- Germany

- /

- Entertainment

- /

- XTRA:HLG

Highlight Communications AG's (ETR:HLG) CEO Might Not Expect Shareholders To Be So Generous This Year

Key Insights

- Highlight Communications will host its Annual General Meeting on 27th of June

- CEO Bernhard Burgener's total compensation includes salary of CHF837.0k

- The overall pay is 533% above the industry average

- Highlight Communications' EPS declined by 105% over the past three years while total shareholder loss over the past three years was 45%

The results at Highlight Communications AG (ETR:HLG) have been quite disappointing recently and CEO Bernhard Burgener bears some responsibility for this. Shareholders can take the chance to hold the board and management accountable for the unsatisfactory performance at the next AGM on 27th of June. It would also be an opportunity for shareholders to influence management through voting on company resolutions such as executive remuneration, which could impact the firm significantly. We present the case why we think CEO compensation is out of sync with company performance.

See our latest analysis for Highlight Communications

Comparing Highlight Communications AG's CEO Compensation With The Industry

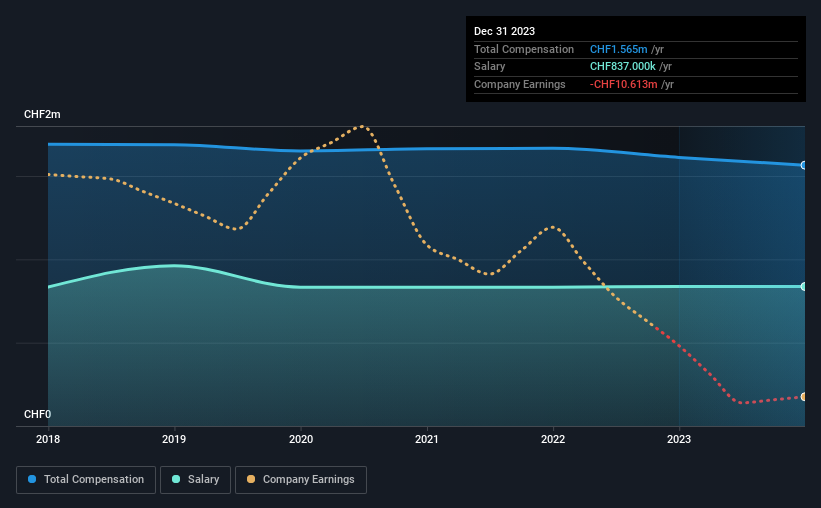

According to our data, Highlight Communications AG has a market capitalization of €123m, and paid its CEO total annual compensation worth CHF1.6m over the year to December 2023. This means that the compensation hasn't changed much from last year. Notably, the salary which is CHF837.0k, represents a considerable chunk of the total compensation being paid.

On comparing similar-sized companies in the German Entertainment industry with market capitalizations below €187m, we found that the median total CEO compensation was CHF247k. Hence, we can conclude that Bernhard Burgener is remunerated higher than the industry median.

| Component | 2023 | 2022 | Proportion (2023) |

| Salary | CHF837k | CHF837k | 53% |

| Other | CHF728k | CHF774k | 47% |

| Total Compensation | CHF1.6m | CHF1.6m | 100% |

On an industry level, around 69% of total compensation represents salary and 31% is other remuneration. Highlight Communications sets aside a smaller share of compensation for salary, in comparison to the overall industry. If salary is the major component in total compensation, it suggests that the CEO receives a higher fixed proportion of the total compensation, regardless of performance.

A Look at Highlight Communications AG's Growth Numbers

Over the last three years, Highlight Communications AG has shrunk its earnings per share by 105% per year. Its revenue is down 15% over the previous year.

The decline in EPS is a bit concerning. And the fact that revenue is down year on year arguably paints an ugly picture. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has Highlight Communications AG Been A Good Investment?

The return of -45% over three years would not have pleased Highlight Communications AG shareholders. This suggests it would be unwise for the company to pay the CEO too generously.

To Conclude...

Along with the business performing poorly, shareholders have suffered with poor share price returns on their investments, suggesting that there's little to no chance of them being in favor of a CEO pay raise. At the upcoming AGM, the board will get the chance to explain the steps it plans to take to improve business performance.

While CEO pay is an important factor to be aware of, there are other areas that investors should be mindful of as well. That's why we did some digging and identified 1 warning sign for Highlight Communications that investors should think about before committing capital to this stock.

Switching gears from Highlight Communications, if you're hunting for a pristine balance sheet and premium returns, this free list of high return, low debt companies is a great place to look.

Valuation is complex, but we're here to simplify it.

Discover if Highlight Communications might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HLG

Highlight Communications

Operates as a strategic and financial holding company in Switzerland, Germany, rest of Europe, and internationally.

Low risk and slightly overvalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026