Why K+S (XTRA:SDF) Is Up 5.6% After Swinging to a Quarterly Profit Amid Ongoing Losses

Reviewed by Sasha Jovanovic

- K+S Aktiengesellschaft reported its third quarter and nine-month 2025 earnings, showing sales of €879.1 million for the quarter and €2.72 billion for the nine months ended September 30, 2025.

- While quarterly results marked a swing to profitability compared to the prior year's net loss, the nine-month figures still reflect a very large net loss mostly from issues reported earlier in the year.

- We'll explore how the company's recent return to quarterly profitability could impact analyst expectations for earnings stability at K+S.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

K+S Investment Narrative Recap

To be a shareholder in K+S, you need to believe in the long-term resilience of potash demand and the company's ability to return to sustainable profitability despite recent volatility in earnings. The return to quarterly profitability in Q3 is a positive signal for those watching for stability, but the outsized nine-month net loss highlights that asset impairments and cost structures remain the primary short-term risk, and the latest results do not materially change that risk profile or the significance of upcoming catalysts.

Among recent announcements, the sharp dividend decrease declared in April 2025 stands out as particularly relevant in the context of ongoing earnings pressure and high capital expenditure demands. While quarterly results have improved, tighter free cash flow combined with regulatory and legacy mining obligations could continue to influence the company's capital allocation decisions in the near term.

Yet, despite signs of recovery, investors should not overlook ongoing sensitivity to exchange rate movements and the impact this may have on...

Read the full narrative on K+S (it's free!)

K+S' narrative projects €3.9 billion revenue and €97.9 million earnings by 2028. This requires 2.3% yearly revenue growth and a €1.8 billion increase in earnings from the current €-1.7 billion.

Uncover how K+S' forecasts yield a €12.72 fair value, a 10% upside to its current price.

Exploring Other Perspectives

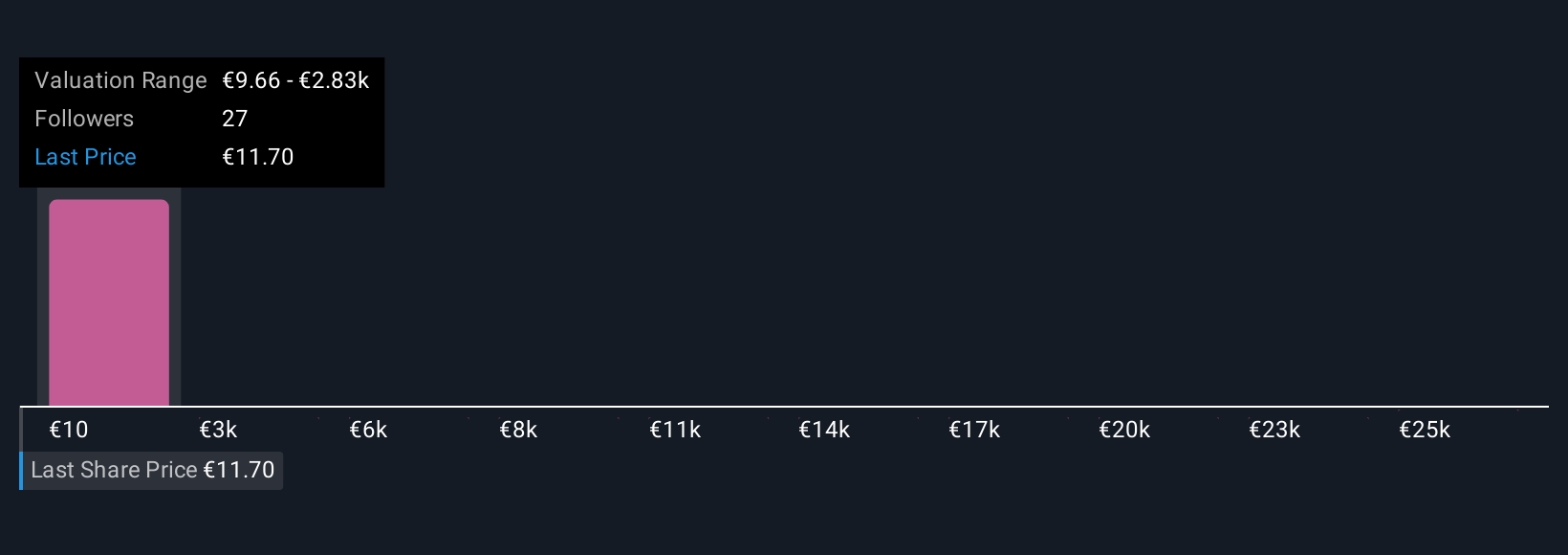

Seven individual fair value estimates from the Simply Wall St Community range widely from €9.66 up to €28,255.68, showing just how differently investors assess K+S’s prospects. With persistent exposure to European cost pressures and a recent swing in quarterly results, you can explore why opinions are so polarized and what that could mean for future performance.

Explore 7 other fair value estimates on K+S - why the stock might be a potential multi-bagger!

Build Your Own K+S Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your K+S research is our analysis highlighting 2 key rewards that could impact your investment decision.

- Our free K+S research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate K+S' overall financial health at a glance.

Contemplating Other Strategies?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Find companies with promising cash flow potential yet trading below their fair value.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if K+S might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:SDF

K+S

Operates as a supplier of mineral products for the agricultural, industrial, consumer, and community sectors in Europe, the United States, Asia, Africa, and Oceania.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives