As European markets face a pullback, with the STOXX Europe 600 Index ending lower due to concerns about overvaluation in AI-related stocks, investors are increasingly looking for stability and income through dividend stocks. In such an environment, selecting companies with strong fundamentals and consistent dividend payouts can provide a reliable source of returns amidst market volatility.

Top 10 Dividend Stocks In Europe

| Name | Dividend Yield | Dividend Rating |

| Zurich Insurance Group (SWX:ZURN) | 4.39% | ★★★★★★ |

| Telekom Austria (WBAG:TKA) | 4.40% | ★★★★★☆ |

| Scandinavian Tobacco Group (CPSE:STG) | 9.74% | ★★★★★★ |

| Holcim (SWX:HOLN) | 4.34% | ★★★★★★ |

| HEXPOL (OM:HPOL B) | 5.01% | ★★★★★★ |

| freenet (XTRA:FNTN) | 6.62% | ★★★★★☆ |

| Evolution (OM:EVO) | 4.76% | ★★★★★★ |

| DKSH Holding (SWX:DKSH) | 4.25% | ★★★★★★ |

| Cembra Money Bank (SWX:CMBN) | 4.62% | ★★★★★★ |

| Bravida Holding (OM:BRAV) | 4.69% | ★★★★★★ |

Click here to see the full list of 225 stocks from our Top European Dividend Stocks screener.

Let's take a closer look at a couple of our picks from the screened companies.

Daimler Truck Holding (XTRA:DTG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Daimler Truck Holding AG manufactures and sells light, medium, and heavy-duty trucks and buses across Europe, North America, Asia, Latin America, and internationally with a market cap of approximately €27.21 billion.

Operations: Daimler Truck Holding AG generates revenue through its key segments, including Trucks North America (€20.47 billion), Mercedes-Benz Trucks (€18.35 billion), Trucks Asia (€6.09 billion), Daimler Buses (€5.79 billion), and Financial Services (€3.49 billion).

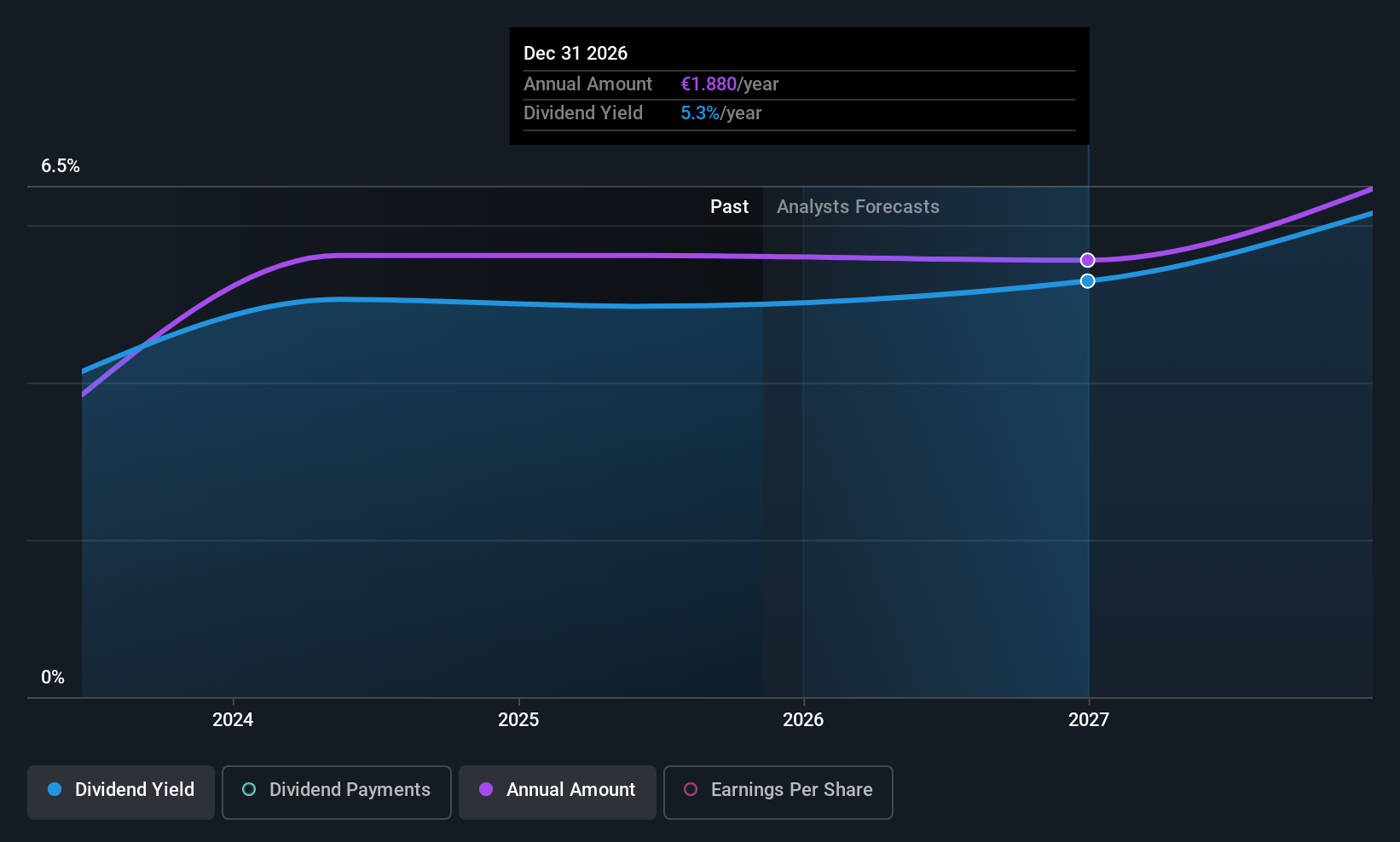

Dividend Yield: 5.3%

Daimler Truck Holding's dividend profile is supported by a reasonable payout ratio of 66.2%, ensuring coverage by earnings, while the cash payout ratio of 57.1% indicates dividends are also covered by cash flows. Despite only three years of dividend history, payments have been reliable and growing with minimal volatility. Recent financials show a decline in sales and net income for Q3 2025 compared to the previous year, potentially impacting future dividend sustainability amidst weaker profitability forecasts for Trucks North America.

- Click here to discover the nuances of Daimler Truck Holding with our detailed analytical dividend report.

- Our valuation report here indicates Daimler Truck Holding may be undervalued.

Hannover Rück (XTRA:HNR1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hannover Rück SE, with a market cap of €31.04 billion, operates as a global reinsurance provider offering products and services across Europe, the United States, Asia, Australia, Africa, and other international markets.

Operations: Hannover Rück SE's revenue is primarily derived from its Property & Casualty Reinsurance segment, which accounts for €19.80 billion, followed by Life and Health Reinsurance at €7.92 billion.

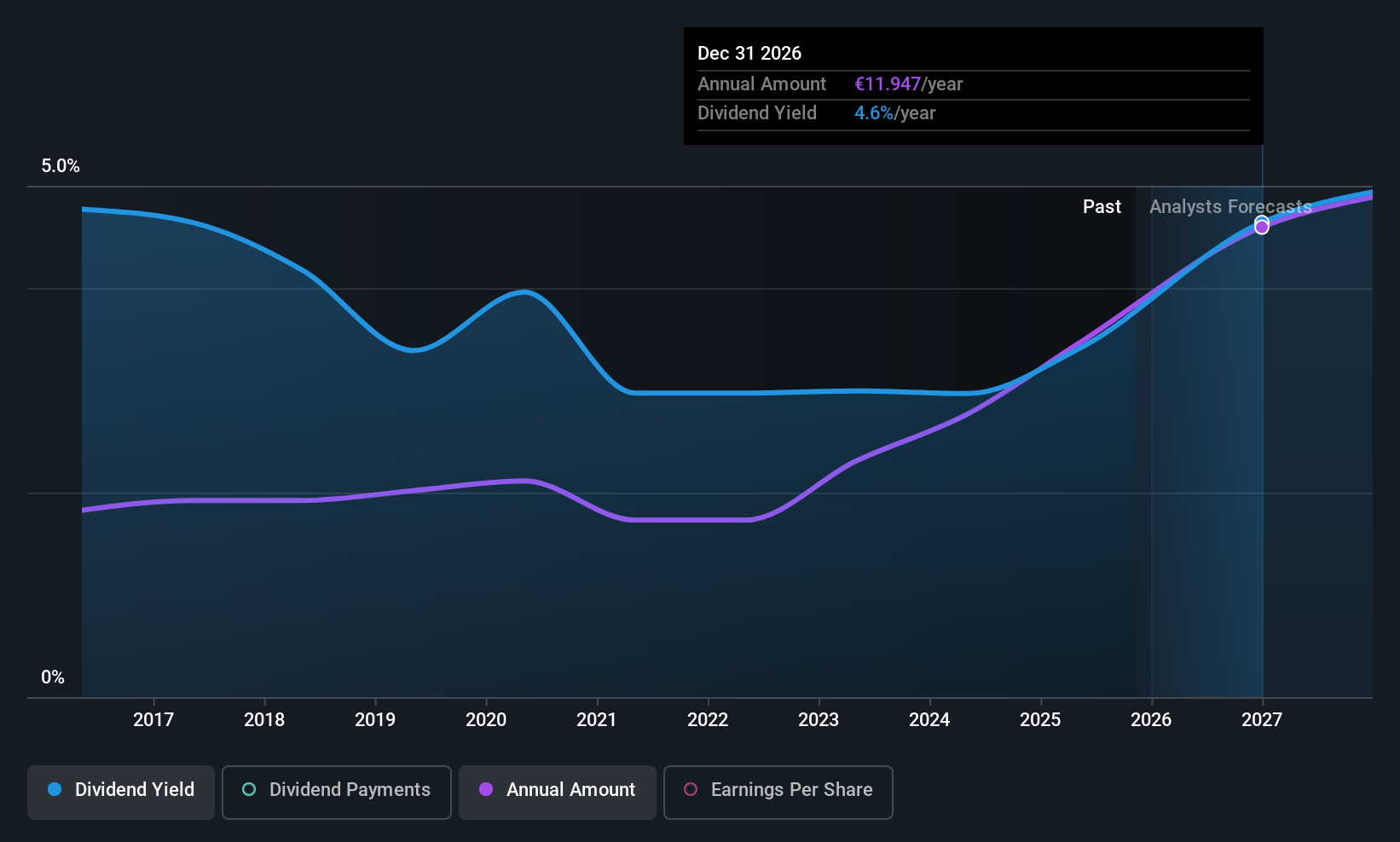

Dividend Yield: 3.5%

Hannover Rück's dividend strategy is robust, supported by a low payout ratio of 34%, ensuring coverage by earnings, and a cash payout ratio of 20.6%. Although its dividend yield of 3.5% is below the top quartile in Germany, dividends have been stable and growing over the past decade. Recent guidance indicates increased earnings expectations for 2025 and beyond, aligning with a new policy to raise the regular dividend payout ratio to around 55% of net income.

- Navigate through the intricacies of Hannover Rück with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Hannover Rück shares in the market.

ProCredit Holding (XTRA:PCZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ProCredit Holding AG, with a market cap of €459.41 million, operates as a commercial bank offering products and services to small and medium enterprises and private customers across Europe, South America, and Germany.

Operations: ProCredit Holding AG generates its revenue primarily through its banking segment, which accounted for €449.56 million.

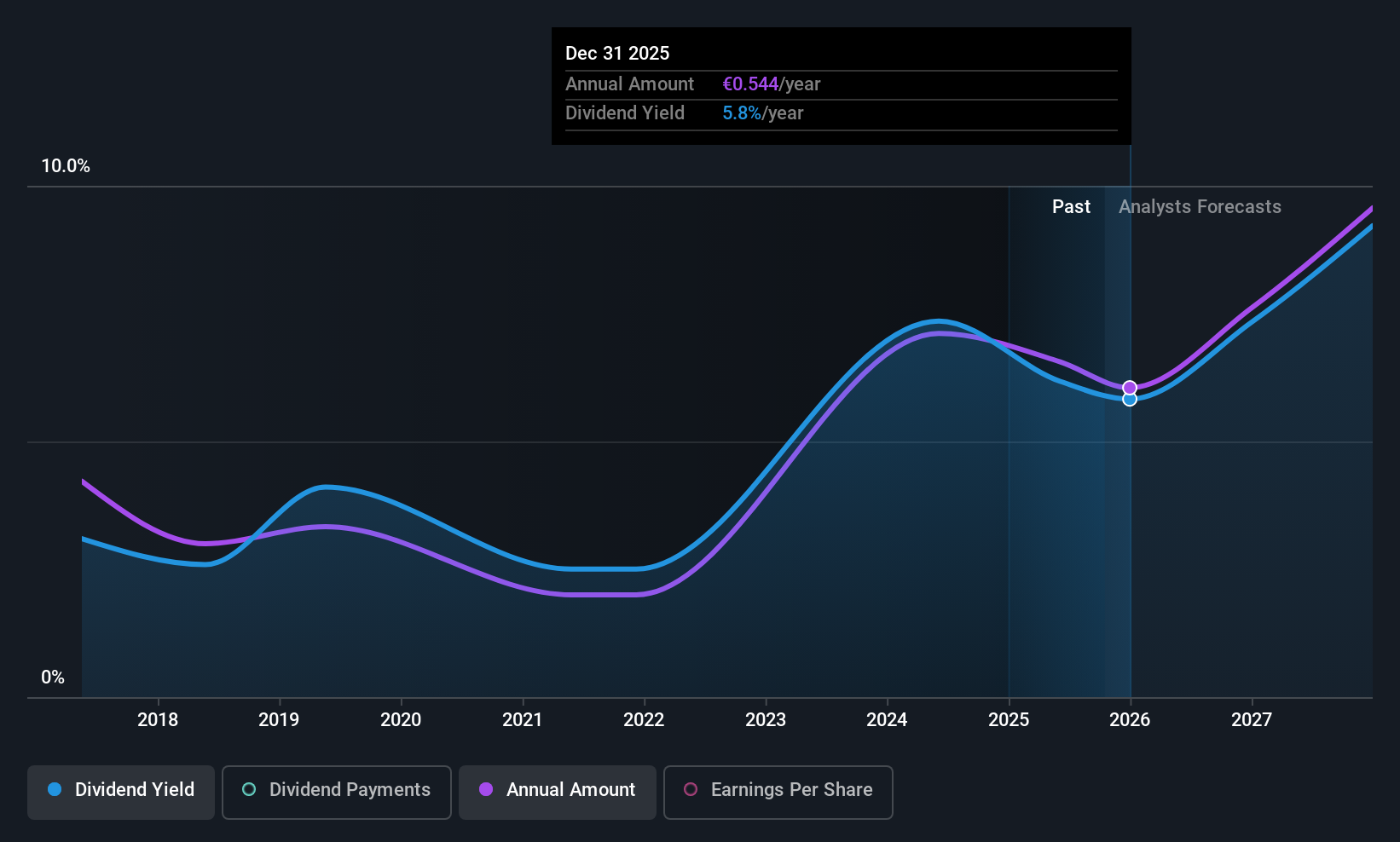

Dividend Yield: 7.6%

ProCredit Holding's dividend yield of 7.56% places it among the top 25% in Germany, though its dividend history is less stable, with payments being volatile over its eight-year track record. Despite this, dividends are well covered by earnings with a payout ratio of 37.1%, and future coverage is expected to improve. Recent inclusion in the S&P Global BMI Index may enhance visibility, although challenges include high non-performing loans at 2.1%.

- Unlock comprehensive insights into our analysis of ProCredit Holding stock in this dividend report.

- Our comprehensive valuation report raises the possibility that ProCredit Holding is priced lower than what may be justified by its financials.

Taking Advantage

- Investigate our full lineup of 225 Top European Dividend Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:PCZ

ProCredit Holding

Provides commercial banking products and services for small and medium enterprises and private customers in Europe, South America, and Germany.

Undervalued with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives