- Germany

- /

- Entertainment

- /

- XTRA:BVB

If You Had Bought Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien (ETR:BVB) Stock Five Years Ago, You Could Pocket A 45% Gain Today

Generally speaking the aim of active stock picking is to find companies that provide returns that are superior to the market average. And while active stock picking involves risks (and requires diversification) it can also provide excess returns. To wit, the Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien share price has climbed 45% in five years, easily topping the market return of 27% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 6.4% in the last year.

See our latest analysis for Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien

Because Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. When a company doesn't make profits, we'd generally expect to see good revenue growth. That's because it's hard to be confident a company will be sustainable if revenue growth is negligible, and it never makes a profit.

For the last half decade, Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien can boast revenue growth at a rate of 1.9% per year. That's not a very high growth rate considering the bottom line. While it's hard to say just how much value the company added over five years, the annualised share price gain of 8% seems about right. We'd be looking for the underlying business to grow revenue a bit faster.

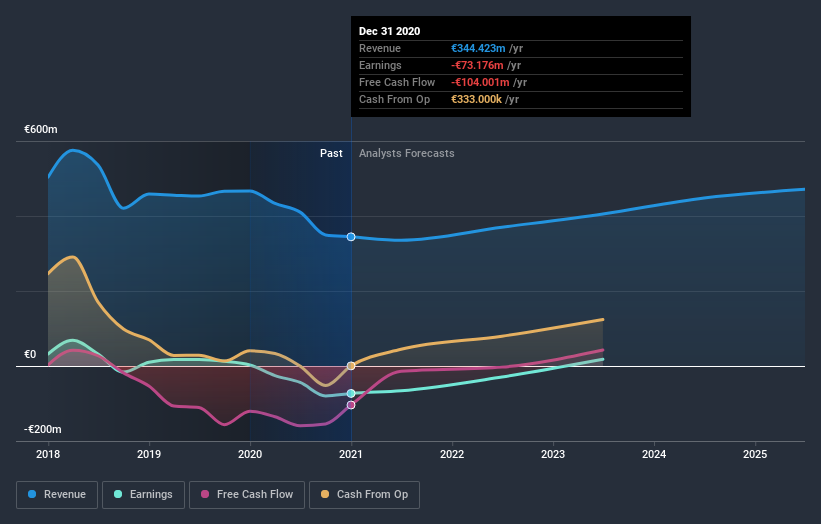

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Take a more thorough look at Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien's financial health with this free report on its balance sheet.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien's total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien shareholders, and that cash payout contributed to why its TSR of 50%, over the last 5 years, is better than the share price return.

A Different Perspective

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien shareholders gained a total return of 6.4% during the year. Unfortunately this falls short of the market return. If we look back over five years, the returns are even better, coming in at 9% per year for five years. It may well be that this is a business worth popping on the watching, given the continuing positive reception, over time, from the market. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

But note: Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

If you’re looking to trade Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About XTRA:BVB

Borussia Dortmund GmbH Kommanditgesellschaft auf Aktien

Operates a football club in Germany.

Good value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives