- Germany

- /

- Metals and Mining

- /

- XTRA:TKA

A Look at thyssenkrupp's (XTRA:TKA) Valuation After Naval-Defense Spinoff and Strategic Realignment

Reviewed by Simply Wall St

Thyssenkrupp (XTRA:TKA) has drawn fresh attention after spinning off its naval-defense unit, which debuted on the market at 60 euros a share and climbed sharply. This strategic move is closely tied to Europe’s rising defense investments.

See our latest analysis for thyssenkrupp.

With the spotlight on thyssenkrupp after the naval-defense spinoff, it is clear momentum has shifted dramatically. While the share price has pulled back sharply in the past week, the year-to-date return remains extraordinary at 142.1%, and the total shareholder return over the past year is an eye-catching 207.6%. Recent volatility and gains suggest investors are actively reassessing both the company’s prospects and associated risks in light of its new direction.

If defense’s resurgence has you watching sector movers, this is a great moment to discover See the full list for free.

As excitement builds after the naval spinoff, the big question remains: is thyssenkrupp’s dazzling rally signaling real value still on the table, or has the market already priced in all the growth ahead?

Most Popular Narrative: 4.7% Undervalued

The most followed narrative assigns a fair value of €10.20, which is noticeably above thyssenkrupp’s recent closing price of €9.72. This sets expectations that the stock could still have upside left according to the leading projection.

Structural reforms, segment autonomy, and planned Marine Systems spin-off are expected to boost operational efficiency and unlock previously unrecognized value.

Curious how much untapped value depends on transformation inside Europe’s industrial giant? The headline figure rests on aggressive profit and revenue improvement projections. Want to know the forecasted turnaround that has analysts dreaming of a higher price, plus the one metric that could surprise even bulls? Dive in to unlock the drivers behind this provocative valuation.

Result: Fair Value of €10.20 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent weak demand or delays in green technology projects could quickly undermine hopes for sustained earnings growth and a higher valuation.

Find out about the key risks to this thyssenkrupp narrative.

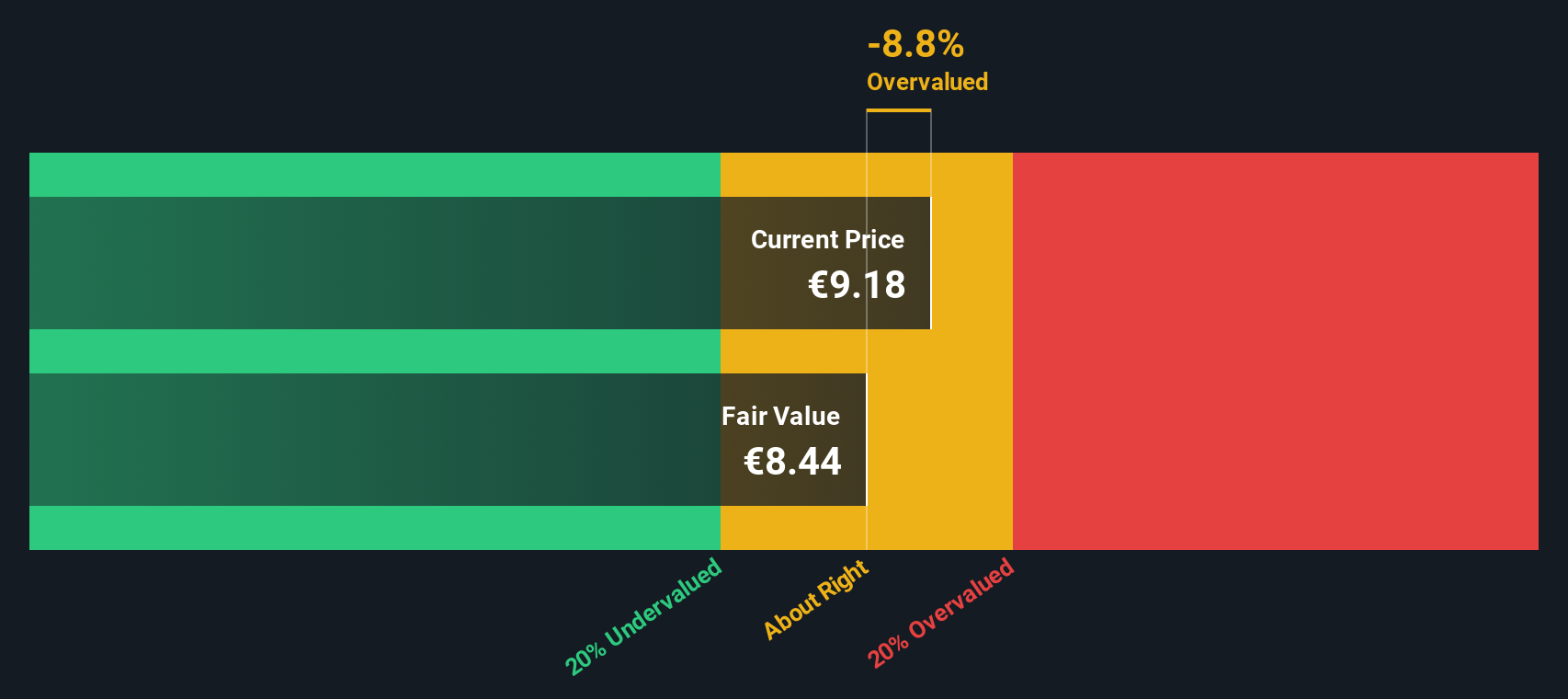

Another View: SWS DCF Model Weighs In

Looking through the lens of our SWS DCF model offers a more cautious perspective. Here, thyssenkrupp's current price of €9.72 actually sits above our DCF-based fair value estimate of €8.46, which suggests the stock may be trading at a premium. Is the market's optimism already reflected in the price, or could DCF assumptions be missing an inflection point?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out thyssenkrupp for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own thyssenkrupp Narrative

Feel free to challenge the consensus and uncover your own story. Exploring the data and building a narrative takes just a few minutes. Do it your way

A great starting point for your thyssenkrupp research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Investment Opportunities?

Don’t let the momentum slow down now. Take charge and find stocks with high potential. Your next big winner could be just a click away.

- Enhance your portfolio with these 24 AI penny stocks making waves in artificial intelligence and transforming industries from the ground up.

- Tap into the power of consistent income by exploring these 17 dividend stocks with yields > 3% that offer attractive yields and steady returns.

- Discover these 875 undervalued stocks based on cash flows that are flying under the radar and may be set for a breakout based on strong underlying fundamentals.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TKA

thyssenkrupp

Operates as an industrial and technology company in Germany and internationally.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives