BASF (XTRA:BAS): Valuation Insights After Weak Earnings and CEO's EU Carbon Regulation Warning

Reviewed by Simply Wall St

BASF (XTRA:BAS) shares have drawn attention after the company reported weaker third-quarter results. At the same time, its CEO publicly urged the European Union to ease carbon trading rules and regulatory pressures.

See our latest analysis for BASF.

BASF’s share price has been relatively resilient this year despite a dip in the last month, with a recent 1-year total shareholder return of -1.05% and 3-year total return of 11.03%. This suggests the stock is holding its ground in a tough industry climate, even as momentum has faded in the short term amid earnings pressures and headline management changes.

If you’re curious to see which other companies insiders are backing, this is an excellent time to discover fast growing stocks with high insider ownership

With BASF trading at a notable discount to analyst targets but facing lingering profit pressures, the question is whether there is real value here for investors or if the market is already accounting for modest prospects for growth.

Most Popular Narrative: 13% Undervalued

BASF's fair value in the most widely followed narrative stands at €49.18, about 13% above the last close at €42.79. This sets the stage for a dynamic discussion around recent strategic shifts and growth expectations.

Portfolio streamlining and divestments focus BASF on higher-margin, resilient segments. Upcoming IPOs and expansion in agricultural and advanced technologies are expected as well. Strategic cost savings, energy sourcing diversification, and the new China site are seen as enhancing competitiveness, stability, and margin potential amid evolving market and regulatory trends.

What numbers do the narrative architects believe will unlock this hidden value? It’s not just asset sales; there are bold assumptions about growth, profit margins, and a powerful future multiple at play. Want to know the catalysts driving this fair value target? The real story is in the financial leap projected for the next few years.

Result: Fair Value of €49.18 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent low margins in global chemicals and structural challenges in Europe could still undermine the case for a meaningful recovery at BASF.

Find out about the key risks to this BASF narrative.

Another View: Market Ratios Raise a Red Flag

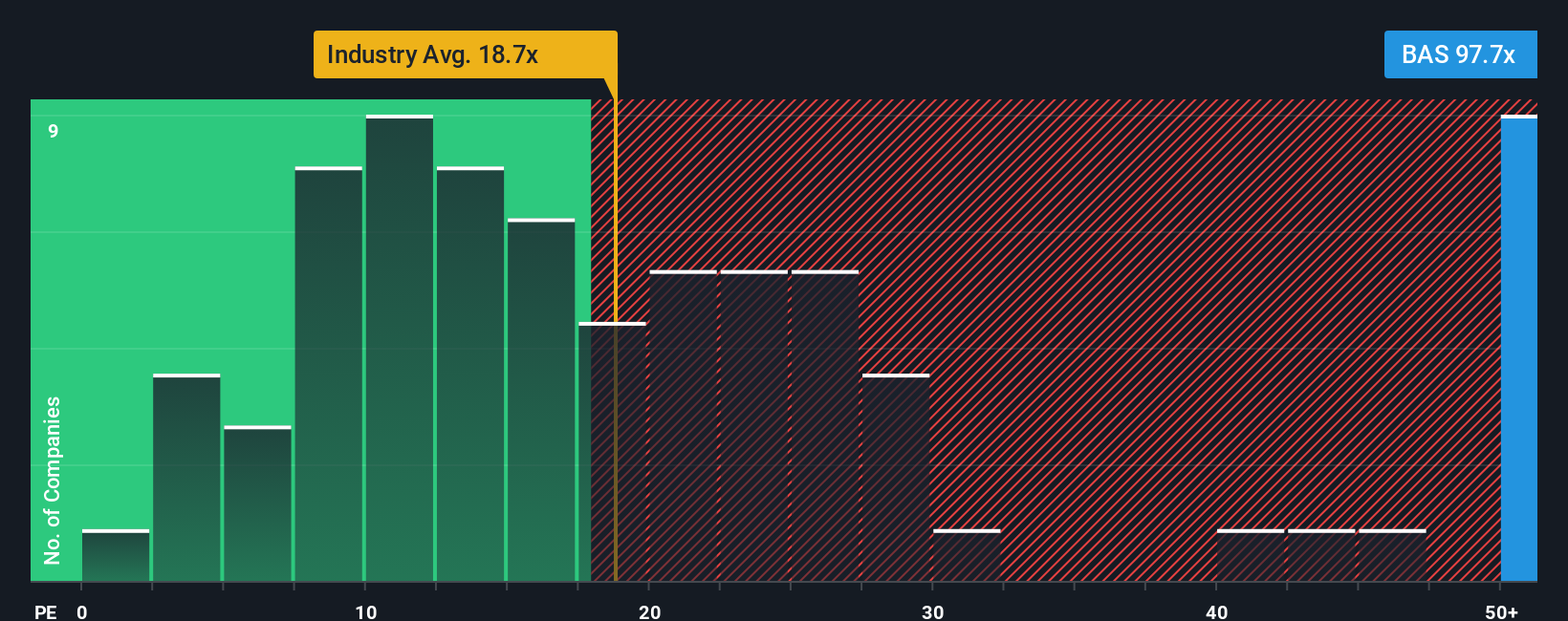

Taking a closer look through earnings-based market ratios, BASF appears pricey. Its current price-to-earnings ratio is around 123.6x, which is dramatically higher than both the industry average of 17.4x and the fair ratio estimate of 37x. This suggests the stock may not offer a cushion against downside risk right now. Could investors be overlooking potential pitfalls, or is the valuation just too rich for a turnaround story?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own BASF Narrative

If you see the story differently or want to dig into the details yourself, you can shape your own view in just minutes, and Do it your way.

A great starting point for your BASF research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don't limit your portfolio to just one story. Exceptional opportunities are waiting, designed to help you capture strong growth or reliable income in any market.

- Tap into the potential of emerging markets by following these 3588 penny stocks with strong financials that stand out for strong financials and notable upside trends.

- Unlock smart income opportunities and secure your future with these 23 dividend stocks with yields > 3% offering attractive yields above 3%.

- Seize the momentum from our picks of these 26 AI penny stocks that are pioneering advancements in artificial intelligence and transforming entire industries.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BASF might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:BAS

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives