As Germany's DAX Index experiences a positive uptick, buoyed by the European Central Bank's recent interest rate cut, investor sentiment is cautiously optimistic about the potential for further monetary easing to bolster economic growth. In this environment, identifying promising stocks requires a focus on companies that demonstrate resilience and adaptability amid shifting economic conditions.

Top 10 Undiscovered Gems With Strong Fundamentals In Germany

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Mineralbrunnen Überkingen-Teinach GmbH KGaA | 19.91% | 0.96% | -5.02% | ★★★★★★ |

| Westag | NA | -1.56% | -21.68% | ★★★★★★ |

| FRoSTA | 8.18% | 4.36% | 16.00% | ★★★★★★ |

| Mühlbauer Holding | NA | 10.49% | -12.73% | ★★★★★★ |

| Paul Hartmann | 26.29% | 1.12% | -17.65% | ★★★★★☆ |

| Südwestdeutsche Salzwerke | 0.30% | 4.57% | 25.01% | ★★★★★☆ |

| HOMAG Group | NA | -31.14% | 23.43% | ★★★★★☆ |

| EnviTec Biogas | 48.48% | 20.85% | 46.34% | ★★★★★☆ |

| Baader Bank | 91.28% | 12.42% | -8.00% | ★★★★★☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

We'll examine a selection from our screener results.

HOMAG Group (DB:HG1)

Simply Wall St Value Rating: ★★★★★☆

Overview: HOMAG Group AG, along with its subsidiaries, provides machinery and solutions for the woodworking and timber construction industries globally, with a market capitalization of €589.87 million.

Operations: HOMAG Group generates revenue primarily through the sale of machinery and solutions for the woodworking and timber construction sectors. The company reported a net profit margin of 5.2% in its recent financial period, reflecting its efficiency in converting revenues into actual profit after expenses.

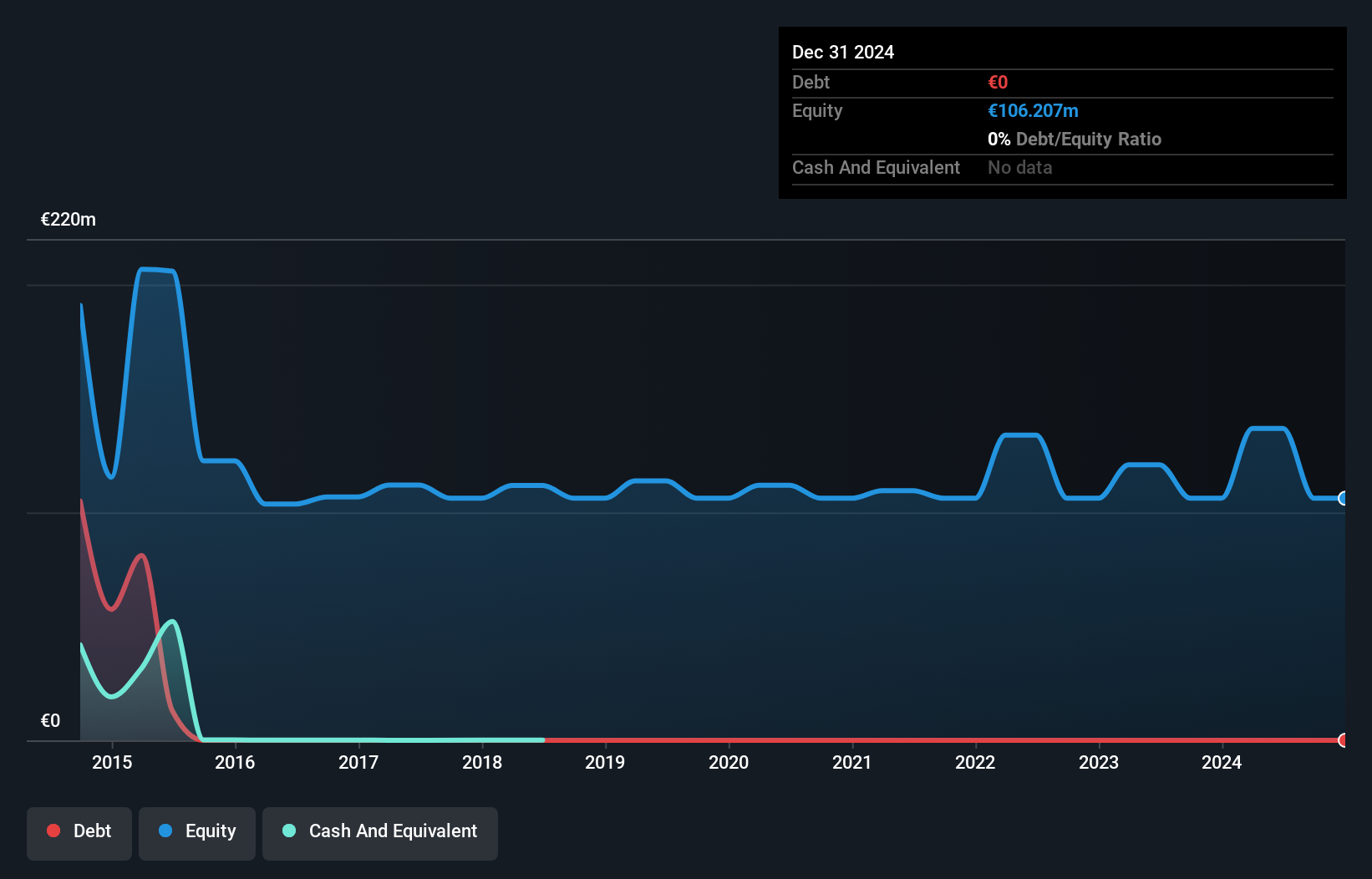

HOMAG Group, a notable player in Germany's machinery sector, reported sales of €3.52 million for the first half of 2024, slightly up from €3.51 million the previous year. Net income saw a significant boost to €30.66 million from €14.71 million last year, despite negative earnings growth of -34.8% over the past year compared to the machinery industry's -4%. The company operates debt-free with high-quality past earnings and boasts a price-to-earnings ratio of 11.7x, lower than Germany's market average of 16.3x, suggesting it may offer good value within its industry context.

RHÖN-KLINIKUM (XTRA:RHK)

Simply Wall St Value Rating: ★★★★★☆

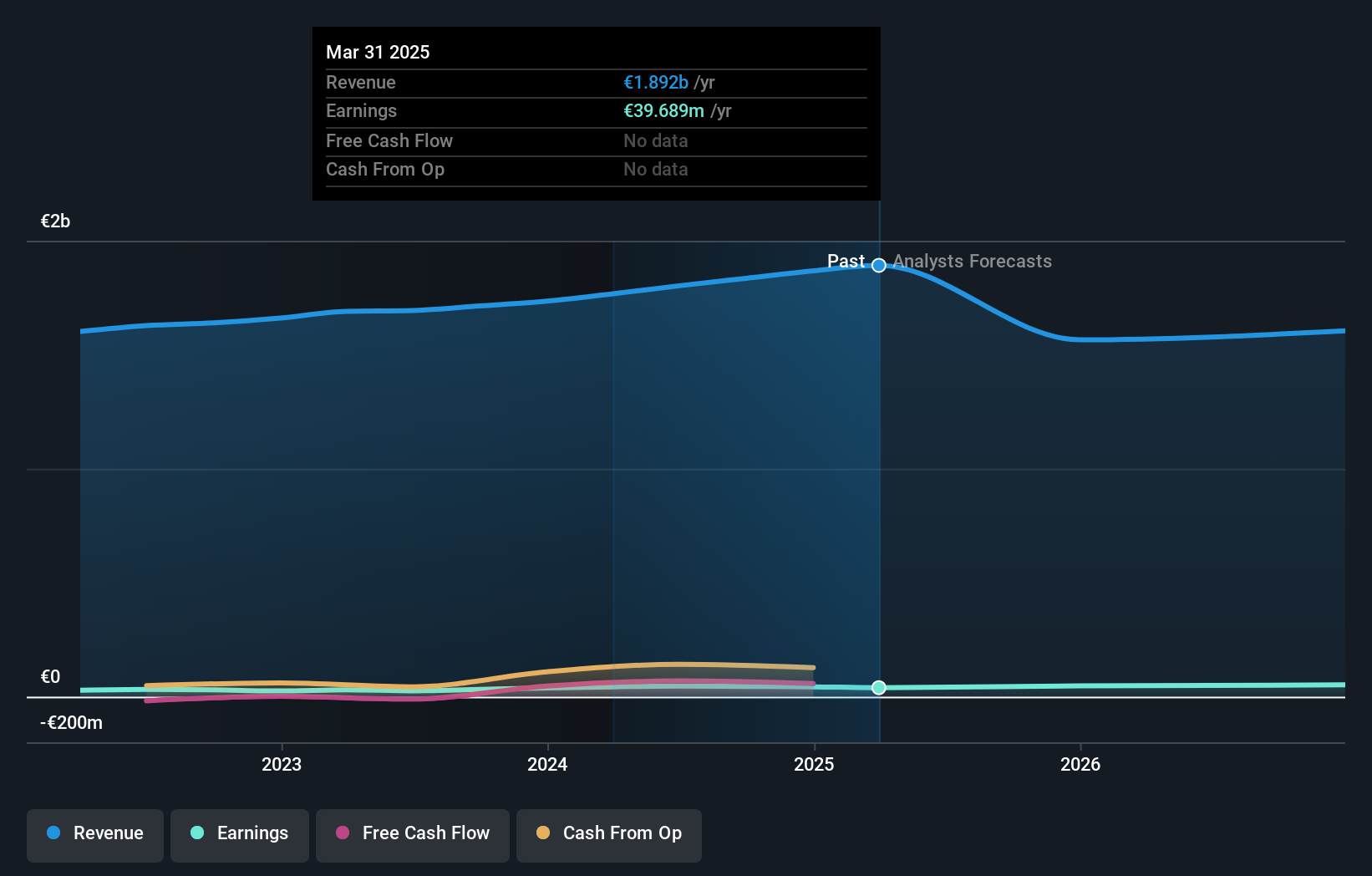

Overview: RHÖN-KLINIKUM Aktiengesellschaft, along with its subsidiaries, provides in-patient, semi-patient, and outpatient healthcare services in Germany with a market capitalization of approximately €850.12 million.

Operations: The primary revenue streams for RHÖN-KLINIKUM include acute hospitals generating €1.45 billion, followed by rehabilitation hospitals and medical care centres with €34.70 million and €23.90 million, respectively.

RHÖN-KLINIKUM, a notable player in Germany's healthcare sector, showcases a compelling mix of financial health and growth potential. With a price-to-earnings ratio of 18.3x, it is attractively valued against the industry average of 20.3x. The company reported robust earnings growth of 81% over the past year, outpacing the healthcare industry's 31%. For the second quarter of 2024, net income surged to €9 million from €5.73 million previously, while revenue climbed to €459 million from €425 million last year. Despite an increase in its debt-to-equity ratio over five years to 11%, RHÖN-KLINIKUM remains cash-rich and free cash flow positive, indicating sound financial management amidst broader economic uncertainties.

- Click here to discover the nuances of RHÖN-KLINIKUM with our detailed analytical health report.

Gain insights into RHÖN-KLINIKUM's historical performance by reviewing our past performance report.

Uzin Utz (XTRA:UZU)

Simply Wall St Value Rating: ★★★★★★

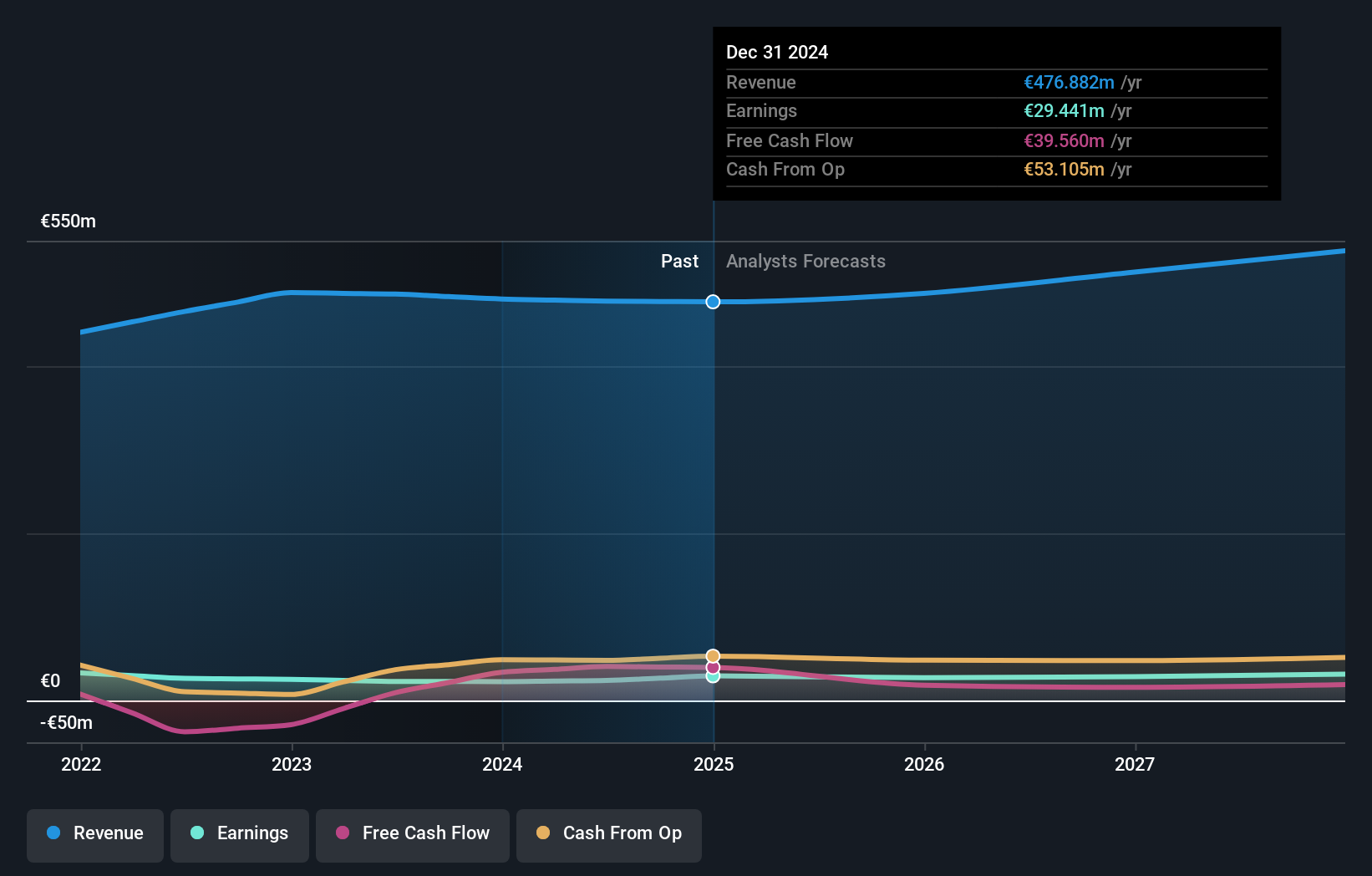

Overview: Uzin Utz SE develops, manufactures, and sells construction chemical system products in Germany, the United States, Netherlands, and internationally with a market cap of approximately €244.15 million.

Operations: Uzin Utz SE generates revenue primarily from its construction chemical system products, with significant contributions from Germany - Laying Systems (€209.68 million) and USA - Laying Systems (€73.60 million). The company's financial performance is influenced by its diverse geographic segments, including Western Europe (€81.64 million) and the Netherlands - Laying Systems (€83.59 million).

Uzin Utz, a player in the chemicals sector, has shown resilience with its net debt to equity ratio dropping from 61.5% to 15.9% over five years, showcasing prudent financial management. The company's price-to-earnings ratio of 10.2x is notably below the German market average of 16.3x, suggesting potential undervaluation. Recent earnings growth of 5% outpaced the industry’s -16.5%, indicating robust performance despite challenging market conditions. For the first half of 2024, sales were €242.29 million and net income rose to €12.38 million from €11 million previously, reflecting steady profitability with basic EPS climbing to €2.45 from €2.19 last year.

- Get an in-depth perspective on Uzin Utz's performance by reading our health report here.

Gain insights into Uzin Utz's past trends and performance with our Past report.

Next Steps

- Investigate our full lineup of 51 German Undiscovered Gems With Strong Fundamentals right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if HOMAG Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DB:HG1

HOMAG Group

Manufactures and sells machines and solutions for wood processing and timber construction industries worldwide.

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives