As global markets navigate the uncertainties surrounding the incoming Trump administration and fluctuating interest rates, investors are keenly observing sector performances and economic indicators. Amidst this backdrop, dividend stocks present a compelling option for those seeking steady income streams, as they often offer resilience in volatile markets due to their regular payout structures and potential for capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.21% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.97% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.12% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.63% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.18% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 6.79% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.48% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.80% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.44% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.51% | ★★★★★★ |

Click here to see the full list of 1969 stocks from our Top Dividend Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

SIMONA (DB:SIM0)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: SIMONA Aktiengesellschaft is a company that develops, manufactures, and markets a variety of semi-finished thermoplastics, pipes, fittings, and profiles globally and has a market capitalization of €339 million.

Operations: SIMONA's revenue primarily comes from its segment focused on semi-finished plastics, pipes, fittings, and finished parts, generating €578.85 million.

Dividend Yield: 3.1%

SIMONA's dividend payments are well-covered, with a payout ratio of 35.7% and a cash payout ratio of 35%, indicating sustainability from both earnings and cash flows. However, the dividend yield is relatively low at 3.14% compared to top German payers, and the track record has been volatile over the past decade despite some growth in dividends. Trading significantly below its estimated fair value, SIMONA offers potential value but presents reliability concerns for consistent income seekers.

- Get an in-depth perspective on SIMONA's performance by reading our dividend report here.

- Upon reviewing our latest valuation report, SIMONA's share price might be too pessimistic.

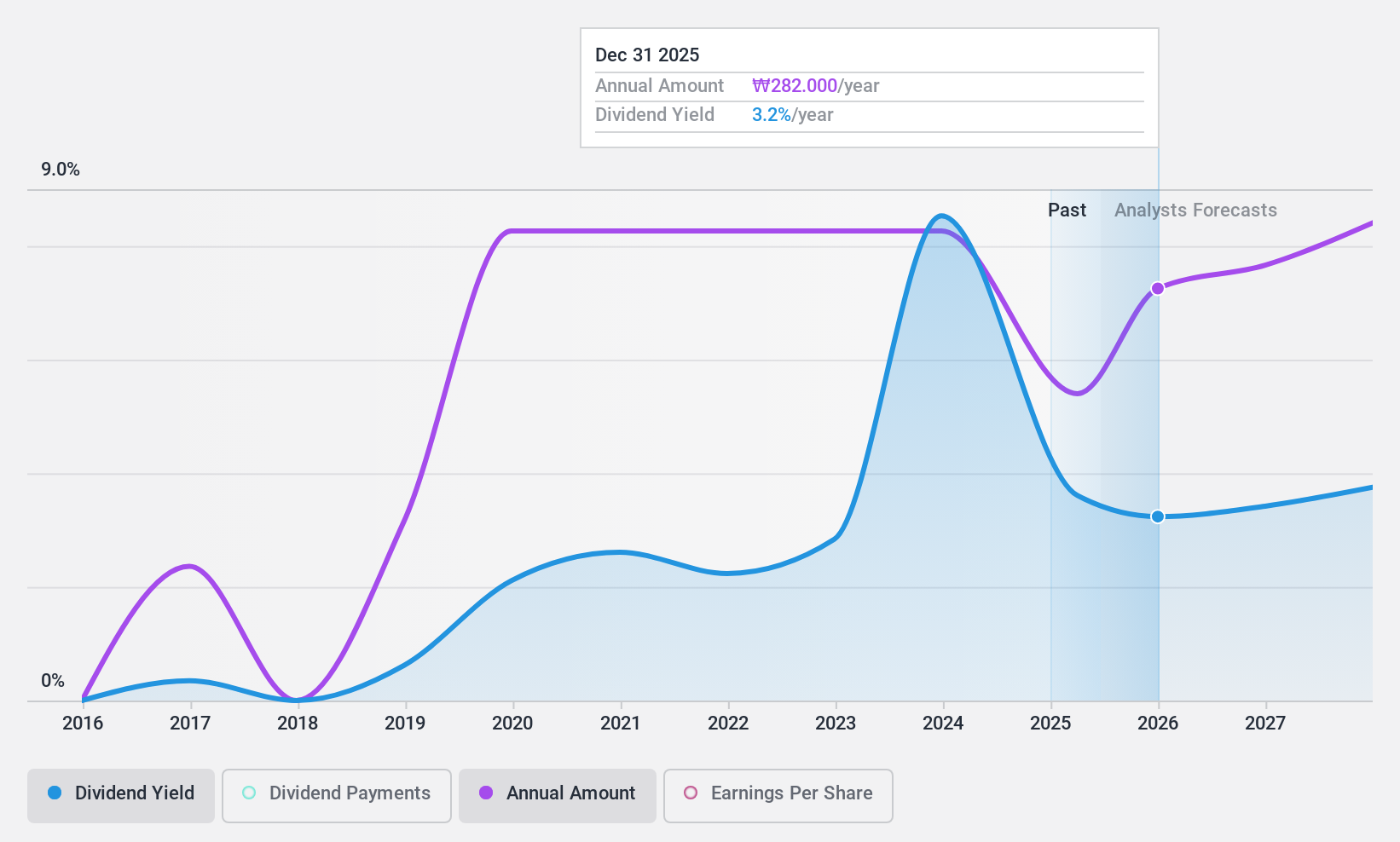

Hyundai G.F. Holdings (KOSE:A005440)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hyundai G.F. Holdings Co., Ltd. operates in the rental and investment sectors, with a market capitalization of approximately ₩732.75 billion.

Operations: Hyundai G.F. Holdings Co., Ltd.'s revenue segments focus on rental and investment activities.

Dividend Yield: 4.3%

Hyundai G.F. Holdings' dividends are well-supported by a low payout ratio of 1.8% and a cash payout ratio of 27.2%, ensuring sustainability from earnings and cash flows. Despite being in the top 25% for dividend yield in Korea at 4.26%, its dividend history is less stable, with volatility over nine years of payments. The stock trades significantly below estimated fair value, suggesting potential value but raising concerns about income reliability due to its unstable track record.

- Click here and access our complete dividend analysis report to understand the dynamics of Hyundai G.F. Holdings.

- Our expertly prepared valuation report Hyundai G.F. Holdings implies its share price may be lower than expected.

Press Kogyo (TSE:7246)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Press Kogyo Co., Ltd. manufactures and sells automotive and construction machinery parts both in Japan and internationally, with a market cap of ¥54.40 billion.

Operations: Press Kogyo Co., Ltd.'s revenue is derived from its operations in the automotive and construction machinery parts sectors, serving both domestic and international markets.

Dividend Yield: 5.8%

Press Kogyo's dividend yield ranks in the top 25% within Japan, yet its sustainability is questionable due to a high cash payout ratio of 95.4%, indicating dividends are not well-covered by cash flows. Despite recent increases, the dividend history has been volatile with significant annual drops. The company announced a special commemorative dividend, raising the annual payout to JPY 32 per share amidst lowered earnings guidance and challenging market conditions impacting demand across key regions.

- Dive into the specifics of Press Kogyo here with our thorough dividend report.

- According our valuation report, there's an indication that Press Kogyo's share price might be on the cheaper side.

Key Takeaways

- Unlock our comprehensive list of 1969 Top Dividend Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:SIM0

SIMONA

Develops, manufactures, and markets a range of semi-finished thermoplastics, pipes, fittings, and profiles worldwide.

Excellent balance sheet second-rate dividend payer.

Market Insights

Community Narratives