Are Evonik Industries's (ETR:EVK) Statutory Earnings A Good Reflection Of Its Earnings Potential?

Statistically speaking, it is less risky to invest in profitable companies than in unprofitable ones. However, sometimes companies receive a one-off boost (or reduction) to their profit, and it's not always clear whether statutory profits are a good guide, going forward. In this article, we'll look at how useful this year's statutory profit is, when analysing Evonik Industries (ETR:EVK).

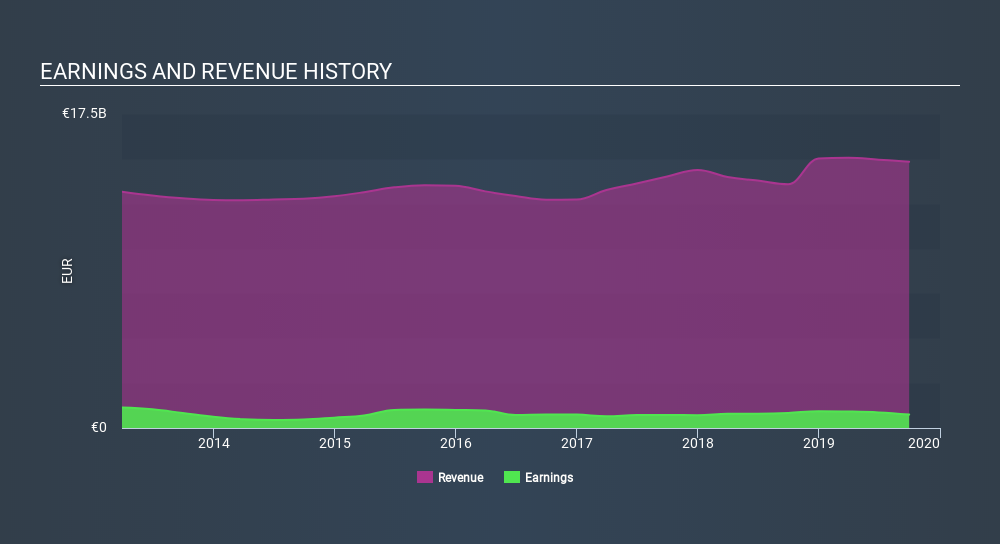

It's good to see that over the last twelve months Evonik Industries made a profit of €750.0m on revenue of €14.8b. As shown in the chart below, it did manage to grow its revenue over the last three years, although its profit has been pretty flat.

Check out our latest analysis for Evonik Industries

Of course, when it comes to statutory profit, the devil is often in the detail, and we can get a better sense for a company by diving deeper into the financial statements. This article will discuss how unusual items have impacted Evonik Industries's most recent profit results. That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

The Impact Of Unusual Items On Profit

Importantly, our data indicates that Evonik Industries's profit was reduced by €274m, due to unusual items, over the last year. It's never great to see unusual items costing the company profits, but on the upside, things might improve sooner rather than later. When we analysed the vast majority of listed companies worldwide, we found that significant unusual items are often not repeated. And that's hardly a surprise given these line items are considered unusual. If Evonik Industries doesn't see those unusual expenses repeat, then all else being equal we'd expect its profit to increase over the coming year.

Our Take On Evonik Industries's Profit Performance

Because unusual items detracted from Evonik Industries's earnings over the last year, you could argue that we can expect an improved result in the current quarter. Based on this observation, we consider it likely that Evonik Industries's statutory profit actually understates its earnings potential! Unfortunately, though, its earnings per share actually fell back over the last year. At the end of the day, it's essential to consider more than just the factors above, if you want to understand the company properly. Obviously, we love to consider the historical data to inform our opinion of a company. But it can be really valuable to consider what other analysts are forecasting. So feel free to check out our free graph representing analyst forecasts.

Today we've zoomed in on a single data point to better understand the nature of Evonik Industries's profit. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. While it might take a little research on your behalf, you may find this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying to be useful.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About XTRA:EVK

Evonik Industries

Produces and sells specialty chemicals in the Asia-Pacific, Europe, the Middle East, Africa, Central and South America, and North America.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives