3 Growth Stocks On The German Exchange With Up To 26% Insider Ownership

Reviewed by Simply Wall St

The German market has been experiencing significant volatility, with the DAX index recently tumbling 4.11% amid global economic uncertainties and weak U.S. data impacting investor sentiment. Despite these challenges, growth companies with high insider ownership can offer unique investment opportunities as they often demonstrate strong internal confidence and alignment of interests between management and shareholders. In this article, we will explore three such growth stocks on the German exchange that boast up to 26% insider ownership, highlighting their potential resilience in a fluctuating market environment.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.3% | 34.7% |

| NAGA Group (XTRA:N4G) | 14.1% | 78.3% |

| Exasol (XTRA:EXL) | 25.3% | 105.4% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| elumeo (XTRA:ELB) | 25.8% | 99.1% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 49.7% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Brockhaus Technologies (XTRA:BKHT)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €322.83 million.

Operations: The company's revenue segments consist of €39.43 million from Security Technologies and €153.43 million from Financial Technologies.

Insider Ownership: 26.6%

Brockhaus Technologies, a growth company with high insider ownership in Germany, is forecast to grow revenue at 17.8% per year, outpacing the German market's 5.2%. Earnings are expected to grow significantly at 74.21% annually and the company aims to become profitable within three years. However, recent earnings show a net loss of €1.38 million for Q1 2024 compared to €0.488 million last year, indicating challenges despite strong revenue growth from €33.89 million to €39.97 million.

- Navigate through the intricacies of Brockhaus Technologies with our comprehensive analyst estimates report here.

- Our expertly prepared valuation report Brockhaus Technologies implies its share price may be lower than expected.

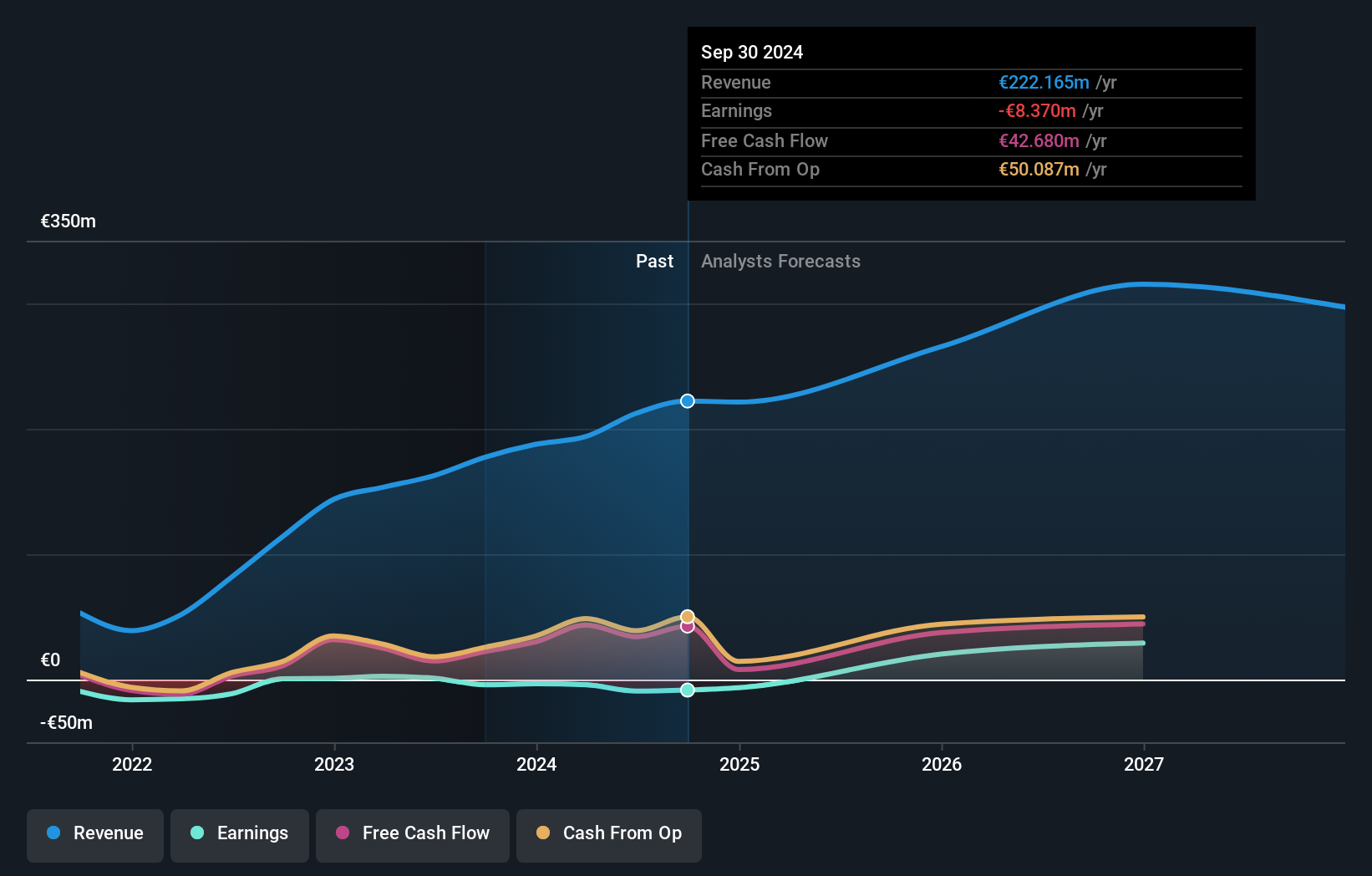

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €450.99 million.

Operations: Verve Group SE generates revenue through its Demand Side Platforms (DSP) at €51.53 million and Supply Side Platforms (SSP) at €318.35 million.

Insider Ownership: 25.1%

Verve Group SE, a growth company with high insider ownership in Germany, has recently appointed Alex Stil as Chief Commercial Officer to enhance its demand-side business. The company completed a €65 million bond issue at favorable terms, reducing financing costs by 2.37% and saving an estimated €10 million annually. Despite recent volatility in share price and past shareholder dilution, Verve's revenue is forecast to grow faster than the German market at 12.4% per year, with earnings expected to rise significantly by 20.62% annually over the next three years.

- Dive into the specifics of Verve Group here with our thorough growth forecast report.

- Upon reviewing our latest valuation report, Verve Group's share price might be too pessimistic.

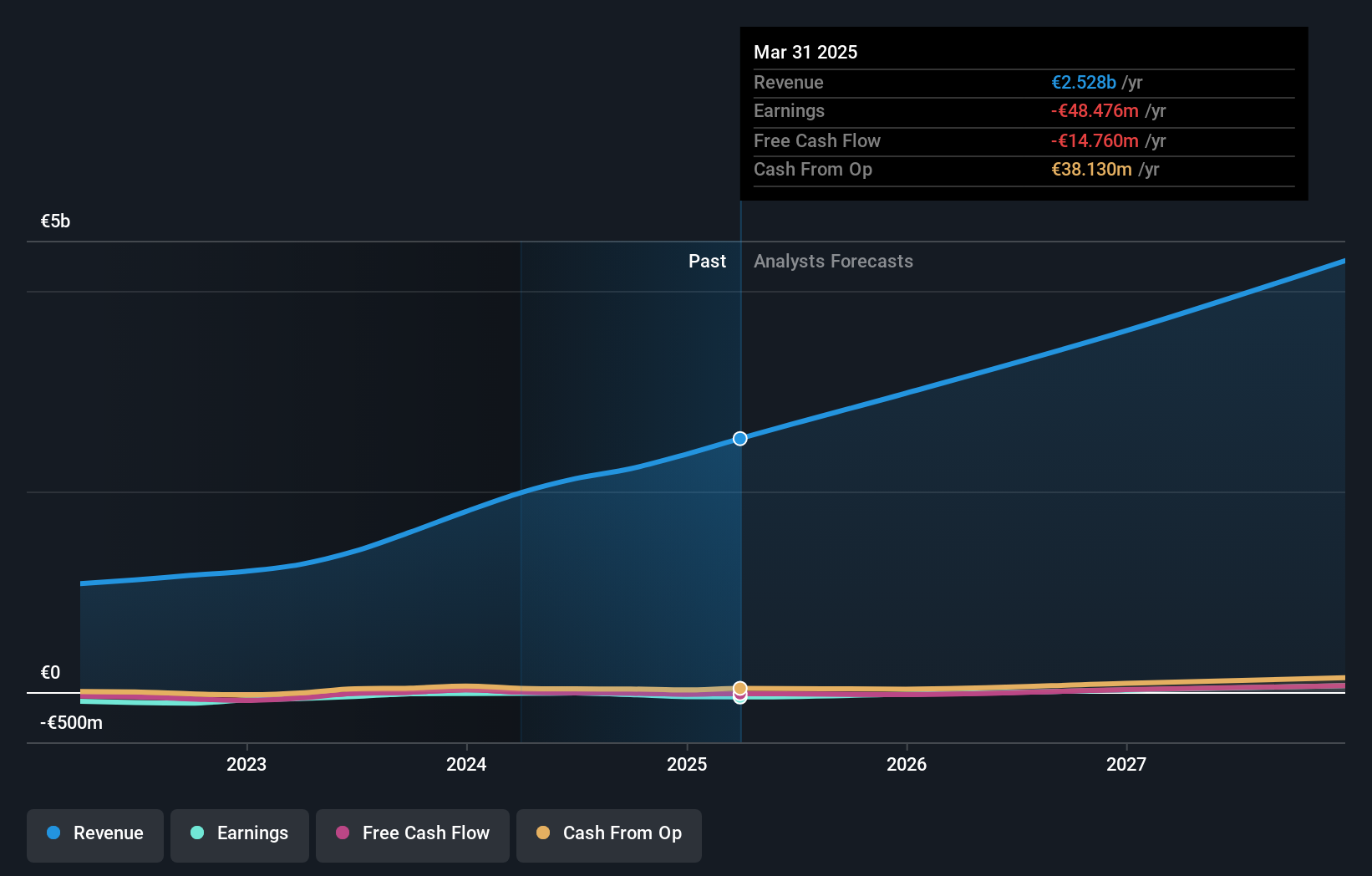

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of €2.69 billion.

Operations: The company's revenue segments include €1.74 billion from the DACH region and €391 million from international markets.

Insider Ownership: 17.7%

Redcare Pharmacy has seen significant revenue growth, with recent half-year sales reaching €1.12 billion, up from €791.94 million the previous year. Despite a net loss of €12.07 million, this is an improvement from the prior year's €14.78 million loss. The company trades at 65.9% below its estimated fair value and is expected to become profitable within three years, with earnings forecasted to grow by 49.7% annually and revenues outpacing the German market at 17% per year.

- Delve into the full analysis future growth report here for a deeper understanding of Redcare Pharmacy.

- Upon reviewing our latest valuation report, Redcare Pharmacy's share price might be too optimistic.

Make It Happen

- Click this link to deep-dive into the 19 companies within our Fast Growing German Companies With High Insider Ownership screener.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:M8G

Verve Group

Operates a software platform for the automated buying and selling of digital advertising space in North America and Europe.

Undervalued with reasonable growth potential.