- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

Why thyssenkrupp (XTRA:TKA) Is Down 28.4% After Spinning Off Naval-Defense Unit TKMS

Reviewed by Sasha Jovanovic

- Earlier this week, thyssenkrupp completed the spin-off of its naval-defense unit, TKMS, which began trading as an independent company at €60 per share and reached as much as €99.99, establishing a market capitalization of US$4.44 billion at the opening price.

- This move enables thyssenkrupp to sharpen its focus on core defense operations and respond to increasing European defense expenditures.

- We will explore how the separation of the naval-defense business and sharper defense focus influence thyssenkrupp's investment narrative.

AI is about to change healthcare. These 33 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

thyssenkrupp Investment Narrative Recap

For shareholders, the investment case for thyssenkrupp centers on its ability to refocus around its core defense and industrial businesses after divesting its naval-defense unit, TKMS. While the spin-off is a key move aligning with rising defense spending in Europe, it does not meaningfully offset the biggest near-term risk: ongoing macroeconomic headwinds continue to pose pressure on thyssenkrupp’s revenues, especially in core steel, materials, and automotive segments.

Among recent developments, the strategic plan to sell or exit the materials trading unit, valued at around €2 billion, stands out. This announcement is closely linked to the company’s broader transformation efforts and capital allocation shifts, factors underpinning both the risk of constrained returns and the potential for a more focused, cash-generative business if executed well. Yet, even with these changes, investors should not overlook that...

Read the full narrative on thyssenkrupp (it's free!)

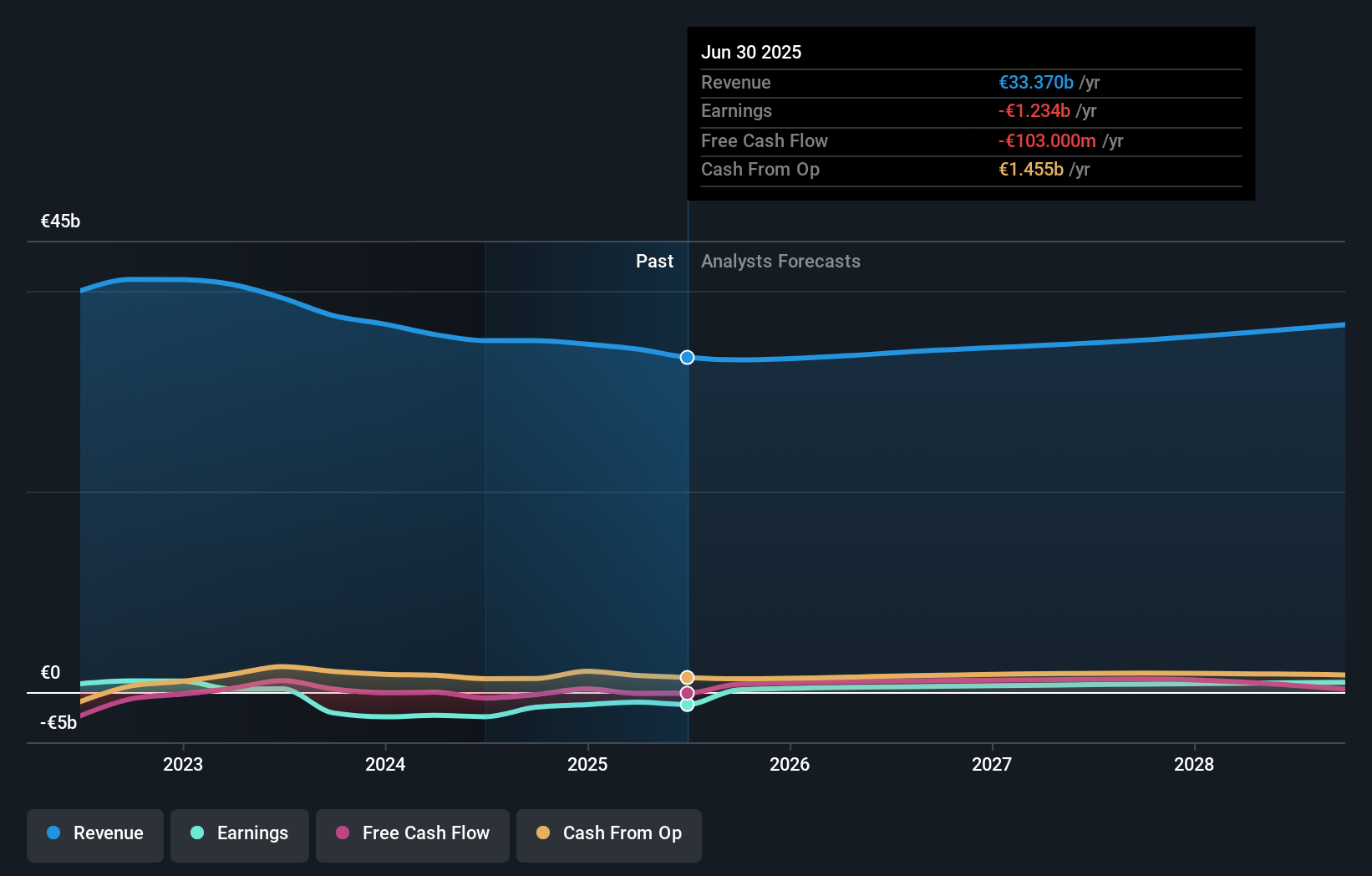

thyssenkrupp's narrative projects €37.0 billion revenue and €1.5 billion earnings by 2028. This requires 3.5% yearly revenue growth and a €2.7 billion earnings increase from the current earnings of €-1.2 billion.

Uncover how thyssenkrupp's forecasts yield a €10.20 fair value, a 12% upside to its current price.

Exploring Other Perspectives

Sixteen community members from Simply Wall St have offered fair value estimates for thyssenkrupp, spanning from €7.29 up to €42.40 per share. While this highlights the wide scope of individual opinions, many have also pointed out persistent operational inefficiencies as an ongoing challenge for future earnings and return potential. Consider exploring several viewpoints before forming your own assessment.

Explore 16 other fair value estimates on thyssenkrupp - why the stock might be worth 20% less than the current price!

Build Your Own thyssenkrupp Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free thyssenkrupp research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate thyssenkrupp's overall financial health at a glance.

Contemplating Other Strategies?

Our top stock finds are flying under the radar-for now. Get in early:

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- This technology could replace computers: discover 27 stocks that are working to make quantum computing a reality.

- Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives