European Market Insights: Unifiedpost Group Among 3 Penny Stocks To Consider

Reviewed by Simply Wall St

As the European markets navigate uncertainties surrounding U.S. trade tariffs and monetary policy, major indices like the STOXX Europe 600 have experienced fluctuations, with some countries showing modest gains while others face declines. In such a climate, investors often turn their attention to smaller or newer companies that might offer unique opportunities for growth. While the term "penny stocks" may seem outdated, these stocks continue to attract interest due to their potential for affordability and growth when backed by strong financials.

Top 10 Penny Stocks In Europe

| Name | Share Price | Market Cap | Financial Health Rating |

| Angler Gaming (NGM:ANGL) | SEK3.75 | SEK281.19M | ★★★★★★ |

| Netgem (ENXTPA:ALNTG) | €0.98 | €32.82M | ★★★★★★ |

| Hifab Group (OM:HIFA B) | SEK4.02 | SEK244.57M | ★★★★★★ |

| High (ENXTPA:HCO) | €2.69 | €52.84M | ★★★★★★ |

| Transferator (NGM:TRAN A) | SEK2.31 | SEK221.42M | ★★★★★☆ |

| Deceuninck (ENXTBR:DECB) | €2.275 | €314.85M | ★★★★★★ |

| Cellularline (BIT:CELL) | €2.63 | €55.38M | ★★★★☆☆ |

| Bredband2 i Skandinavien (OM:BRE2) | SEK2.105 | SEK2.01B | ★★★★☆☆ |

| I.M.D. International Medical Devices (BIT:IMD) | €1.38 | €23.9M | ★★★★★☆ |

| IMS (WSE:IMS) | PLN3.67 | PLN124.39M | ★★★★☆☆ |

Click here to see the full list of 433 stocks from our European Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Unifiedpost Group (ENXTBR:UPG)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Unifiedpost Group SA is a fintech company that operates a cloud-based platform for administrative and financial services in Belgium and internationally, with a market cap of €124.39 million.

Operations: Unifiedpost Group does not report specific revenue segments.

Market Cap: €124.39M

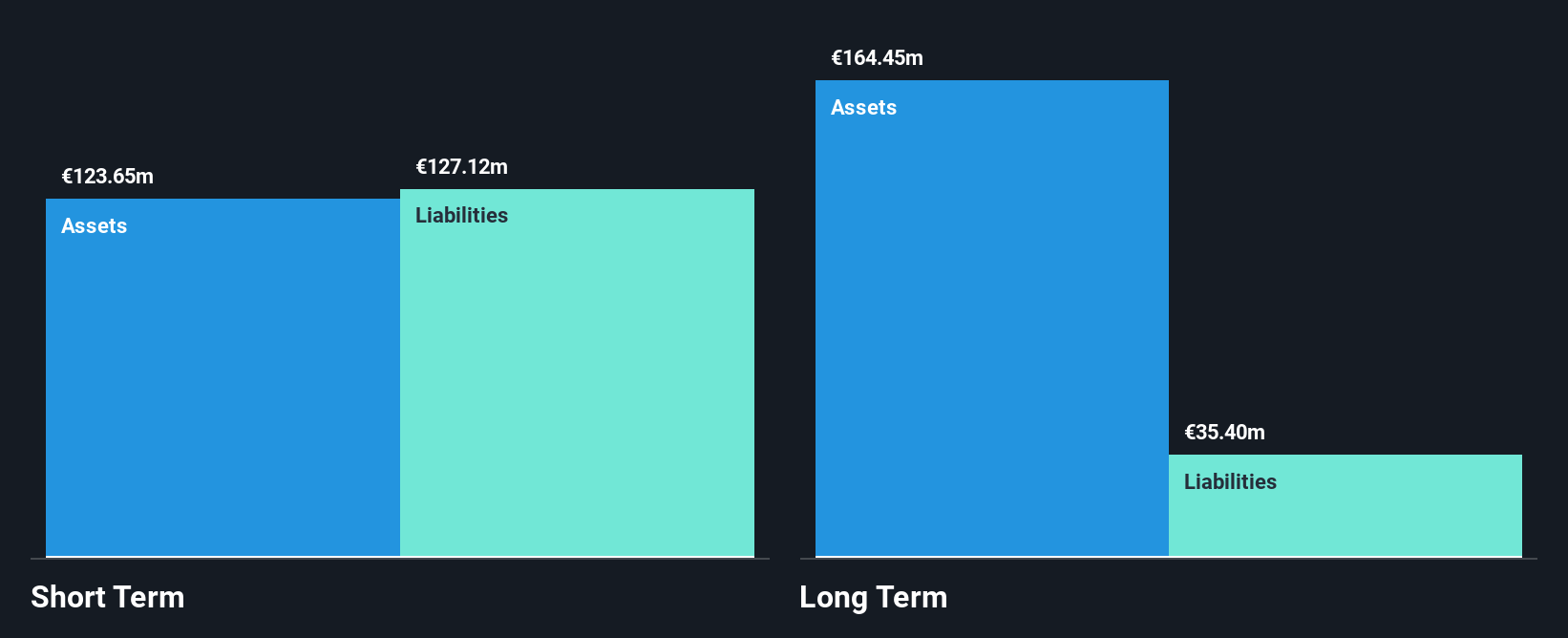

Unifiedpost Group, with a market cap of €124.39 million, has shown significant improvement in financial health by reporting a net income of €71.03 million for 2024, reversing from a loss the previous year. Despite being unprofitable in recent years and not expected to achieve profitability soon, its short-term assets exceed both short- and long-term liabilities, indicating solid liquidity. The company trades at 75.1% below estimated fair value and has stable weekly volatility at 5%. With an experienced management team and board, Unifiedpost is forecasted to grow revenue by 13.52% annually without significant shareholder dilution recently.

- Dive into the specifics of Unifiedpost Group here with our thorough balance sheet health report.

- Evaluate Unifiedpost Group's prospects by accessing our earnings growth report.

BRAIN Biotech (XTRA:BNN)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: BRAIN Biotech AG develops bio-based products and solutions across Germany, the United States, France, the Netherlands, and the United Kingdom with a market cap of €52.65 million.

