- Germany

- /

- Metals and Mining

- /

- XTRA:NDA

Here's Why We Think Aurubis (ETR:NDA) Might Deserve Your Attention Today

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Unfortunately, these high risk investments often have little probability of ever paying off, and many investors pay a price to learn their lesson. A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Aurubis (ETR:NDA). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Aurubis with the means to add long-term value to shareholders.

Check out our latest analysis for Aurubis

How Quickly Is Aurubis Increasing Earnings Per Share?

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. That means EPS growth is considered a real positive by most successful long-term investors. Recognition must be given to the that Aurubis has grown EPS by 59% per year, over the last three years. While that sort of growth rate isn't sustainable for long, it certainly catches the eye of prospective investors.

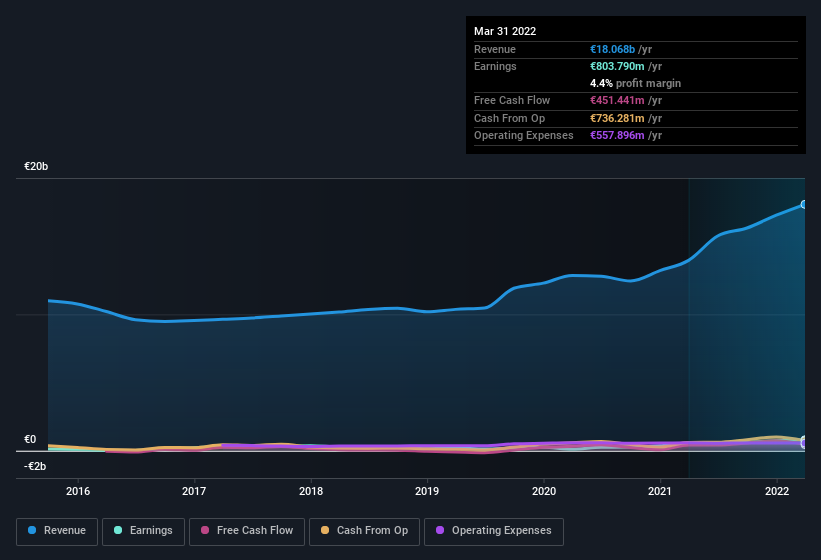

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. Aurubis maintained stable EBIT margins over the last year, all while growing revenue 29% to €18b. That's progress.

You can take a look at the company's revenue and earnings growth trend, in the chart below. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Aurubis?

Are Aurubis Insiders Aligned With All Shareholders?

Prior to investment, it's always a good idea to check that the management team is paid reasonably. Pay levels around or below the median, can be a sign that shareholder interests are well considered. The median total compensation for CEOs of companies similar in size to Aurubis, with market caps between €2.0b and €6.3b, is around €2.4m.

Aurubis' CEO took home a total compensation package worth €2.0m in the year leading up to September 2021. That seems pretty reasonable, especially given it's below the median for similar sized companies. While the level of CEO compensation shouldn't be the biggest factor in how the company is viewed, modest remuneration is a positive, because it suggests that the board keeps shareholder interests in mind. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Aurubis Worth Keeping An Eye On?

Aurubis' earnings per share have been soaring, with growth rates sky high. Such fast EPS growth prompts the question: has the business reached an inflection point? What's more, the fact that the CEO's compensation is quite reasonable is a sign that the company is conscious of excessive spending. So faced with these facts, it seems that researching this stock a little more may lead you to discover an investment opportunity that meets your quality standards. What about risks? Every company has them, and we've spotted 1 warning sign for Aurubis you should know about.

Although Aurubis certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:NDA

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives