Why Talanx (XTRA:TLX) Is Up 7.6% After Raising 2026 Earnings Guidance and Reporting Strong Q3

Reviewed by Sasha Jovanovic

- Talanx reported earnings for the nine months ended September 30, 2025, with net income rising to €1.96 billion from €1.59 billion a year earlier, and issued new guidance expecting consolidated net income of approximately €2.7 billion for 2026.

- The company's increased earnings outlook and continued momentum underscore management's confidence and the potential for further operational growth in the coming years.

- We will explore how Talanx's upgraded earnings guidance for 2026 could reshape the company's investment narrative and future growth outlook.

The latest GPUs need a type of rare earth metal called Neodymium and there are only 37 companies in the world exploring or producing it. Find the list for free.

Talanx Investment Narrative Recap

To be a Talanx shareholder, you need to believe in the company's ability to deliver consistent earnings growth by leveraging its balanced insurance and reinsurance model, disciplined underwriting, and international momentum. The upgraded earnings guidance for 2026 signals strong management confidence, but it does not materially shift the biggest short-term catalyst: Talanx’s ability to sustain profitable growth in international markets while navigating integration costs, nor does it remove the ongoing risk from currency volatility or unforeseen challenges impacting subsidiary contributions.

Among several recent corporate actions, the announcement to increase the dividend to €2.70 per share for 2024, with a target of €4.00 by 2027, stands out. This move aligns with management’s optimistic earnings outlook while serving as a near-term attractor for income-focused investors; however, it also highlights the reliance on robust cash flows from subsidiaries, a factor closely tied to both the company’s growth catalyst and its primary risk.

Still, despite the rising earnings and a higher dividend, investors should be mindful of challenges in international markets, especially if subsidiaries face...

Read the full narrative on Talanx (it's free!)

Talanx's outlook anticipates €59.6 billion in revenue and €2.7 billion in earnings by 2028. This is based on a 9.6% annual revenue growth rate and a €0.4 billion increase in earnings from the current €2.3 billion.

Uncover how Talanx's forecasts yield a €104.40 fair value, a 8% downside to its current price.

Exploring Other Perspectives

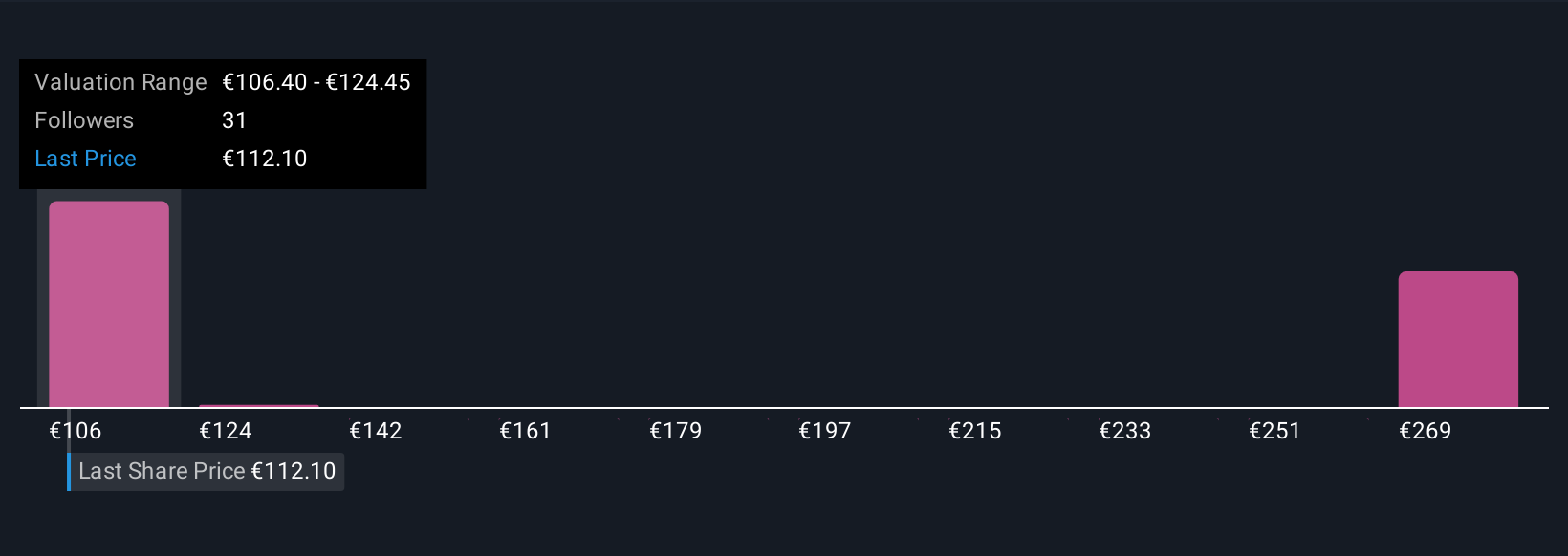

Five Simply Wall St Community fair value estimates for Talanx range from €104.40 to €271.61 per share. While many see growth momentum and higher earnings, your opinion may differ sharply from others, review all viewpoints before deciding.

Explore 5 other fair value estimates on Talanx - why the stock might be worth 8% less than the current price!

Build Your Own Talanx Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Talanx research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free Talanx research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Talanx's overall financial health at a glance.

Curious About Other Options?

Don't miss your shot at the next 10-bagger. Our latest stock picks just dropped:

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- Explore 27 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Talanx might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:TLX

Talanx

Provides insurance and reinsurance products and services worldwide.

Established dividend payer with proven track record.

Similar Companies

Market Insights

Community Narratives