MGI - Media and Games Invest SE (ETR:M8G) Stocks Shoot Up 54% But Its P/S Still Looks Reasonable

MGI - Media and Games Invest SE (ETR:M8G) shareholders have had their patience rewarded with a 54% share price jump in the last month. Taking a wider view, although not as strong as the last month, the full year gain of 15% is also fairly reasonable.

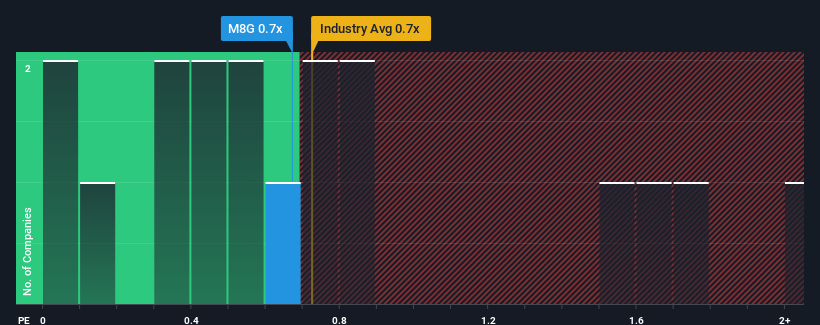

Although its price has surged higher, it's still not a stretch to say that MGI - Media and Games Invest's price-to-sales (or "P/S") ratio of 0.7x right now seems quite "middle-of-the-road" compared to the Media industry in Germany, seeing as it matches the P/S ratio of the wider industry. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Check out our latest analysis for MGI - Media and Games Invest

What Does MGI - Media and Games Invest's P/S Mean For Shareholders?

There hasn't been much to differentiate MGI - Media and Games Invest's and the industry's retreating revenue lately. It seems that few are expecting the company's revenue performance to deviate much from most other companies, which has held the P/S back. You'd much rather the company improve its revenue if you still believe in the business. At the very least, you'd be hoping that revenue doesn't accelerate downwards if your plan is to pick up some stock while it's not in favour.

Want the full picture on analyst estimates for the company? Then our free report on MGI - Media and Games Invest will help you uncover what's on the horizon.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like MGI - Media and Games Invest's to be considered reasonable.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 1.5%. Still, the latest three year period has seen an excellent 123% overall rise in revenue, in spite of its unsatisfying short-term performance. Accordingly, while they would have preferred to keep the run going, shareholders would definitely welcome the medium-term rates of revenue growth.

Shifting to the future, estimates from the eight analysts covering the company suggest revenue should grow by 7.0% per year over the next three years. That's shaping up to be similar to the 5.8% per annum growth forecast for the broader industry.

In light of this, it's understandable that MGI - Media and Games Invest's P/S sits in line with the majority of other companies. It seems most investors are expecting to see average future growth and are only willing to pay a moderate amount for the stock.

The Bottom Line On MGI - Media and Games Invest's P/S

MGI - Media and Games Invest appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've seen that MGI - Media and Games Invest maintains an adequate P/S seeing as its revenue growth figures match the rest of the industry. At this stage investors feel the potential for an improvement or deterioration in revenue isn't great enough to push P/S in a higher or lower direction. Unless these conditions change, they will continue to support the share price at these levels.

We don't want to rain on the parade too much, but we did also find 4 warning signs for MGI - Media and Games Invest (2 can't be ignored!) that you need to be mindful of.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M8G

Verve Group

A digital media company, engages in the provision of ad-software solutions in North America and Europe.

Good value with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives