Heidelberg Pharma (XTRA:HPHA): 50.4% Revenue Growth Forecast Reinforces Bullish Narratives Despite Losses

Reviewed by Simply Wall St

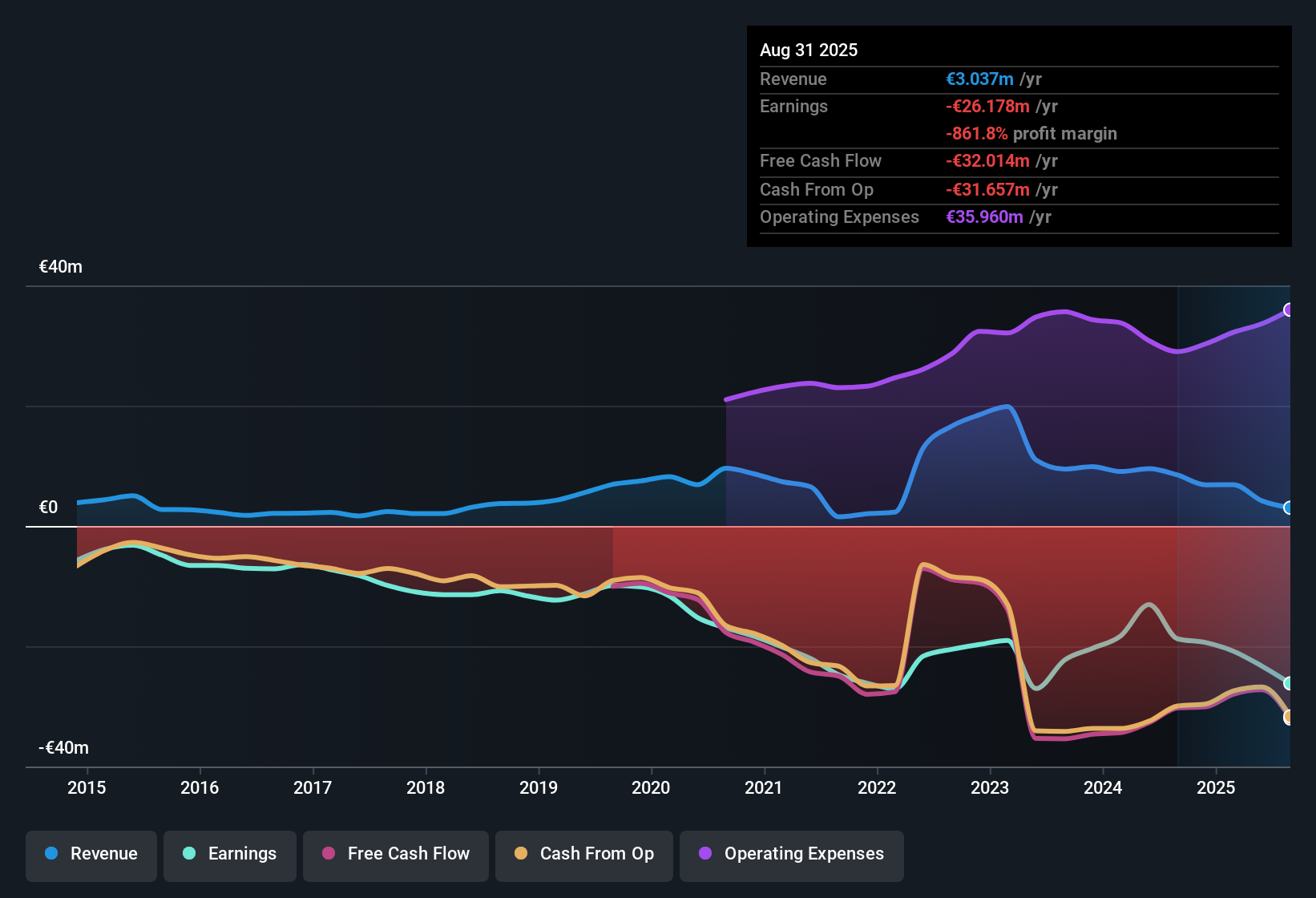

Heidelberg Pharma (XTRA:HPHA) is forecast to grow revenue at a rapid 50.4% per year, far outpacing the German market's expected 6.1% growth rate. However, despite this strong sales outlook, the company remains unprofitable and is projected to stay in the red over the next three years, with only a minor reduction in annual losses of 0.1% per year over the past five years. For investors, the headline is clear: rapid top-line growth is being weighed against persistent losses and a high Price-To-Sales ratio of 25.2x compared to industry averages.

See our full analysis for Heidelberg Pharma.With the key numbers in place, we are now turning to how these results match up with the major narratives swirling around Heidelberg Pharma. Some storylines may be confirmed, while others could face new scrutiny.

See what the community is saying about Heidelberg Pharma

Milestone Payments and Pipeline Risk Loom Large

- Sales revenue fell from €9.9 million to €6.9 million year-over-year because of a decrease in partnership monetization, revealing reliance on external milestone payments to support operations.

- Analysts' consensus view highlights tension over this dependence, noting the company’s lead compound HDP-101 is still in early clinical trials.

- A significant portion of future cash flow may hinge on reaching development and regulatory milestones, particularly milestone payments through the Healthcare Royalty agreement and the potential for U.S. FDA approval.

- Any shortfall from declining sales, manufacturing issues, or missed milestones could significantly constrain liquidity and limit the ability to fund ongoing research.

Operating Expenses Still Outpace Revenue

- With a net loss of €19.4 million in FY 2024 and profit margins remaining at -303.9%, expenses consistently exceed income and have not markedly improved over recent years.

- Analysts' consensus narrative notes this persistent net loss.

- Despite planned revenue growth, R&D and other operating costs are expected to keep profit margins deeply negative for several more years.

- This dynamic challenges the company’s financial sustainability unless either revenues increase or operating expenses are reduced.

Valuation Premium Hinges on High Growth Forecast

- Heidelberg Pharma’s Price-To-Sales ratio is at 25.2x, well above the European biotech industry’s 9.5x and peer group’s 24.4x, with the current share price of €3.06 sitting 72% below the analyst consensus target of €10.7.

- Analysts' consensus narrative points out that justifying this valuation requires sustained high growth.

- Analysts estimate that revenue must rise to €22.3 million by 2028 with earnings moving from a €-20.8 million loss today to a €1.9 million profit, narrowing the margin gap versus sector averages.

- For these projections to be met, Heidelberg would need to trade at a future PE multiple of 303.5x, which is substantially higher than the sector’s 24.1x and challenges even optimistic expectations.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for Heidelberg Pharma on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Have your own take on the latest figures? In just a few minutes, you can turn your insights into a unique narrative. Do it your way.

A great starting point for your Heidelberg Pharma research is our analysis highlighting 1 key reward and 4 important warning signs that could impact your investment decision.

See What Else Is Out There

Heidelberg Pharma’s persistent operating losses and ongoing reliance on milestone payments raise concerns about financial sustainability and consistent profitability.

If you want to focus on stocks with stronger finances and healthier liquidity positions, accelerate your research using our solid balance sheet and fundamentals stocks screener to spot companies built for resilience.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Heidelberg Pharma might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HPHA

Heidelberg Pharma

A biopharmaceutical company, focuses on oncology and antibody targeted amanitin conjugates (ATAC) in Germany, the United States, and internationally.

Adequate balance sheet with slight risk.

Market Insights

Community Narratives