Further Upside For BRAIN Biotech AG (ETR:BNN) Shares Could Introduce Price Risks After 50% Bounce

BRAIN Biotech AG (ETR:BNN) shares have had a really impressive month, gaining 50% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 39% in the last twelve months.

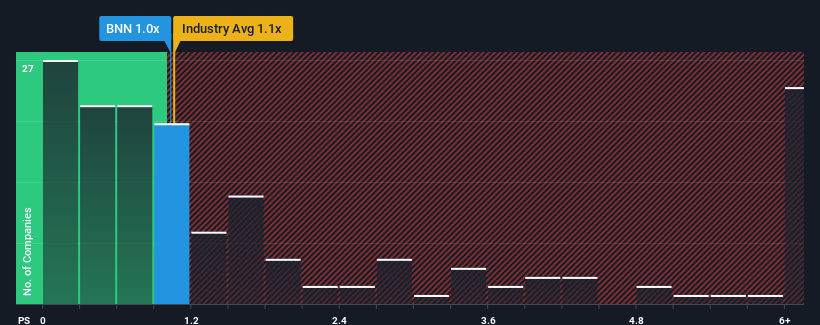

Even after such a large jump in price, there still wouldn't be many who think BRAIN Biotech's price-to-sales (or "P/S") ratio of 1x is worth a mention when the median P/S in Germany's Chemicals industry is similar at about 0.6x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

View our latest analysis for BRAIN Biotech

How BRAIN Biotech Has Been Performing

With its revenue growth in positive territory compared to the declining revenue of most other companies, BRAIN Biotech has been doing quite well of late. One possibility is that the P/S ratio is moderate because investors think the company's revenue will be less resilient moving forward. Those who are bullish on BRAIN Biotech will be hoping that this isn't the case, so that they can pick up the stock at a slightly lower valuation.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on BRAIN Biotech.What Are Revenue Growth Metrics Telling Us About The P/S?

BRAIN Biotech's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, we see that the company managed to grow revenues by a handy 2.9% last year. This was backed up an excellent period prior to see revenue up by 51% in total over the last three years. Therefore, it's fair to say the revenue growth recently has been superb for the company.

Looking ahead now, revenue is anticipated to climb by 13% each year during the coming three years according to the four analysts following the company. Meanwhile, the rest of the industry is forecast to only expand by 4.5% per year, which is noticeably less attractive.

With this in consideration, we find it intriguing that BRAIN Biotech's P/S is closely matching its industry peers. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From BRAIN Biotech's P/S?

Its shares have lifted substantially and now BRAIN Biotech's P/S is back within range of the industry median. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

Looking at BRAIN Biotech's analyst forecasts revealed that its superior revenue outlook isn't giving the boost to its P/S that we would've expected. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. This uncertainty seems to be reflected in the share price which, while stable, could be higher given the revenue forecasts.

You should always think about risks. Case in point, we've spotted 2 warning signs for BRAIN Biotech you should be aware of, and 1 of them is a bit unpleasant.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if BRAIN Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives