Bayer (XTRA:BAYN): Valuation Insights Following Strong Phase III Asundexian Stroke Trial Results

Reviewed by Simply Wall St

Bayer (XTRA:BAYN) is in the spotlight after reporting successful topline results from its Phase III OCEANIC-STROKE trial for asundexian. The investigational anticoagulant significantly reduced the risk of ischemic stroke without an increase in major bleeding events.

See our latest analysis for Bayer.

Bayer’s upbeat OCEANIC-STROKE trial results for asundexian come amid a period of heightened momentum for the stock. After surging on the news, Bayer’s 7-day share price return jumped 12.4%, with the 1-year total shareholder return now at an impressive 59.3%. Even with setbacks earlier in the decade, recent product launches and regulatory approvals are shifting sentiment. This suggests optimism is building around the company’s pharmaceutical pipeline and crop science innovations.

If the pace of innovation at Bayer has you scanning for other opportunities, now’s the perfect moment to discover See the full list for free.

With shares rebounding sharply, investors are left to wonder if Bayer’s recent rally is leaving shares undervalued or if all the anticipated growth from its innovations is already reflected in the price.

Most Popular Narrative: 5.7% Overvalued

With Bayer’s fair value estimated at €28.71 and the last close at €30.36, the current narrative points to a modest overvaluation. The debate now focuses on how Bayer’s future margins, innovation, and portfolio moves will play out in coming years.

Bayer's strategic focus on portfolio optimization and disciplined divestitures, along with digital transformation, enhanced customer-centricity, and an R&D-rich environment, supports a shift toward higher-value, less volatile market segments. This approach is intended to increase the resilience and quality of future earnings and improve net margin over time.

What assumptions are powering this valuation call? The key points are projected profit margin expansion, ambitious revenue targets, and a future multiple rarely granted in this sector. Want to see the numbers driving this premium? Take a closer look at the key forecasts and catalysts inside the full narrative.

Result: Fair Value of $28.71 (OVERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, ongoing litigation and tightening regulatory oversight in key markets still pose real threats to Bayer's growth and near-term margin recovery.

Find out about the key risks to this Bayer narrative.

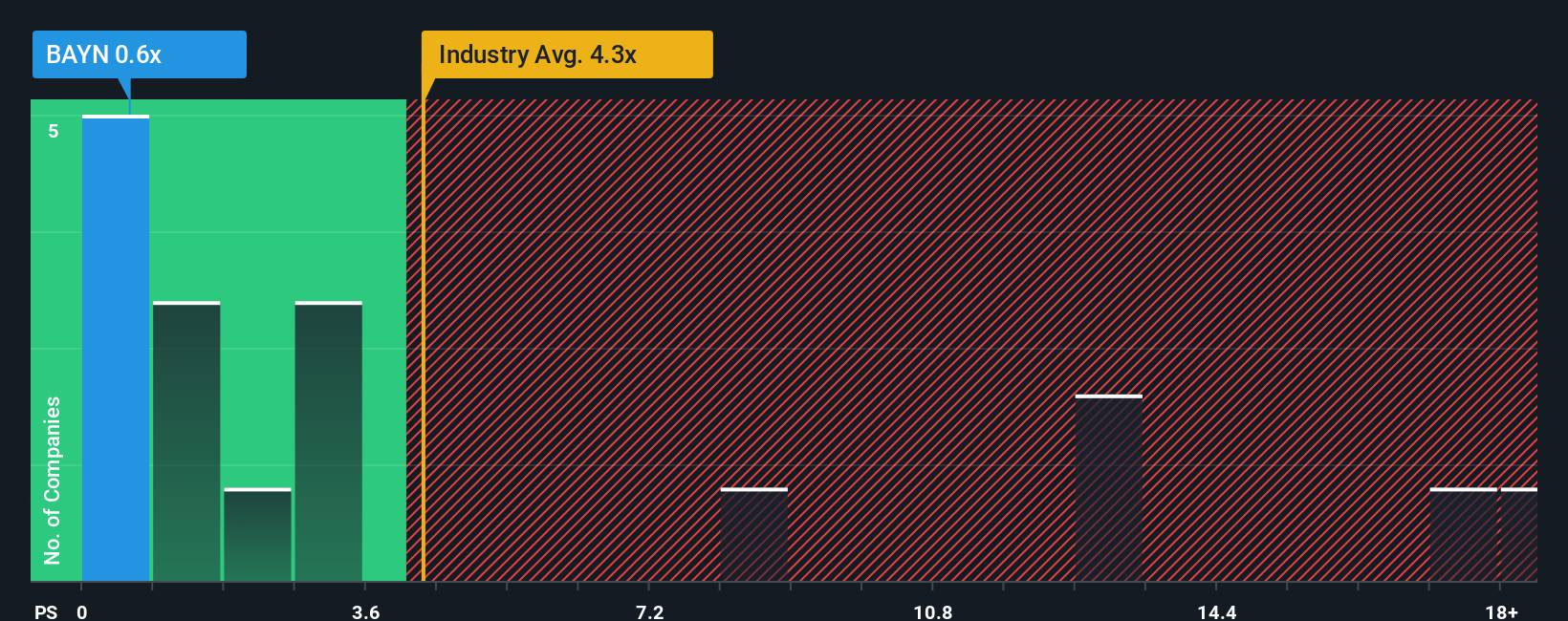

Another View: Price-to-Sales Ratio Signals Opportunity

Looking at value from another angle, Bayer’s price-to-sales ratio sits at just 0.7x. This is much lower than both the European sector average of 3.1x and the peer average of 2.1x. Compared to its fair ratio of 1.4x, Bayer appears attractively valued on this front. Does the market see more risk here or could this gap close as confidence returns?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Bayer Narrative

If you think there is another side to the story, or want to dig into the numbers yourself, you can piece together your own narrative in just a few minutes, Do it your way

A great starting point for your Bayer research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Unlock your next big investing move by checking out unique stock opportunities that could redefine your portfolio's trajectory. Don't let these slip by.

- Tap into the future of healthcare by reviewing these 30 healthcare AI stocks, which is poised for breakthroughs in AI-driven treatments and diagnostics.

- Boost your passive income with these 15 dividend stocks with yields > 3%, spotlighting shares offering impressive yields above 3%.

- Stay ahead of market shifts by uncovering these 927 undervalued stocks based on cash flows, featuring companies with strong cash flow potential trading well below their true worth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bayer might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAYN

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Q3 Outlook modestly optimistic

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success