Global markets have experienced a mixed week, with major indices mostly lower amid a busy earnings season and divergent economic signals. Despite these fluctuations, investors continue to seek opportunities in various market segments, including penny stocks. While the term "penny stocks" might seem outdated, it still represents an intriguing area for investment in smaller or newer companies that can offer growth potential at lower price points. When backed by strong financial health and solid fundamentals, these stocks can provide stability and potential upside.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.57 | MYR2.83B | ★★★★★★ |

| Rexit Berhad (KLSE:REXIT) | MYR0.73 | MYR126.45M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.81 | HK$514.18M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.77 | A$143.12M | ★★★★☆☆ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR295.43M | ★★★★★★ |

| BP Plastics Holding Bhd (KLSE:BPPLAS) | MYR1.25 | MYR351.85M | ★★★★★★ |

| FRP Advisory Group (AIM:FRP) | £1.47 | £347M | ★★★★★★ |

| Wellcall Holdings Berhad (KLSE:WELLCAL) | MYR1.53 | MYR761.86M | ★★★★★★ |

| Kelington Group Berhad (KLSE:KGB) | MYR3.01 | MYR2.07B | ★★★★★☆ |

| Next 15 Group (AIM:NFG) | £3.94 | £397.82M | ★★★★☆☆ |

Click here to see the full list of 5,814 stocks from our Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Yidu Tech (SEHK:2158)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Yidu Tech Inc. is an investment holding company that offers healthcare solutions utilizing big data and AI technologies across China, Brunei, Singapore, and other international markets, with a market cap of HK$3.86 billion.

Operations: The company's revenue is primarily derived from three segments: Life Sciences Solutions (CN¥324.04 million), Big Data Platform and Solutions (CN¥313.63 million), and Health Management Platform and Solutions (CN¥169.40 million).

Market Cap: HK$3.86B

Yidu Tech Inc. has demonstrated financial resilience with short-term assets of CN¥4.4 billion exceeding both its short-term and long-term liabilities, indicating strong liquidity. The company is undertaking share repurchases, potentially enhancing net asset value per share and earnings per share. Despite being unprofitable and not expected to achieve profitability in the next three years, Yidu Tech has reduced losses at a significant rate over the past five years. The management team is relatively new with an average tenure of 1.8 years, which may impact strategic execution as the company navigates its growth trajectory in healthcare solutions using AI technologies.

- Jump into the full analysis health report here for a deeper understanding of Yidu Tech.

- Learn about Yidu Tech's future growth trajectory here.

E for L Aim (SET:EFORL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: E for L Aim Public Company Limited, along with its subsidiaries, operates in Thailand by distributing medical devices and equipment, with a market cap of THB799.70 million.

Operations: The company generates revenue of THB1.16 billion from its role as a distributor of medical devices and equipment in Thailand.

Market Cap: THB799.7M

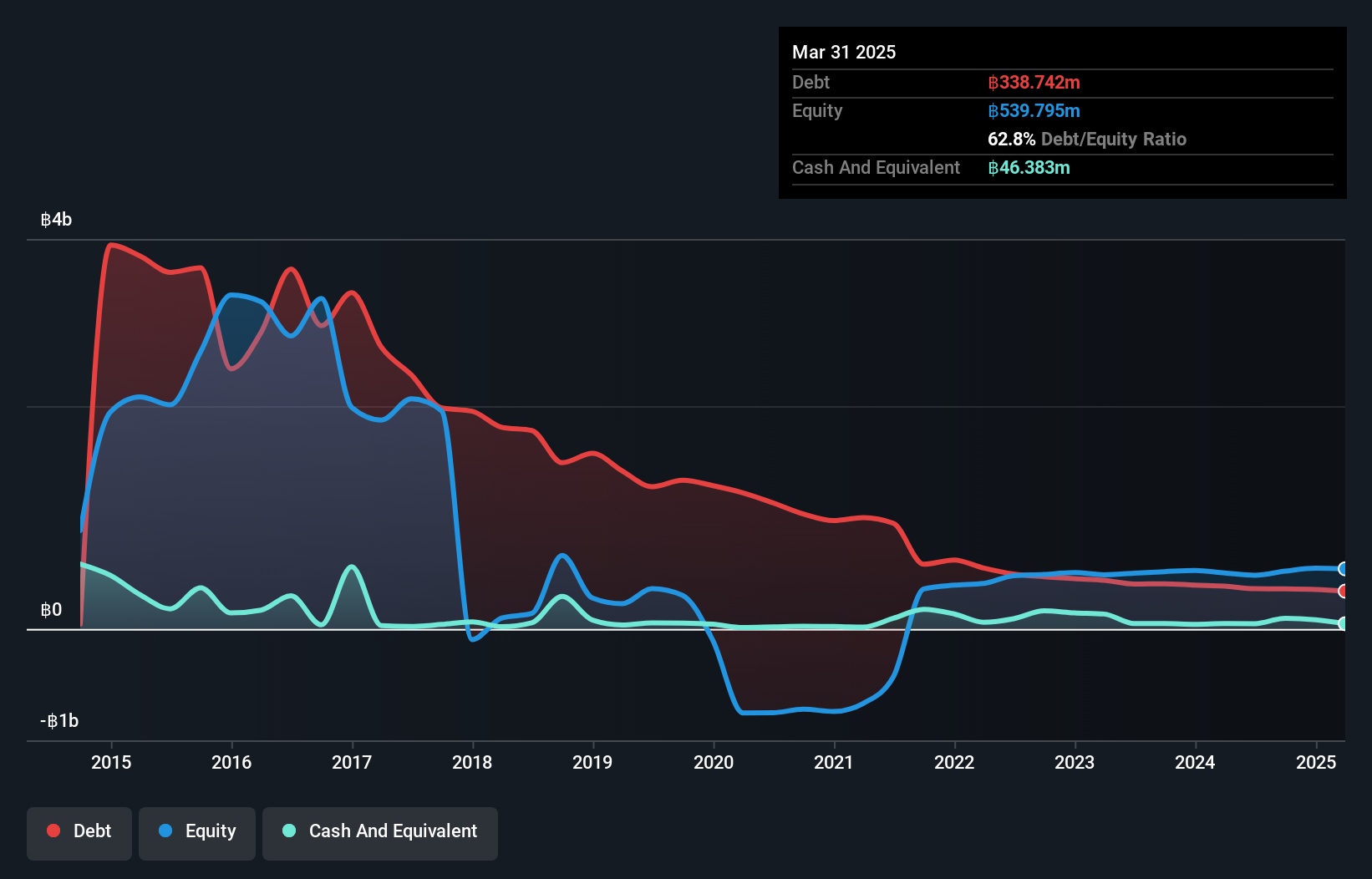

E for L Aim Public Company Limited, operating in Thailand's medical devices sector, is currently unprofitable but has shown financial stability with a sufficient cash runway exceeding three years due to positive free cash flow. Despite its high net debt to equity ratio of 65.1%, the company has improved its debt position significantly over five years. Recent earnings reports indicate a decline in sales and an increased net loss compared to the previous year, highlighting ongoing challenges. However, short-term assets comfortably cover both short- and long-term liabilities, suggesting manageable liquidity risks amidst volatile share price movements.

- Click here and access our complete financial health analysis report to understand the dynamics of E for L Aim.

- Assess E for L Aim's previous results with our detailed historical performance reports.

BRAIN Biotech (XTRA:BNN)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: BRAIN Biotech AG is involved in the research and development of bio-based products and solutions across Germany, the United States, France, the Netherlands, and the United Kingdom, with a market cap of €57.68 million.

Operations: The company's revenue is primarily derived from its Bioproducts segment, which generated €42.66 million, followed by the Bioscience segment (excluding Bioincubator) with €11.64 million, and the Bioincubator segment contributing €2.08 million.

Market Cap: €57.68M

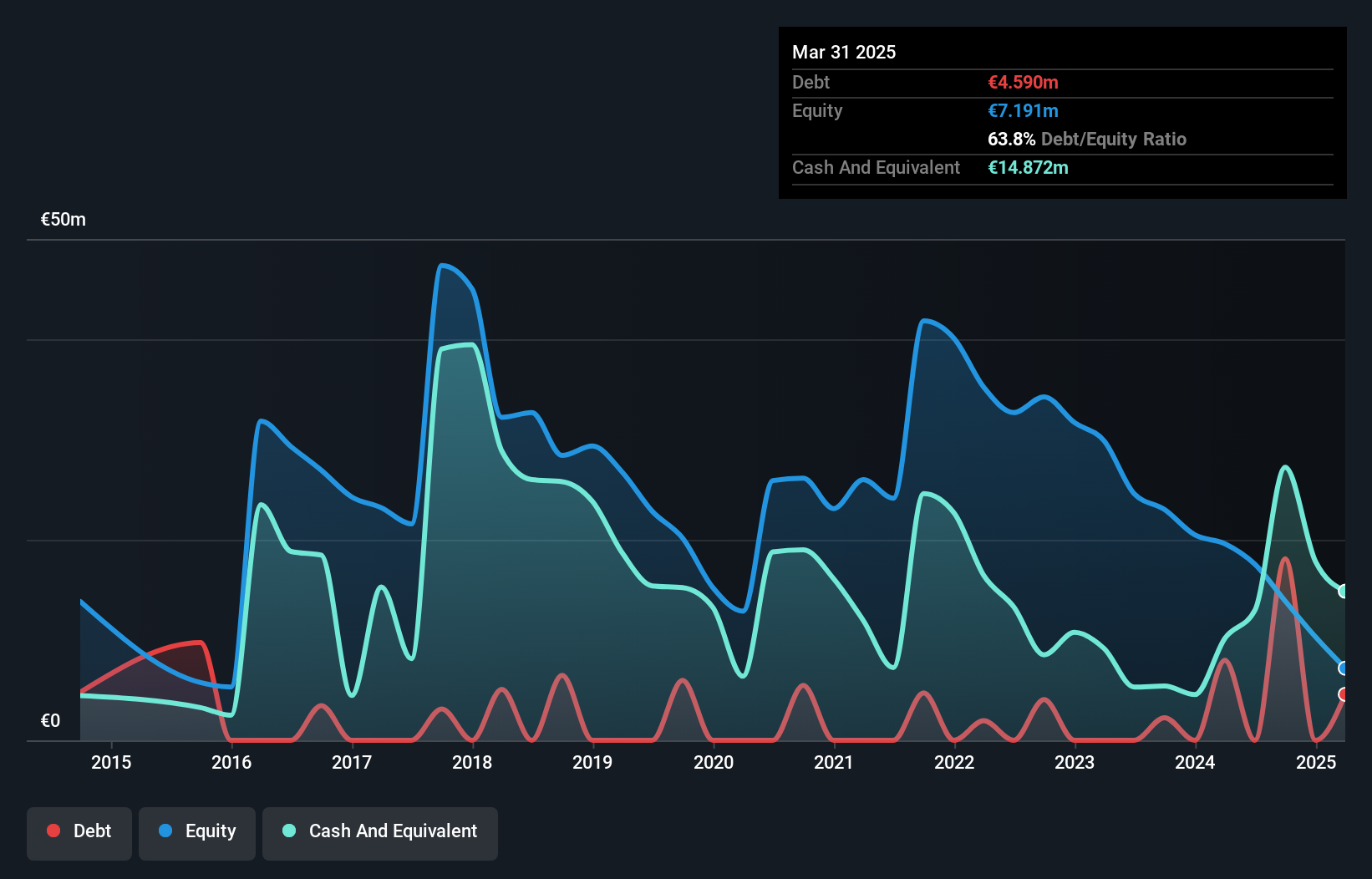

BRAIN Biotech AG, with a market cap of €57.68 million, operates in the bio-based products sector and remains unprofitable despite reducing losses over five years. Its revenue primarily stems from the Bioproducts segment (€42.66 million), but short-term assets (€30.6M) do not cover long-term liabilities (€44.7M). The company is debt-free and has a cash runway exceeding one year, offering some financial stability amidst high share price volatility. Recent earnings reports show stable sales but an increased net loss compared to last year, reflecting ongoing profitability challenges as it navigates leadership changes within its supervisory board.

- Unlock comprehensive insights into our analysis of BRAIN Biotech stock in this financial health report.

- Understand BRAIN Biotech's earnings outlook by examining our growth report.

Summing It All Up

- Access the full spectrum of 5,814 Penny Stocks by clicking on this link.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BRAIN Biotech might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BNN

BRAIN Biotech

Provides bio-based products and solutions in Germany, the United States, France, the Netherlands, and the United Kingdom.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives