If You Had Bought Evonik Industries (ETR:EVK) Stock A Year Ago, You'd Be Sitting On A 27% Loss, Today

The simplest way to benefit from a rising market is to buy an index fund. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. For example, the Evonik Industries AG (ETR:EVK) share price is down 27% in the last year. That falls noticeably short of the market return of around -3.7%. Even if shareholders bought some time ago, they wouldn't be particularly happy: the stock is down 27% in three years. The falls have accelerated recently, with the share price down 15% in the last three months.

View our latest analysis for Evonik Industries

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Even though the Evonik Industries share price is down over the year, its EPS actually improved. It's quite possible that growth expectations may have been unreasonable in the past.

It's surprising to see the share price fall so much, despite the improved EPS. So it's well worth checking out some other metrics, too.

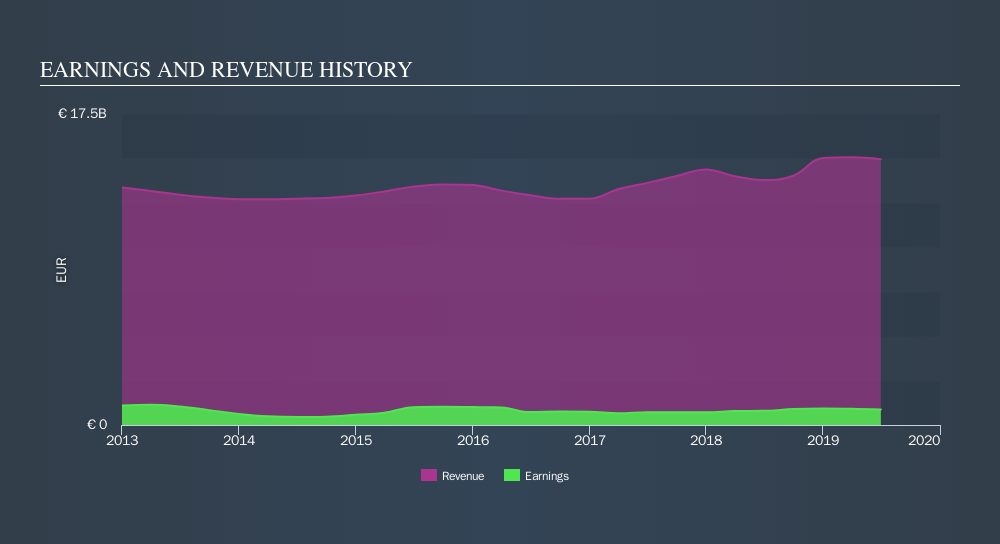

We don't see any weakness in the Evonik Industries's dividend so the steady payout can't really explain the share price drop. From what we can see, revenue is pretty flat, so that doesn't really explain the share price drop. Of course, it could simply be that it simply fell short of the market consensus expectations.

You can see how revenue has changed over time in the image below.

Evonik Industries is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. You can see what analysts are predicting for Evonik Industries in this interactive graph of future profit estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of Evonik Industries, it has a TSR of -23% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

While the broader market lost about 3.7% in the twelve months, Evonik Industries shareholders did even worse, losing 23% (even including dividends) . Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Longer term investors wouldn't be so upset, since they would have made 0.9%, each year, over five years. It could be that the recent sell-off is an opportunity, so it may be worth checking the fundamental data for signs of a long term growth trend. Keeping this in mind, a solid next step might be to take a look at Evonik Industries's dividend track record. This free interactive graph is a great place to start.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives