Further Upside For Apontis Pharma AG (ETR:APPH) Shares Could Introduce Price Risks After 35% Bounce

Apontis Pharma AG (ETR:APPH) shares have had a really impressive month, gaining 35% after a shaky period beforehand. The last month tops off a massive increase of 141% in the last year.

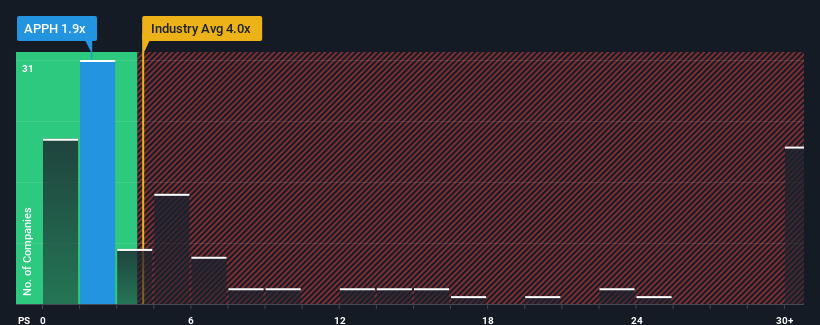

Even after such a large jump in price, it's still not a stretch to say that Apontis Pharma's price-to-sales (or "P/S") ratio of 1.9x right now seems quite "middle-of-the-road" compared to the Pharmaceuticals industry in Germany, seeing as it matches the P/S ratio of the wider industry. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

See our latest analysis for Apontis Pharma

How Has Apontis Pharma Performed Recently?

Apontis Pharma has been struggling lately as its revenue has declined faster than most other companies. It might be that many expect the dismal revenue performance to revert back to industry averages soon, which has kept the P/S from falling. You'd much rather the company improve its revenue if you still believe in the business. If not, then existing shareholders may be a little nervous about the viability of the share price.

Keen to find out how analysts think Apontis Pharma's future stacks up against the industry? In that case, our free report is a great place to start.What Are Revenue Growth Metrics Telling Us About The P/S?

Apontis Pharma's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Retrospectively, the last year delivered a frustrating 12% decrease to the company's top line. As a result, revenue from three years ago have also fallen 11% overall. Therefore, it's fair to say the revenue growth recently has been undesirable for the company.

Shifting to the future, estimates from the four analysts covering the company suggest revenue should grow by 24% per year over the next three years. With the industry only predicted to deliver 5.1% per year, the company is positioned for a stronger revenue result.

With this in consideration, we find it intriguing that Apontis Pharma's P/S is closely matching its industry peers. It may be that most investors aren't convinced the company can achieve future growth expectations.

What We Can Learn From Apontis Pharma's P/S?

Its shares have lifted substantially and now Apontis Pharma's P/S is back within range of the industry median. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that Apontis Pharma currently trades on a lower than expected P/S since its forecasted revenue growth is higher than the wider industry. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Don't forget that there may be other risks. For instance, we've identified 2 warning signs for Apontis Pharma (1 is a bit concerning) you should be aware of.

If you're unsure about the strength of Apontis Pharma's business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:APPH

Apontis Pharma

Engages in the marketing and sale of medical drugs for indication fields of internal medicine in Germany.

Excellent balance sheet and good value.