- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6804

High Growth Tech Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets continue to react positively to political developments and economic indicators, major U.S. stock indices have reached record highs, driven by optimism surrounding potential trade deals and advancements in artificial intelligence. In this environment of growth stocks outperforming value shares, identifying high-growth tech stocks with strong exposure to emerging technologies like AI could be a strategic move for investors looking to capitalize on these trends.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Seojin SystemLtd | 35.41% | 39.86% | ★★★★★★ |

| Clinuvel Pharmaceuticals | 21.39% | 26.17% | ★★★★★★ |

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Yggdrazil Group | 30.20% | 87.10% | ★★★★★★ |

| Ascelia Pharma | 76.15% | 47.16% | ★★★★★★ |

| Medley | 20.95% | 27.32% | ★★★★★★ |

| Mental Health TechnologiesLtd | 25.83% | 113.12% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

Click here to see the full list of 1224 stocks from our High Growth Tech and AI Stocks screener.

Let's uncover some gems from our specialized screener.

Suzhou Sushi Testing GroupLtd (SZSE:300416)

Simply Wall St Growth Rating: ★★★★★☆

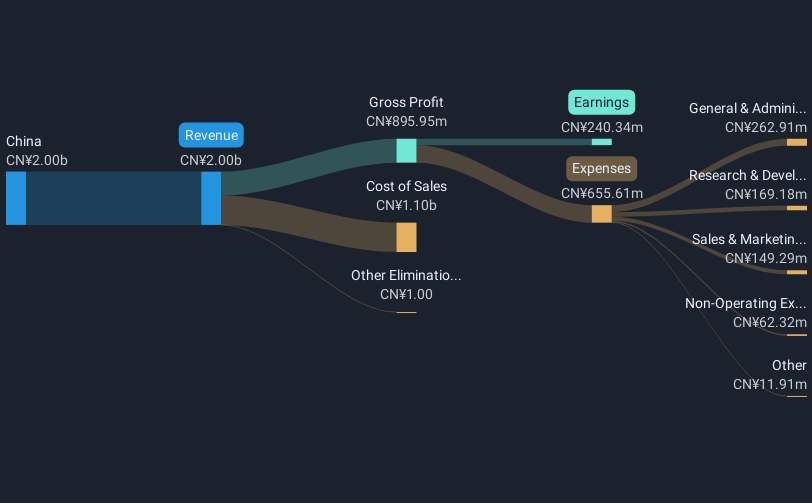

Overview: Suzhou Sushi Testing Group Co., Ltd. specializes in providing environmental and reliability test verification equipment, analysis services, and solutions, with a market cap of CN¥5.65 billion.

Operations: Suzhou Sushi Testing Group Co., Ltd. generates revenue primarily through the sale of test verification equipment and provision of analysis services. The company operates within the environmental and reliability testing sector, leveraging its expertise to offer comprehensive solutions to clients.

Suzhou Sushi Testing GroupLtd. stands out in the tech sector with its robust annual revenue growth at 20.1% and an impressive forecast for earnings growth at 31.7% annually, signaling strong potential despite a challenging past performance with a 22.8% earnings decline last year. The company's commitment to innovation is evident from its recent share repurchase initiative, investing CNY 30.08 million to buy back shares, underscoring confidence in its financial health and future prospects. This strategic move, combined with expected revenue growth outpacing the Chinese market average significantly (20.1% vs 13.3%), positions Suzhou Sushi Testing GroupLtd as a noteworthy entity in high-tech amidst fierce competition and rapid market changes.

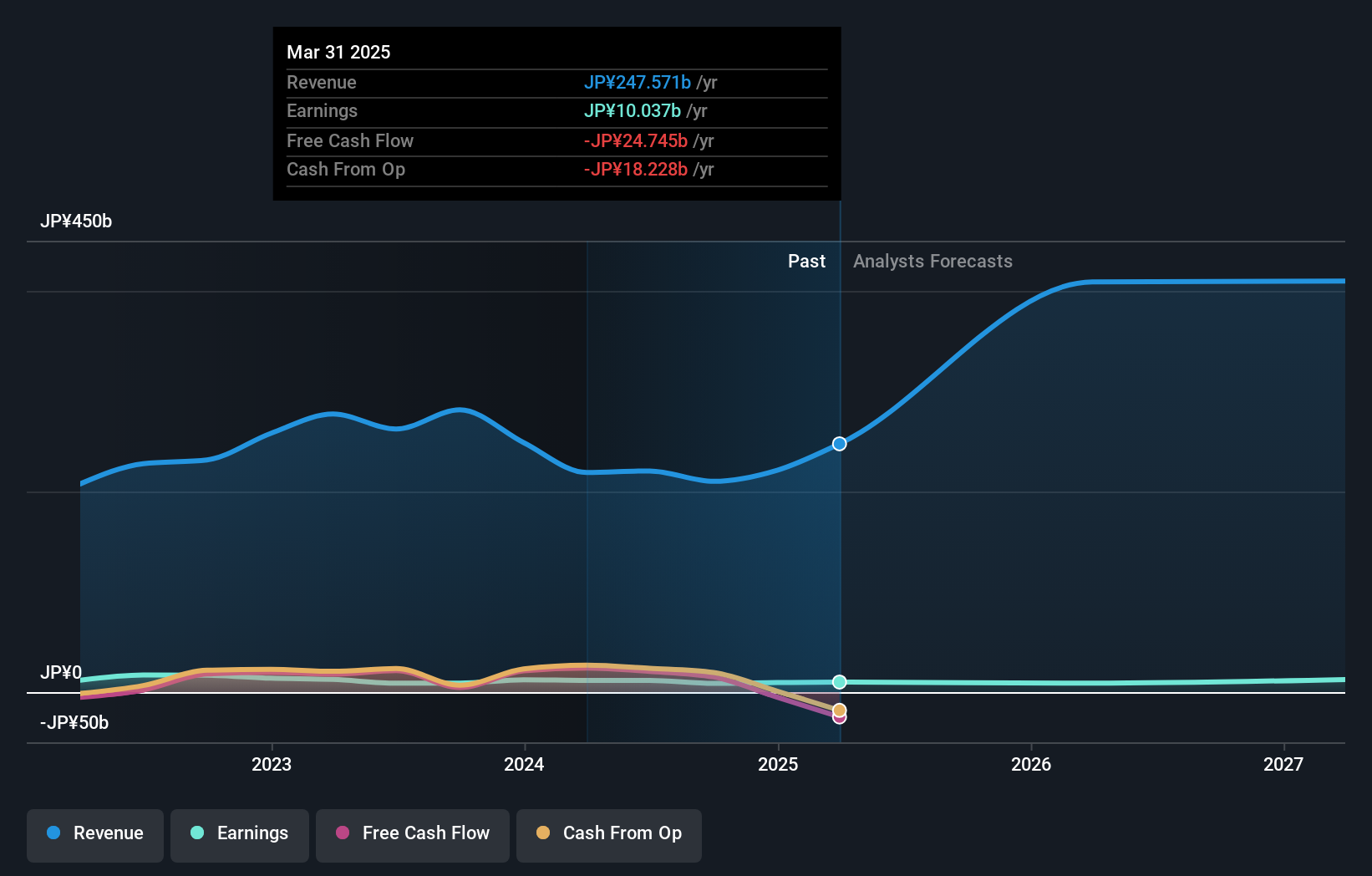

Hosiden (TSE:6804)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hosiden Corporation is engaged in the development, manufacturing, and sale of electronic components both domestically in Japan and internationally, with a market capitalization of ¥107.53 billion.

Operations: The company generates revenue primarily from the sale of mechanical parts, which account for a significant portion of its income at ¥174.75 billion. Other revenue streams include audio parts and display parts, contributing ¥21.72 billion and ¥2.61 billion respectively.

Hosiden has demonstrated a notable commitment to enhancing shareholder value, evidenced by its recent decision to repurchase 1,500,000 shares for ¥3 billion. This strategic move underscores management's confidence in the company’s robust forecasted earnings growth of 32.7% annually, significantly outpacing the Japanese market average of 8%. Despite a challenging past with a -3% earnings contraction last year, Hosiden's aggressive R&D investment and revenue growth projections (19.9% annually) suggest strong future potential in the competitive electronics sector.

- Dive into the specifics of Hosiden here with our thorough health report.

Gain insights into Hosiden's historical performance by reviewing our past performance report.

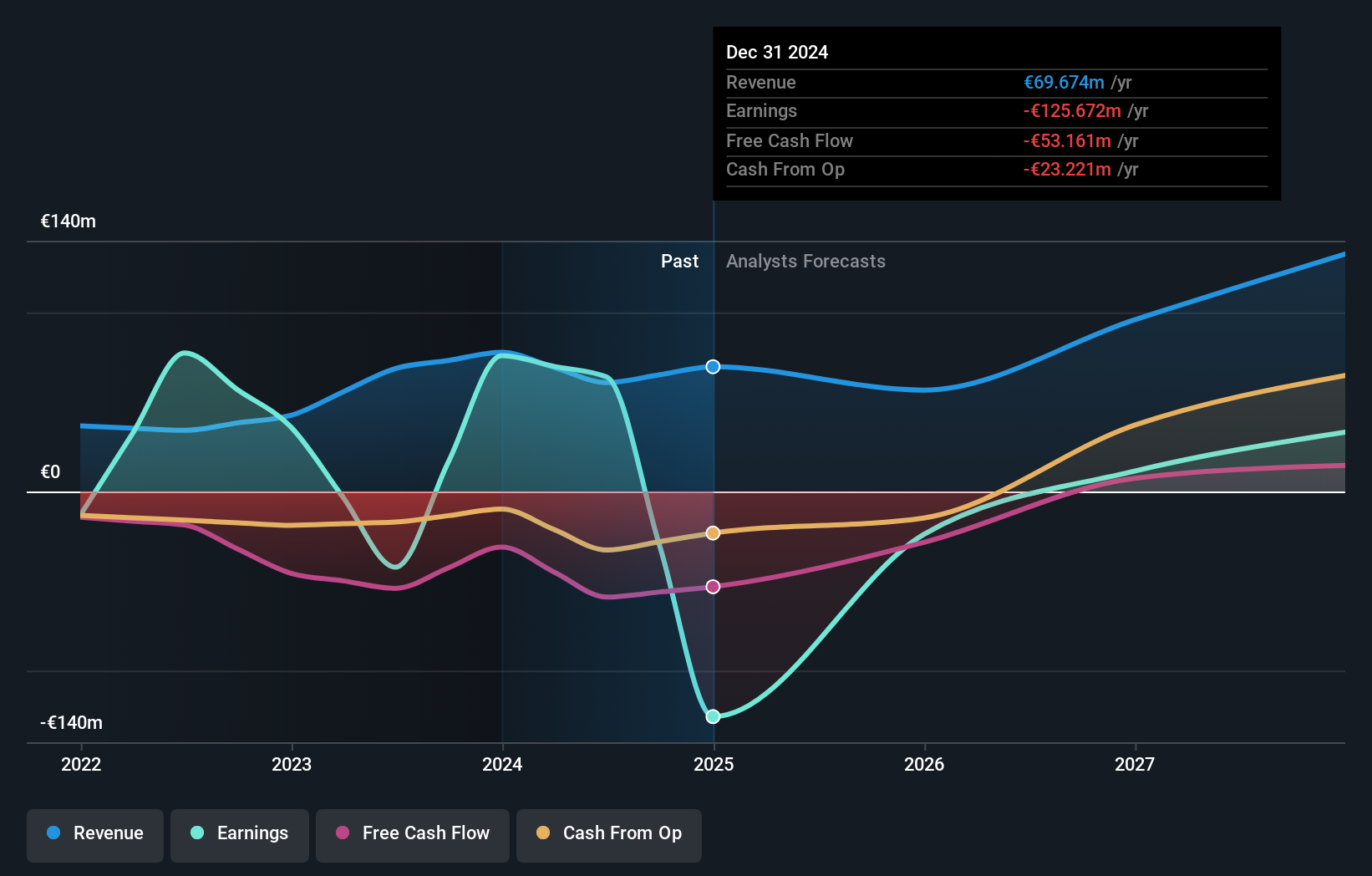

Formycon (XTRA:FYB)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Formycon AG is a biotechnology company focused on developing biosimilar drugs in Germany and Switzerland, with a market capitalization of approximately €962.30 million.

Operations: The company generates revenue primarily from its Drug Delivery Systems segment, amounting to €60.80 million.

Formycon AG's recent EU and U.S. approvals for its biosimilars, FYB203 and FYB202, mark significant milestones in expanding its portfolio in high-demand therapeutic areas. These developments are complemented by strategic alliances with Teva Pharmaceuticals for the commercialization of FYB203 across Europe and Israel, enhancing Formycon's market penetration. The company's revenue is projected to grow at 24.6% annually, outpacing the German market average of 5.6%, while earnings are expected to surge by 22.6% per year, reflecting robust operational efficiency and market acceptance of its products. This performance is underpinned by a focused R&D strategy that aligns with industry needs for cost-effective treatment alternatives in specialized medicine sectors like ophthalmology and dermatology.

- Unlock comprehensive insights into our analysis of Formycon stock in this health report.

Evaluate Formycon's historical performance by accessing our past performance report.

Summing It All Up

- Unlock our comprehensive list of 1224 High Growth Tech and AI Stocks by clicking here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hosiden might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6804

Hosiden

Develops, manufactures, and sells electronic components in Japan and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives