As of June 2025, the European market has been navigating a complex landscape marked by geopolitical tensions and economic uncertainties, with key indices like the STOXX Europe 600 Index reflecting these challenges through recent declines. In this environment, identifying high growth tech stocks requires a focus on companies that demonstrate resilience and innovation, particularly those capable of capitalizing on technological advancements and adapting to shifting market dynamics.

Top 10 High Growth Tech Companies In Europe

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Intellego Technologies | 30.80% | 45.66% | ★★★★★★ |

| Archos | 21.07% | 36.58% | ★★★★★★ |

| KebNi | 21.51% | 66.96% | ★★★★★★ |

| Pharma Mar | 29.61% | 44.92% | ★★★★★★ |

| Bonesupport Holding | 29.17% | 58.57% | ★★★★★★ |

| Smartoptics Group | 20.34% | 47.07% | ★★★★★★ |

| Skolon | 31.51% | 99.52% | ★★★★★★ |

| Xbrane Biopharma | 24.95% | 56.77% | ★★★★★★ |

| Elliptic Laboratories | 36.33% | 78.99% | ★★★★★★ |

| Diamyd Medical | 86.29% | 93.04% | ★★★★★★ |

Here's a peek at a few of the choices from the screener.

Planisware SAS (ENXTPA:PLNW)

Simply Wall St Growth Rating: ★★★★☆☆

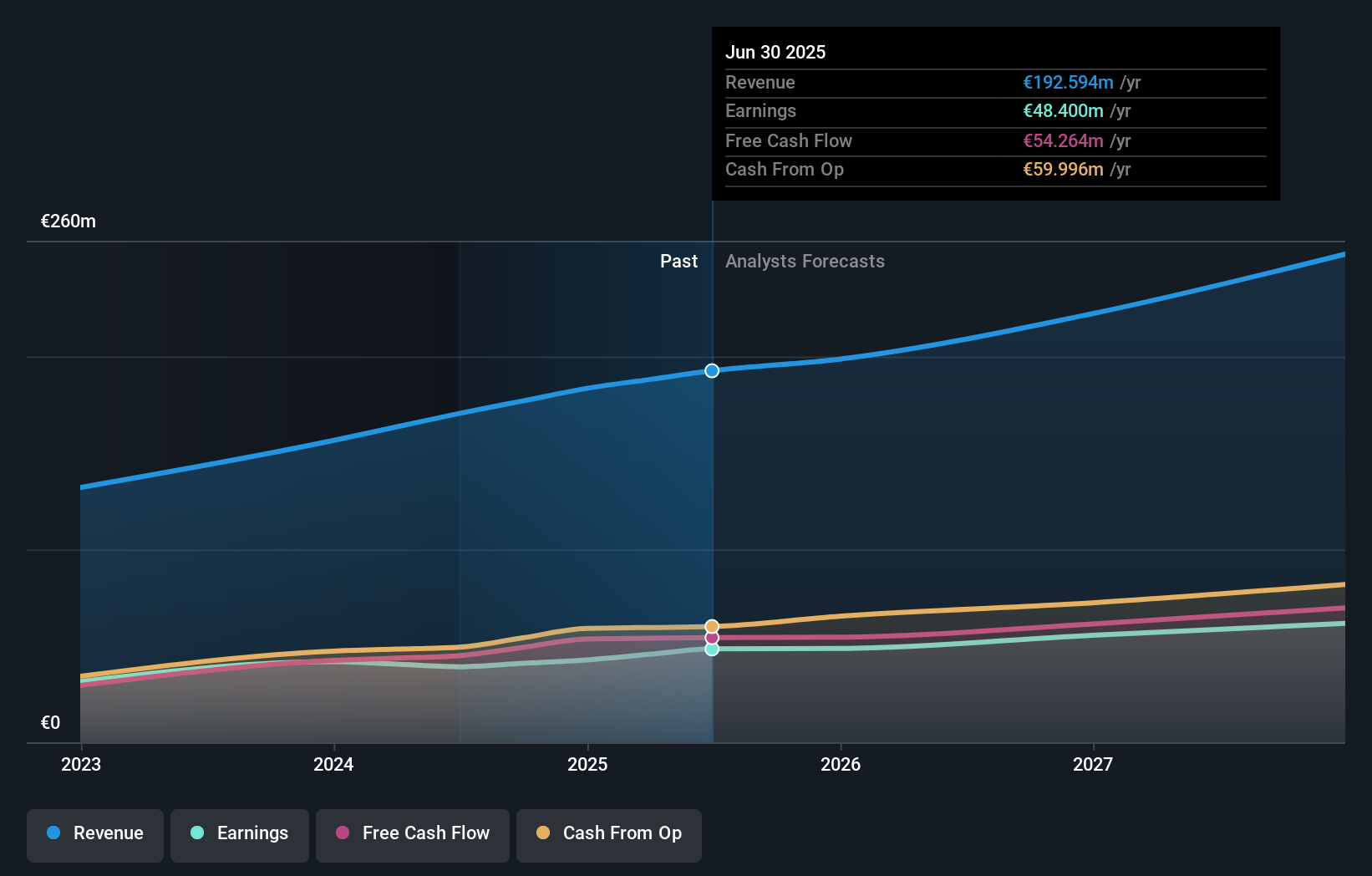

Overview: Planisware SAS is a business-to-business software-as-a-service provider with operations in Europe, North America, the Asia-Pacific, and internationally, and has a market capitalization of €1.75 billion.

Operations: Planisware SAS generates revenue primarily from its Software & Programming segment, which accounts for €183.45 million. The company operates across multiple regions, including Europe, North America, and the Asia-Pacific.

Planisware SAS, a key player in the European tech scene, recently showcased its robust commitment to innovation at Exchange25 EMEA in Paris, unveiling an AI-powered platform aimed at enhancing user experience through intelligent agents. This move aligns with its strategy to deepen AI and automation integration across its offerings. Financially, Planisware demonstrated solid growth with a 13.9% annual increase in revenue and earnings forecasted to rise by 15.9% annually. The company's R&D focus is evident from its recent product enhancements and strategic expansion into Belgium, aiming to capitalize on the dynamic Benelux market where it has doubled revenue over four years. This blend of strategic innovation and consistent financial performance positions Planisware well amid Europe's rapidly evolving tech landscape.

Storytel (OM:STORY B)

Simply Wall St Growth Rating: ★★★★★☆

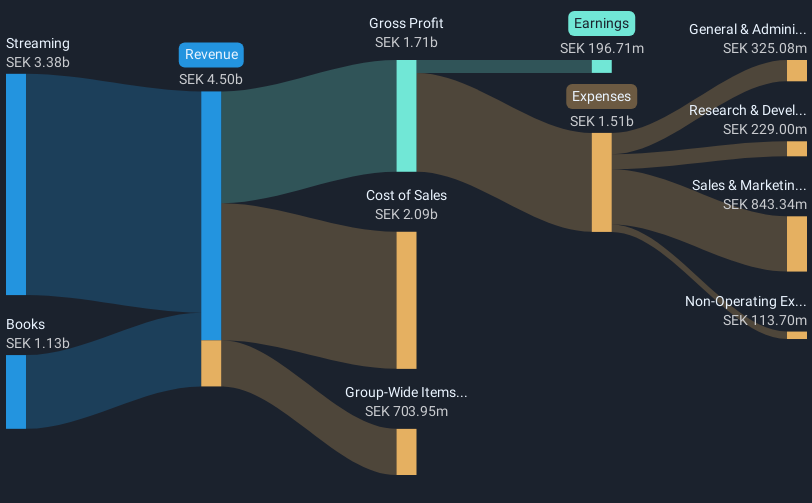

Overview: Storytel AB (publ) offers audiobooks and e-books streaming services with a market cap of approximately SEK6.97 billion.

Operations: Storytel AB generates revenue primarily through its streaming services, contributing SEK3.43 billion, and publishing segment, adding SEK1.16 billion.

Storytel's trajectory in the European tech landscape is marked by robust growth and strategic acquisitions, such as the recent integration of Bokfabriken, which solidifies its market position. The company's financial health is evident with a 10.4% annual revenue increase and an impressive 27.3% projected annual earnings growth, outpacing the Swedish market average of 14.7%. With R&D expenses tailored to foster innovation—evidenced by significant investments in content and technology—the firm is well-positioned to leverage emerging opportunities in digital storytelling. Moreover, Storytel’s commitment to shareholder returns was highlighted through a dividend payment announced for May 2025, reflecting confidence in sustained profitability and cash flow positivity.

- Unlock comprehensive insights into our analysis of Storytel stock in this health report.

Review our historical performance report to gain insights into Storytel's's past performance.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

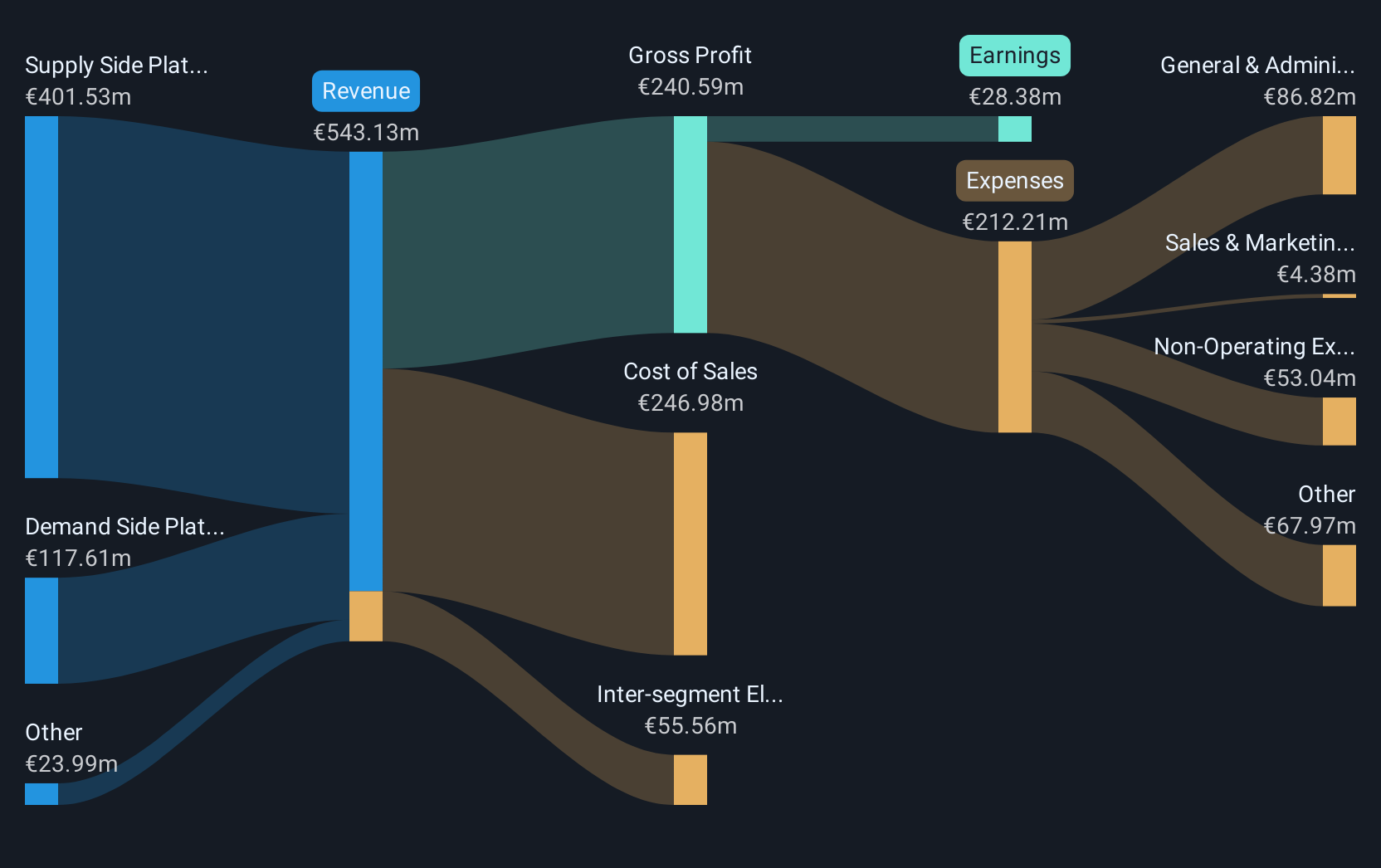

Overview: Verve Group SE is a digital media company that provides ad-software solutions in North America and Europe, with a market capitalization of €528.13 million.

Operations: Verve Group SE generates revenue primarily through its Demand Side Platforms (DSP) and Supply Side Platforms (SSP), with SSP contributing €401.53 million and DSP €117.61 million.

Verve Group SE, amidst a dynamic phase, recently completed a substantial Follow-on Equity Offering raising SEK 360 million, signaling robust market confidence. This follows a notable first-quarter revenue surge to EUR 114.91 million from EUR 89.28 million year-over-year and an ambitious revenue forecast for 2025 projecting up to EUR 565 million, marking a potential increase of up to 29%. However, net income dipped slightly to EUR 0.186 million from EUR 0.603 million in the same period last year, reflecting some operational challenges despite top-line growth. The company's commitment to innovation and market expansion is underscored by significant R&D investments aimed at enhancing its competitive edge in the tech sector.

- Navigate through the intricacies of Verve Group with our comprehensive health report here.

Explore historical data to track Verve Group's performance over time in our Past section.

Summing It All Up

- Get an in-depth perspective on all 218 European High Growth Tech and AI Stocks by using our screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:PLNW

Planisware SAS

Operates as a business-to-business software-as-a-service provider in Europe, North America, the Asia-Pacific, and internationally.

Outstanding track record with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives