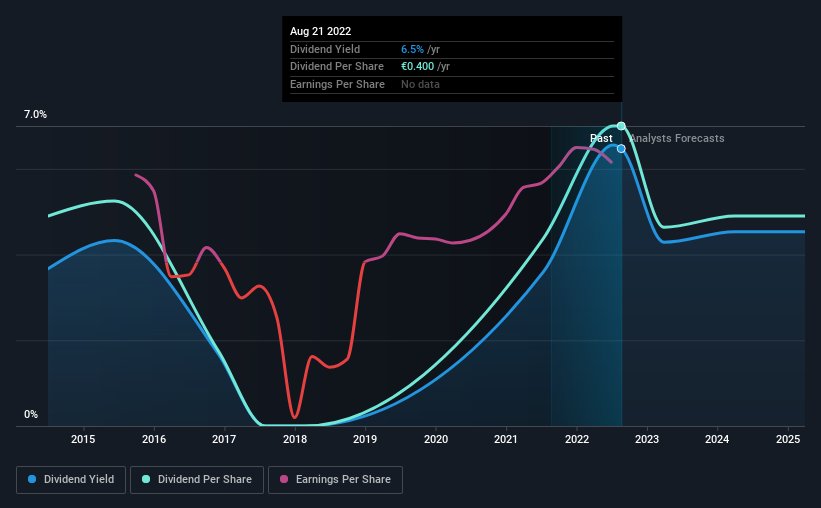

The board of Bastei Lübbe AG (ETR:BST) has announced that it will be paying its dividend of €0.40 on the 19th of September, an increased payment from last year's comparable dividend. Although the dividend is now higher, the yield is only 6.5%, which is below the industry average.

See our latest analysis for Bastei Lübbe

Bastei Lübbe's Payment Has Solid Earnings Coverage

Even a low dividend yield can be attractive if it is sustained for years on end. The last dividend was quite easily covered by Bastei Lübbe's earnings. This means that a large portion of its earnings are being retained to grow the business.

Looking forward, earnings per share is forecast to fall by 22.3% over the next year. However, if the dividend continues along recent trends, we estimate the payout ratio could reach 77%, meaning that most of the company's earnings are being paid out to shareholders.

Bastei Lübbe's Dividend Has Lacked Consistency

Even in its relatively short history, the company has reduced the dividend at least once. If the company cuts once, it definitely isn't argument against the possibility of it cutting in the future. The annual payment during the last 8 years was €0.28 in 2014, and the most recent fiscal year payment was €0.40. This works out to be a compound annual growth rate (CAGR) of approximately 4.6% a year over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. Bastei Lübbe has impressed us by growing EPS at 70% per year over the past five years. Bastei Lübbe is clearly able to grow rapidly while still returning cash to shareholders, positioning it to become a strong dividend payer in the future.

We Really Like Bastei Lübbe's Dividend

Overall, we think this could be an attractive income stock, and it is only getting better by paying a higher dividend this year. The distributions are easily covered by earnings, and there is plenty of cash being generated as well. If earnings do fall over the next 12 months, the dividend could be buffeted a little bit, but we don't think it should cause too much of a problem in the long term. Taking this all into consideration, this looks like it could be a good dividend opportunity.

It's important to note that companies having a consistent dividend policy will generate greater investor confidence than those having an erratic one. Still, investors need to consider a host of other factors, apart from dividend payments, when analysing a company. Case in point: We've spotted 3 warning signs for Bastei Lübbe (of which 1 is a bit concerning!) you should know about. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if Bastei Lübbe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BST

Bastei Lübbe

A media company, publishes books, audio books, e-books, and related digital products in the genres of fiction and popular science content in European Union, Germany, Austria, Luxembourg, Czech Republic, and Switzerland.

Very undervalued with flawless balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.