Stock Analysis

Earnings growth of 26% over 3 years hasn't been enough to translate into positive returns for MGI - Media and Games Invest (ETR:M8G) shareholders

It is doubtless a positive to see that the MGI - Media and Games Invest SE (ETR:M8G) share price has gained some 61% in the last three months. But over the last three years we've seen a quite serious decline. In that time, the share price dropped 68%. Some might say the recent bounce is to be expected after such a bad drop. After all, could be that the fall was overdone.

Given the past week has been tough on shareholders, let's investigate the fundamentals and see what we can learn.

Check out our latest analysis for MGI - Media and Games Invest

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

MGI - Media and Games Invest became profitable within the last five years. We would usually expect to see the share price rise as a result. So it's worth looking at other metrics to try to understand the share price move.

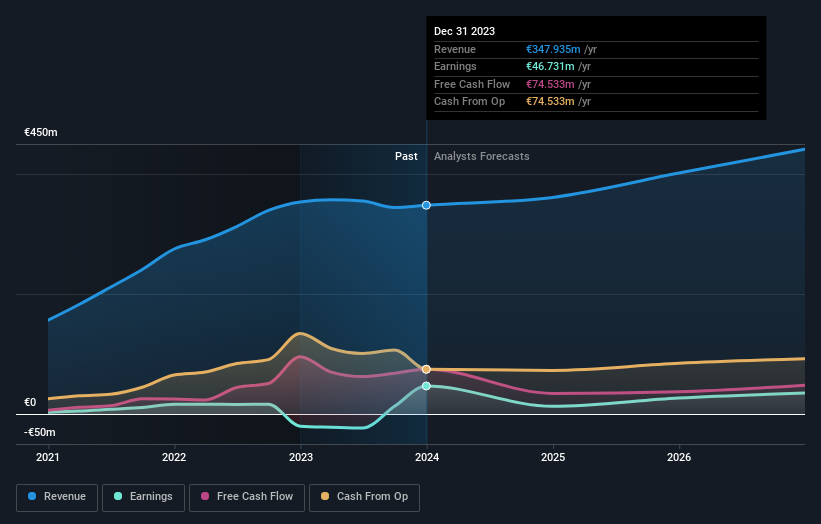

We note that, in three years, revenue has actually grown at a 23% annual rate, so that doesn't seem to be a reason to sell shares. It's probably worth investigating MGI - Media and Games Invest further; while we may be missing something on this analysis, there might also be an opportunity.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So it makes a lot of sense to check out what analysts think MGI - Media and Games Invest will earn in the future (free profit forecasts).

A Different Perspective

We're pleased to report that MGI - Media and Games Invest shareholders have received a total shareholder return of 22% over one year. That gain is better than the annual TSR over five years, which is 5%. Therefore it seems like sentiment around the company has been positive lately. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. For example, we've discovered 4 warning signs for MGI - Media and Games Invest (3 shouldn't be ignored!) that you should be aware of before investing here.

MGI - Media and Games Invest is not the only stock insiders are buying. So take a peek at this free list of growing companies with insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on German exchanges.

Valuation is complex, but we're helping make it simple.

Find out whether MGI - Media and Games Invest is potentially over or undervalued by checking out our comprehensive analysis, which includes fair value estimates, risks and warnings, dividends, insider transactions and financial health.

View the Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M8G

MGI - Media and Games Invest

MGI - Media and Games Invest SE operates a software platform for the automated buying and selling of digital advertising space in North America and Europe.

Undervalued with questionable track record.