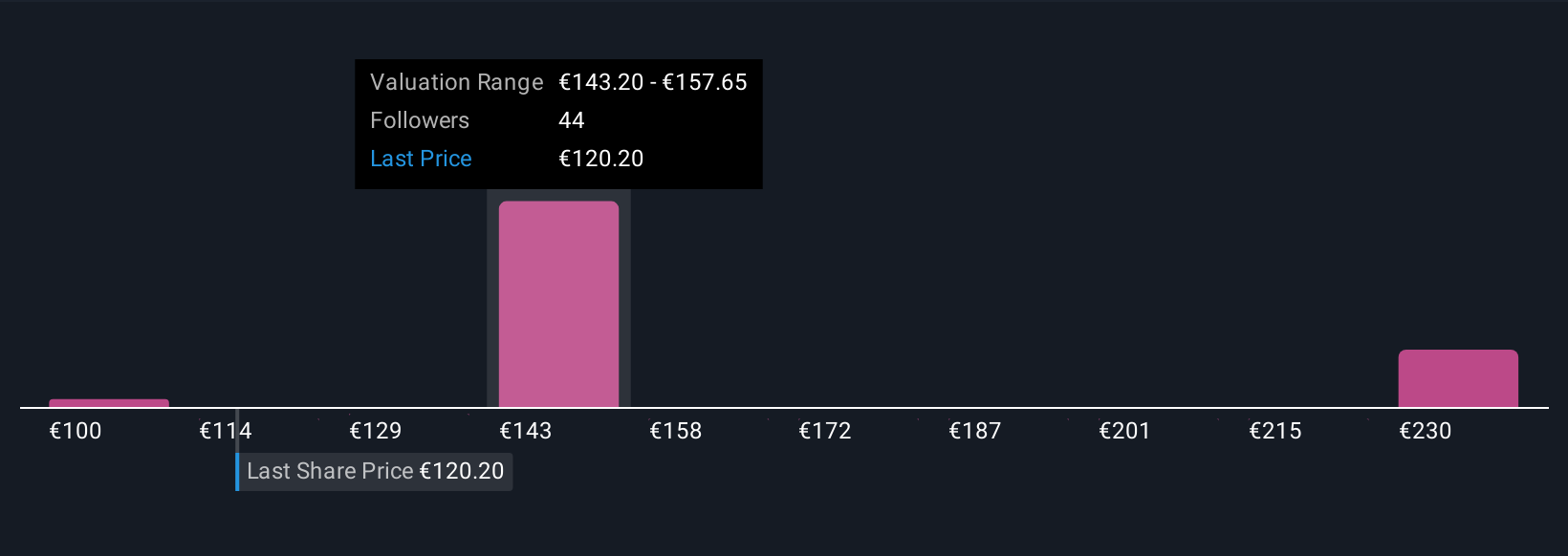

Uncover how Merck KGaA's forecasts yield a €147.53 fair value, a 25% upside to its current price.

Exploring Other Perspectives

Fair value estimates from the Simply Wall St Community span from €99.85 to €244.36 across five analyses, underscoring wide-ranging outlooks. While many see strong Life Science momentum as a catalyst, opinions differ on how much this offsets ongoing risks to Electronics segment results, be sure to consider a variety of viewpoints when assessing Merck KGaA’s prospects.

Explore 5 other fair value estimates on Merck KGaA - why the stock might be worth over 2x more than the current price!

Build Your Own Merck KGaA Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Merck KGaA research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free Merck KGaA research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Merck KGaA's overall financial health at a glance.

Interested In Other Possibilities?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 33 companies in the world exploring or producing it. Find the list for free.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:MRK

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives