Profit Growth Amid Falling Sales Might Change the Case For Investing In ProSiebenSat.1 Media (XTRA:PSM)

Reviewed by Sasha Jovanovic

- ProSiebenSat.1 Media SE recently reported third quarter earnings, showing a drop in sales to €820 million but a significant increase in net income to €77 million compared to a year earlier.

- This improvement in profitability, achieved despite lower sales, highlights how cost management or other non-sales factors contributed meaningfully to the company's bottom line.

- We'll explore how ProSiebenSat.1 Media's stronger quarterly net income, despite lower sales, may impact its broader investment narrative.

The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 27 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

ProSiebenSat.1 Media Investment Narrative Recap

To be a shareholder in ProSiebenSat.1 Media, you need confidence in the company's ability to shift its earnings base from traditional TV advertising toward digital and streaming, while successfully managing costs amid a competitive and evolving market. The latest quarterly earnings show improved profitability despite falling sales, signaling effective cost control but not yet offsetting the underlying revenue pressure from secular and macro headwinds. As a result, the short-term outlook for a material catalyst remains unchanged, with continued monitoring of digital growth and margin sustainability critical, while revenue dependence on the DACH region is still the primary risk.

The most relevant recent announcement tied to this earnings release is the September completion of MFE-Mediaforeurope's increased stake, which now totals 60 percent ownership. This event reinforces questions about future business direction and governance, which could impact the realization of digital growth catalysts and add further complexity to execution risks surrounding strategic repositioning.

By contrast, investors should be aware that persistent declines in core TV ad revenue may...

Read the full narrative on ProSiebenSat.1 Media (it's free!)

ProSiebenSat.1 Media's outlook forecasts €4.1 billion in revenue and €332.1 million in earnings by 2028. This scenario assumes 2.0% annual revenue growth and an earnings increase of €406.1 million from the current earnings of €-74.0 million.

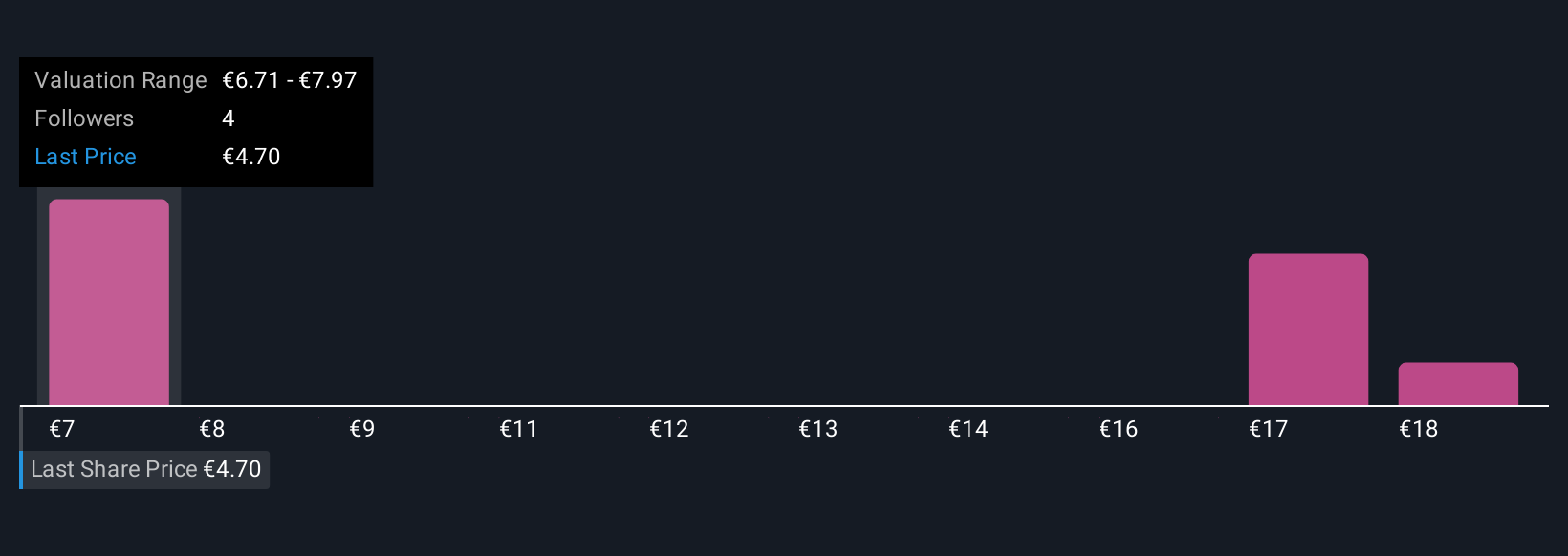

Uncover how ProSiebenSat.1 Media's forecasts yield a €6.71 fair value, a 42% upside to its current price.

Exploring Other Perspectives

Simply Wall St Community members produced three fair value estimates for ProSiebenSat.1 Media ranging from €6.71 to €19.37 per share. While some expect higher digital-driven earnings, others point to ongoing challenges like regional revenue reliance as critical to the company's future results, so consider multiple viewpoints before deciding.

Explore 3 other fair value estimates on ProSiebenSat.1 Media - why the stock might be worth just €6.71!

Build Your Own ProSiebenSat.1 Media Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your ProSiebenSat.1 Media research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free ProSiebenSat.1 Media research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate ProSiebenSat.1 Media's overall financial health at a glance.

Searching For A Fresh Perspective?

Early movers are already taking notice. See the stocks they're targeting before they've flown the coop:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Find companies with promising cash flow potential yet trading below their fair value.

- We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PSM

ProSiebenSat.1 Media

Operates as a media company in Germany, Austria, Switzerland, the United States, and internationally.

Very undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives