- Germany

- /

- Food and Staples Retail

- /

- XTRA:RDC

3 German Growth Stocks With Insider Ownership And Up To 76% Earnings Growth

Reviewed by Simply Wall St

The German market has faced significant challenges recently, with the DAX index tumbling 4.11% amid global economic uncertainties and weak U.S. data sparking growth concerns. Despite these headwinds, some growth companies in Germany stand out due to their high insider ownership and robust earnings potential. In such volatile times, stocks with strong insider ownership can be particularly attractive as they often indicate confidence from those closest to the company’s operations. Here are three German growth stocks that exemplify this trend while showcasing up to 76% earnings growth potential.

Top 10 Growth Companies With High Insider Ownership In Germany

| Name | Insider Ownership | Earnings Growth |

| pferdewetten.de (XTRA:EMH) | 26.8% | 75.4% |

| YOC (XTRA:YOC) | 24.8% | 21.8% |

| Deutsche Beteiligungs (XTRA:DBAN) | 39.3% | 34.7% |

| Exasol (XTRA:EXL) | 25.3% | 105.4% |

| NAGA Group (XTRA:N4G) | 14.1% | 78.3% |

| Alelion Energy Systems (DB:2FZ) | 37.4% | 106.6% |

| elumeo (XTRA:ELB) | 25.8% | 99.1% |

| Redcare Pharmacy (XTRA:RDC) | 17.7% | 50.2% |

| Your Family Entertainment (DB:RTV) | 17.5% | 116.8% |

| Friedrich Vorwerk Group (XTRA:VH2) | 18% | 30.4% |

Below we spotlight a couple of our favorites from our exclusive screener.

Brockhaus Technologies (XTRA:BKHT)

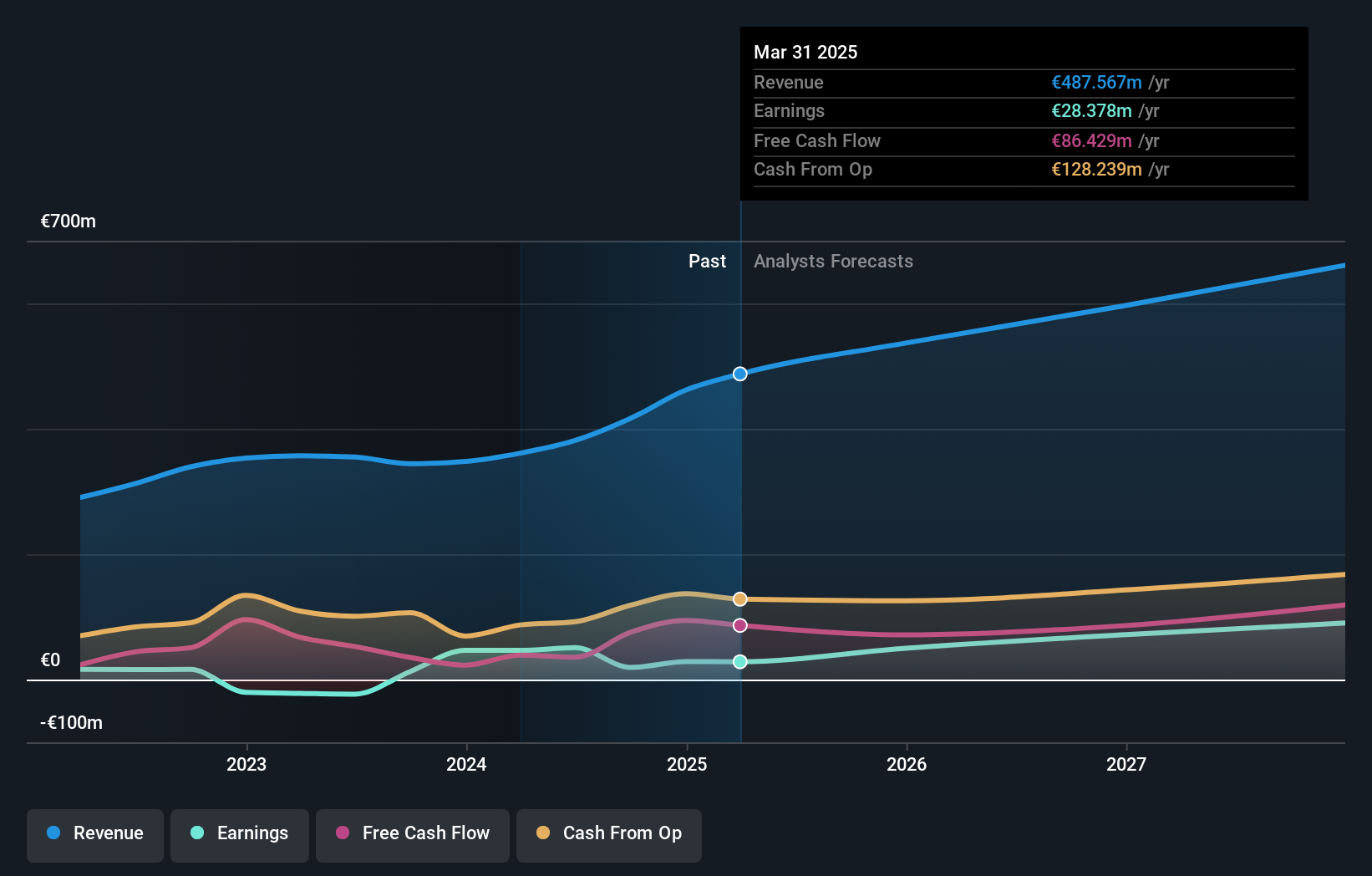

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brockhaus Technologies AG is a private equity firm with a market cap of €307.16 million.

Operations: Brockhaus Technologies generates revenue from its Security Technologies segment (€39.43 million) and Financial Technologies segment (€153.43 million).

Insider Ownership: 26.6%

Earnings Growth Forecast: 76.3% p.a.

Brockhaus Technologies reported Q1 2024 revenue of €39.97 million, up from €33.89 million a year ago, though it incurred a net loss of €1.38 million compared to €0.488 million previously. Despite slower forecasted revenue growth (17.8% per year) than some high-growth benchmarks, it outpaces the German market average (5.3%). Expected to become profitable within three years with robust earnings growth (76.28% per year), Brockhaus trades at 79.3% below its estimated fair value but has low forecasted ROE (8.1%).

- Take a closer look at Brockhaus Technologies' potential here in our earnings growth report.

- Our valuation report unveils the possibility Brockhaus Technologies' shares may be trading at a discount.

Verve Group (XTRA:M8G)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Verve Group SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe, with a market cap of €466.83 million.

Operations: Verve Group SE generates revenue through its Demand Side Platforms (DSP) segment, which brought in €51.53 million, and its Supply Side Platforms (SSP) segment, contributing €318.35 million.

Insider Ownership: 25.1%

Earnings Growth Forecast: 20.6% p.a.

Verve Group SE, recently renamed from MGI - Media and Games Invest SE, has seen substantial insider buying over the past three months. Despite a highly volatile share price, its earnings are forecast to grow significantly at 20.62% per year, outpacing the German market. The company completed a €65 million bond issue and expects to save €10 million annually in interest costs following refinancing. However, shareholders have been diluted recently and interest payments are not well covered by earnings.

- Unlock comprehensive insights into our analysis of Verve Group stock in this growth report.

- Upon reviewing our latest valuation report, Verve Group's share price might be too pessimistic.

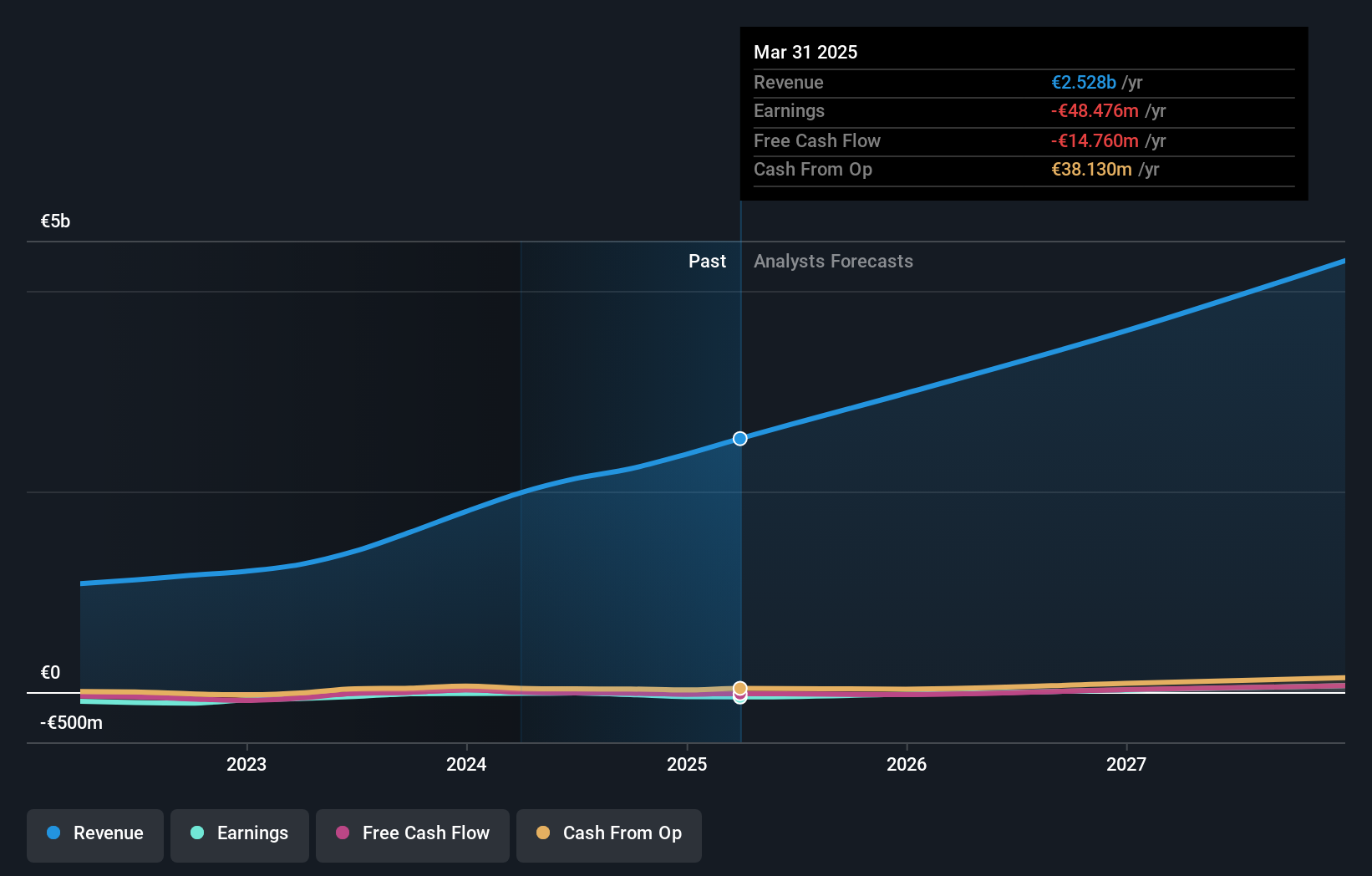

Redcare Pharmacy (XTRA:RDC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Redcare Pharmacy NV operates an online pharmacy business across the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France with a market cap of approximately €2.91 billion.

Operations: The company's revenue segments include €1.74 billion from the DACH region and €391 million from international markets.

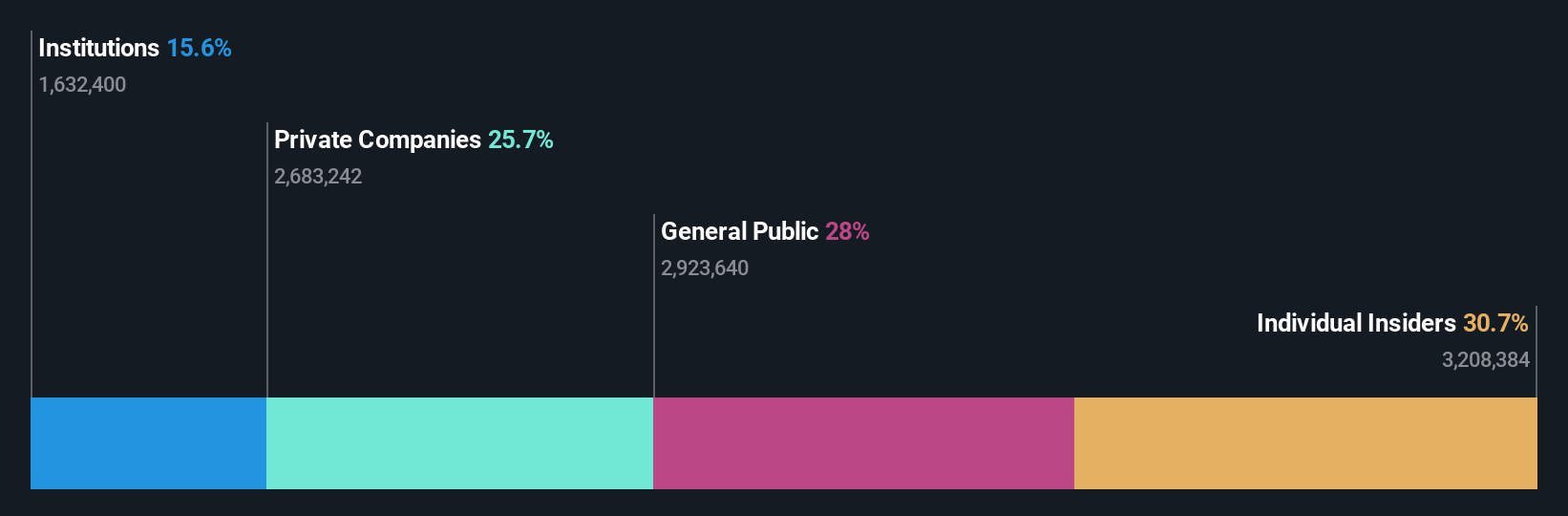

Insider Ownership: 17.7%

Earnings Growth Forecast: 50.2% p.a.

Redcare Pharmacy is forecast to become profitable within the next three years, with earnings expected to grow 50.21% annually. Despite trading at 63.1% below its estimated fair value, its share price has been highly volatile over the past three months. Recent earnings reported a sales increase to €1.12 billion for H1 2024, up from €791.94 million a year ago, although net losses narrowed slightly to €12.07 million from €14.78 million previously.

- Dive into the specifics of Redcare Pharmacy here with our thorough growth forecast report.

- The analysis detailed in our Redcare Pharmacy valuation report hints at an inflated share price compared to its estimated value.

Where To Now?

- Explore the 19 names from our Fast Growing German Companies With High Insider Ownership screener here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:RDC

Redcare Pharmacy

Operates in online pharmacy business in the Netherlands, Germany, Italy, Belgium, Switzerland, Austria, and France.

Excellent balance sheet with reasonable growth potential.