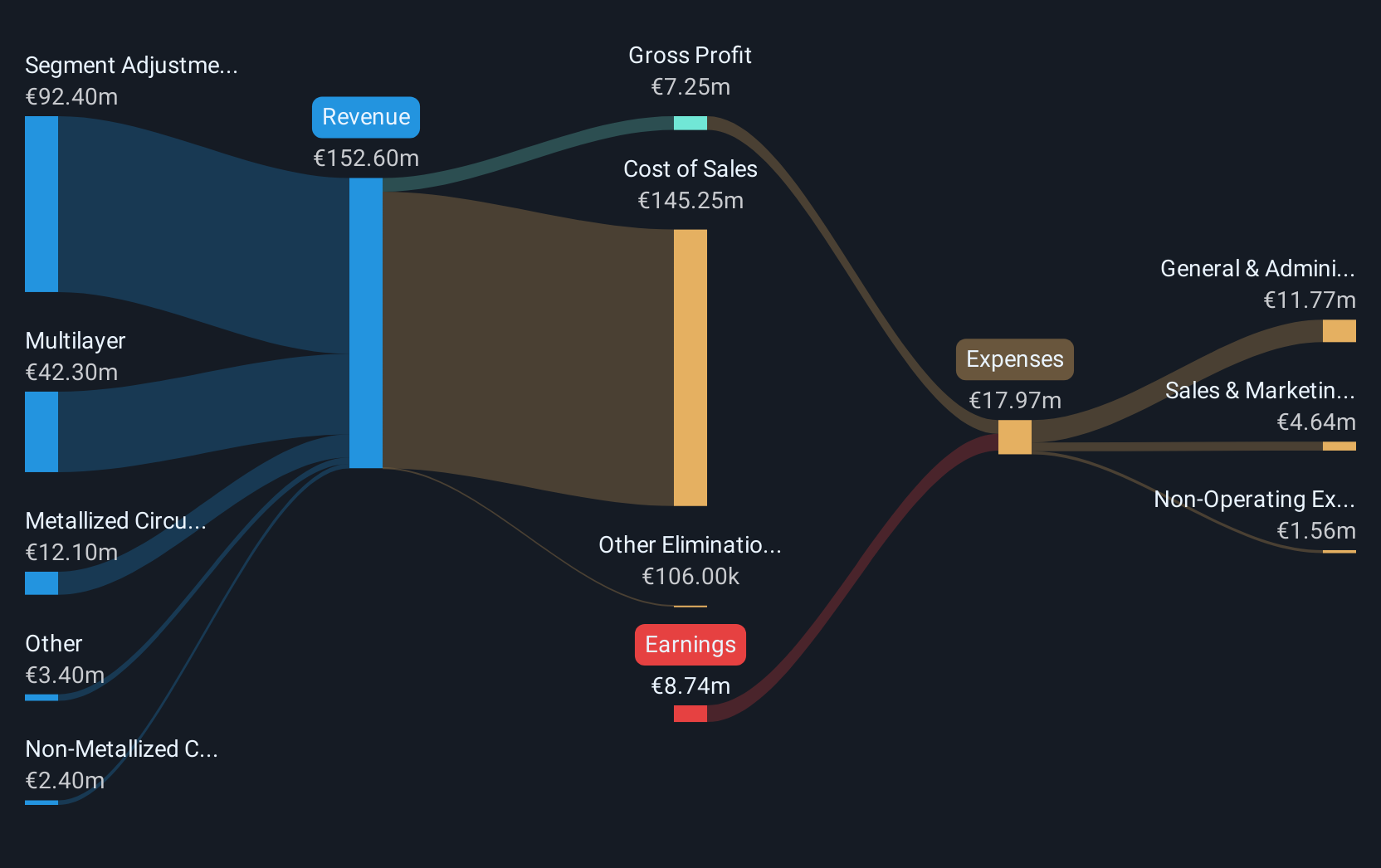

Operations: The company generates revenue primarily from its Bioproducts segment, which accounts for €42.95 million, and its Bioscience segment (excluding Bioincubator), contributing €10.36 million.

Market Cap: €52.65M

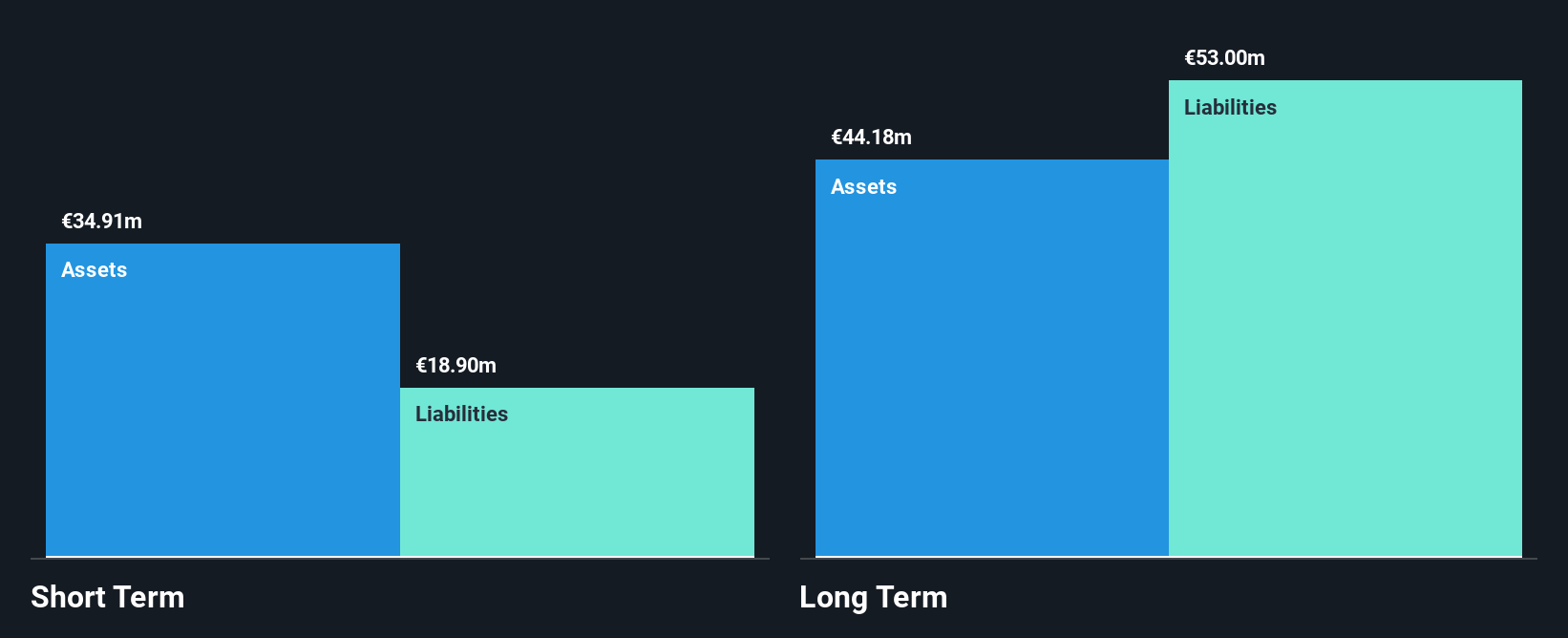

BRAIN Biotech AG, with a market cap of €52.65 million, remains unprofitable but has managed to reduce losses over the past five years. Its revenue from the Bioproducts and Bioscience segments totals €53.31 million annually, although recent earnings reports show a net loss increase to €4.03 million for Q1 2025. The company maintains a cash runway exceeding one year and is debt-free, which provides some financial stability despite its negative return on equity of -121.33%. A strategic collaboration with PX Group aims to enhance urban mining initiatives through innovative biological extraction technologies like BioXtractor V2.

- Click here to discover the nuances of BRAIN Biotech with our detailed analytical financial health report.

- Review our growth performance report to gain insights into BRAIN Biotech's future.

Schweizer Electronic (XTRA:SCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Schweizer Electronic AG, with a market cap of €12.67 million, develops, produces, and distributes printed circuit boards and embedding solutions globally through its subsidiaries.

Operations: The company's revenue is primarily derived from Germany (€60.4 million), followed by Europe excluding Germany (€47.9 million), America (€8.4 million), and other countries (€2 million).

Market Cap: €12.67M

Schweizer Electronic AG, with a market cap of €12.67 million, is currently unprofitable but has significantly reduced its losses over the past five years. Despite its negative return on equity of -81.73%, the company maintains a stable financial position with short-term assets exceeding both short and long-term liabilities. Schweizer's debt to equity ratio has increased over time, yet it benefits from a positive and growing free cash flow, ensuring a cash runway for more than three years. The management team is experienced, contributing to strategic stability as earnings are forecasted to grow substantially per year.

- Unlock comprehensive insights into our analysis of Schweizer Electronic stock in this financial health report.

- Assess Schweizer Electronic's future earnings estimates with our detailed growth reports.

Make It Happen

- Dive into all 433 of the European Penny Stocks we have identified here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRAIN Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Excellent balance sheet with reasonable growth potential.

Market Insights

Community Narratives