A Fresh Look at Covestro (XTRA:1COV) Valuation as Shares Show Signs of Upward Momentum

Reviewed by Simply Wall St

See our latest analysis for Covestro.

Covestro’s share price has steadily edged up by 7.73% year-to-date, signaling that momentum could be shifting after a period of muted movement. While the one-year total shareholder return stands at 5.03%, the impressive 65.83% total return over three years points to long-term resilience despite recent bumps in the road.

If Covestro’s gradual rebound has you wondering what else is gathering strength, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

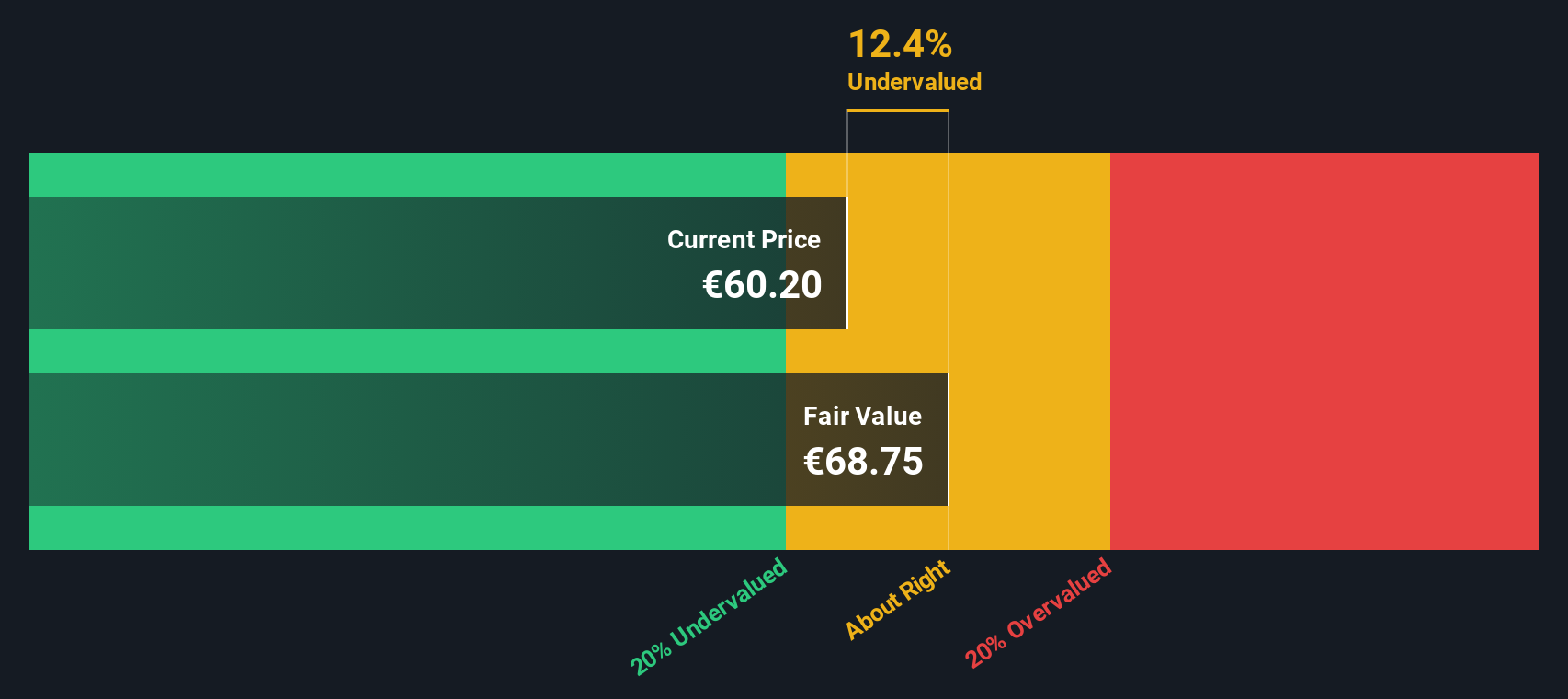

With shares pushing higher but trading close to analyst price targets, the real question for investors is clear: Is Covestro currently undervalued, or is the market already factoring in the company’s upcoming growth?

Most Popular Narrative: 1.8% Undervalued

With Covestro's most popular narrative putting fair value at €61.31, the latest closing price of €60.18 sits just below that target. This suggests only a slight valuation gap that hinges on key assumptions about growth and profitability.

The company's ongoing transformation toward a circular economy, including investments in sustainable, circular feedstocks and process optimization, positions Covestro to capture a growing share of customers and end markets prioritizing green materials. This supports higher price realization and long-term gross margin improvement.

Want to know why this next phase could push Covestro ahead? The narrative's bold price relies on higher margins and a premium growth path, but the full fair value blueprint is hidden within the detailed financial projections. What big assumptions are fueling the optimism? Uncover the numbers for yourself to see where the story gets real.

Result: Fair Value of €61.31 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent margin pressure from global overcapacity or sudden spikes in raw material costs could quickly challenge Covestro’s rebound narrative.

Find out about the key risks to this Covestro narrative.

Another View: Discounted Cash Flow Puts a Different Price Tag on Covestro

Looking through the lens of our DCF model, Covestro’s shares appear to be trading above their estimated fair value. The SWS DCF model suggests a fair value of just €51.69 compared to the current market price. This indicates potential downside risk if growth and margin forecasts do not materialize as expected. Could the market have gotten ahead of itself, or are optimistic narratives set to prevail?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Covestro for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 877 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Covestro Narrative

If you want to dig into Covestro's story from your own angle, the data is all there. You can shape your own narrative in minutes and see what conclusions you draw. Do it your way

A good starting point is our analysis highlighting 1 key reward investors are optimistic about regarding Covestro.

Looking for More Smart Investment Ideas?

Don't let great opportunities pass you by. With the right tools, you can spot undervalued stocks and emerging leaders before the crowd catches on. Tap into market shifts confidently. Simply Wall St's powerful screener can help you act before the trends go mainstream.

- Unlock cash flow bargains by evaluating these 877 undervalued stocks based on cash flows primed for growth beyond their current prices, giving your portfolio a head start on value opportunities.

- Supercharge your search for income by targeting these 15 dividend stocks with yields > 3% that consistently deliver yields over 3 percent to help you build a foundation for steady returns.

- Get ahead in technology’s next frontier by tracking these 27 quantum computing stocks that are setting the pace in quantum computing breakthroughs and future-proofing tomorrow’s digital landscape.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:1COV

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives