Revenues Tell The Story For ad pepper media International N.V. (ETR:APM) As Its Stock Soars 30%

The ad pepper media International N.V. (ETR:APM) share price has done very well over the last month, posting an excellent gain of 30%. The last month tops off a massive increase of 114% in the last year.

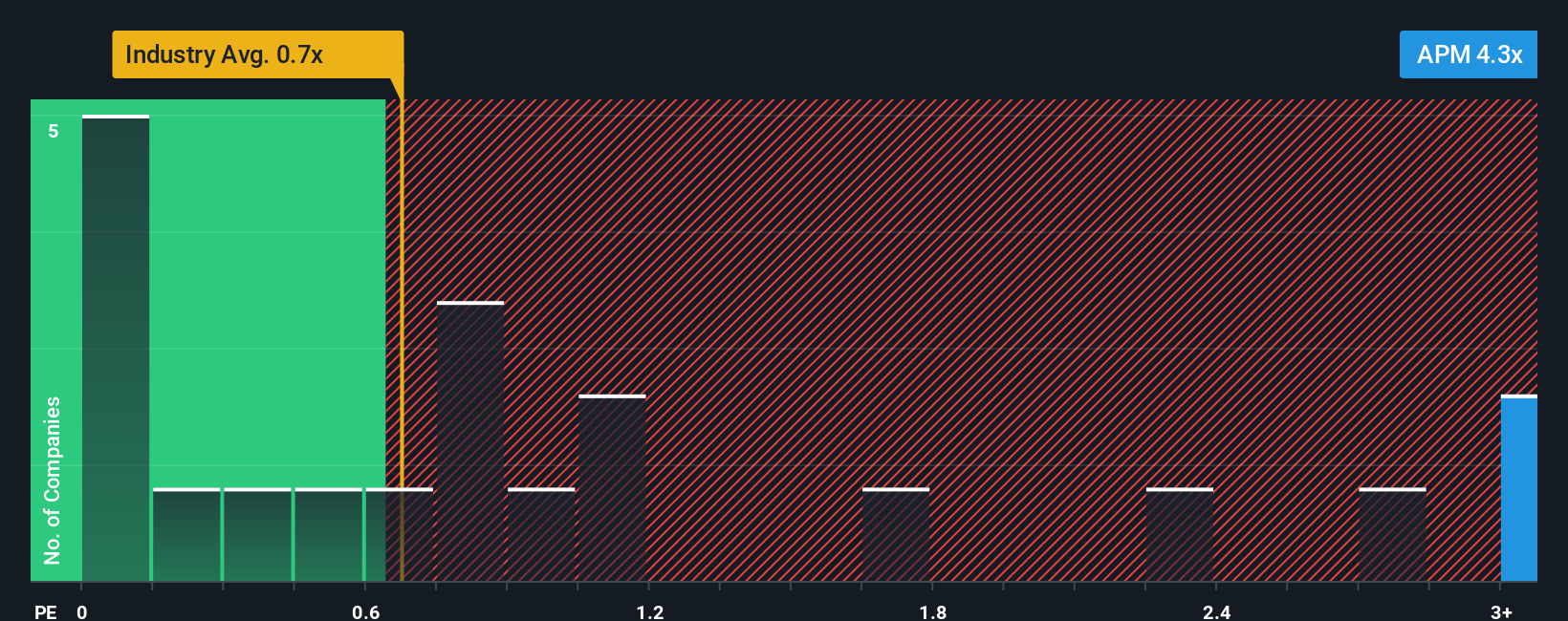

Since its price has surged higher, when almost half of the companies in Germany's Media industry have price-to-sales ratios (or "P/S") below 0.9x, you may consider ad pepper media International as a stock not worth researching with its 4.3x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for ad pepper media International

How ad pepper media International Has Been Performing

ad pepper media International hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is high because investors think this poor revenue performance will turn the corner. However, if this isn't the case, investors might get caught out paying too much for the stock.

Want the full picture on analyst estimates for the company? Then our free report on ad pepper media International will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as ad pepper media International's is when the company's growth is on track to outshine the industry decidedly.

In reviewing the last year of financials, we were disheartened to see the company's revenues fell to the tune of 1.2%. The last three years don't look nice either as the company has shrunk revenue by 19% in aggregate. Accordingly, shareholders would have felt downbeat about the medium-term rates of revenue growth.

Turning to the outlook, the next three years should generate growth of 62% per annum as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 5.4% each year growth forecast for the broader industry.

With this in mind, it's not hard to understand why ad pepper media International's P/S is high relative to its industry peers. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From ad pepper media International's P/S?

ad pepper media International's P/S has grown nicely over the last month thanks to a handy boost in the share price. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

We've established that ad pepper media International maintains its high P/S on the strength of its forecasted revenue growth being higher than the the rest of the Media industry, as expected. It appears that shareholders are confident in the company's future revenues, which is propping up the P/S. Unless the analysts have really missed the mark, these strong revenue forecasts should keep the share price buoyant.

The company's balance sheet is another key area for risk analysis. Take a look at our free balance sheet analysis for ad pepper media International with six simple checks on some of these key factors.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:APM

ad pepper media International

Provides performance marketing services in Germany, the United Kingdom, Spain, Switzerland, France, Italy, and the Netherlands.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives