Hannover Rück Leads Trio of Premier German Dividend Stocks

Reviewed by Kshitija Bhandaru

As the German market exhibits stability with a 4.7% increase over the past 12 months, and with expectations of earnings to grow by 13% annually, investors may find reassurance in this steady economic backdrop. In such a climate, dividend stocks like Hannover Rück offer an attractive combination of potential income and growth prospects amidst a market where certain sectors, such as Materials, have recently outperformed.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Edel SE KGaA (XTRA:EDL) | 5.88% | ★★★★★★ |

| FORTEC Elektronik (XTRA:FEV) | 3.76% | ★★★★★☆ |

| Mensch und Maschine Software (XTRA:MUM) | 2.80% | ★★★★★☆ |

| CEWE Stiftung KGaA (XTRA:CWC) | 2.40% | ★★★★★☆ |

| Siemens (XTRA:SIE) | 2.58% | ★★★★★☆ |

| Talanx (XTRA:TLX) | 2.96% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 7.17% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 2.90% | ★★★★★☆ |

| Deutsche Börse (XTRA:DB1) | 2.01% | ★★★★★☆ |

| Hannover Rück (XTRA:HNR1) | 2.51% | ★★★★★☆ |

Click here to see the full list of 23 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Hannover Rück (XTRA:HNR1)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Hannover Rück SE is a global provider of reinsurance products and services, with a market capitalization of approximately €28.88 billion.

Operations: Hannover Rück SE generates the majority of its revenue from Property & Casualty Reinsurance at €24.05 billion, followed by Life and Health Reinsurance contributing €8.51 billion.

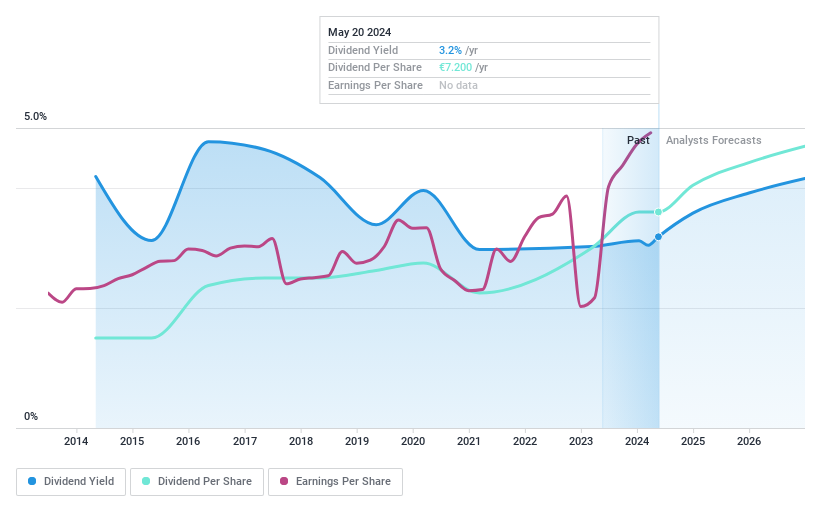

Dividend Yield: 2.5%

Hannover Rück maintains a conservative payout ratio of 35.7%, indicating a well-covered dividend by earnings, complemented by an even lower cash payout ratio at 12.9%. Despite a modest yield of 2.51%, which trails the top quartile of German dividend payers, the firm has demonstrated consistent dividend growth and stability over the past decade. Currently trading at a significant discount to estimated fair value, Hannover Rück combines reliable payouts with potential capital appreciation prospects.

- Navigate through the intricacies of Hannover Rück with our comprehensive dividend report here.

-

Our valuation report unveils the possibility Hannover Rück's shares may be trading at a premium.

Talanx (XTRA:TLX)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Talanx AG is a global provider of insurance and reinsurance products and services, with a market capitalization of approximately €17.42 billion.

Operations: Talanx AG operates through distinct revenue streams, including primary insurance at €34.48 billion and reinsurance with €23.13 billion in contributions to their financial profile.

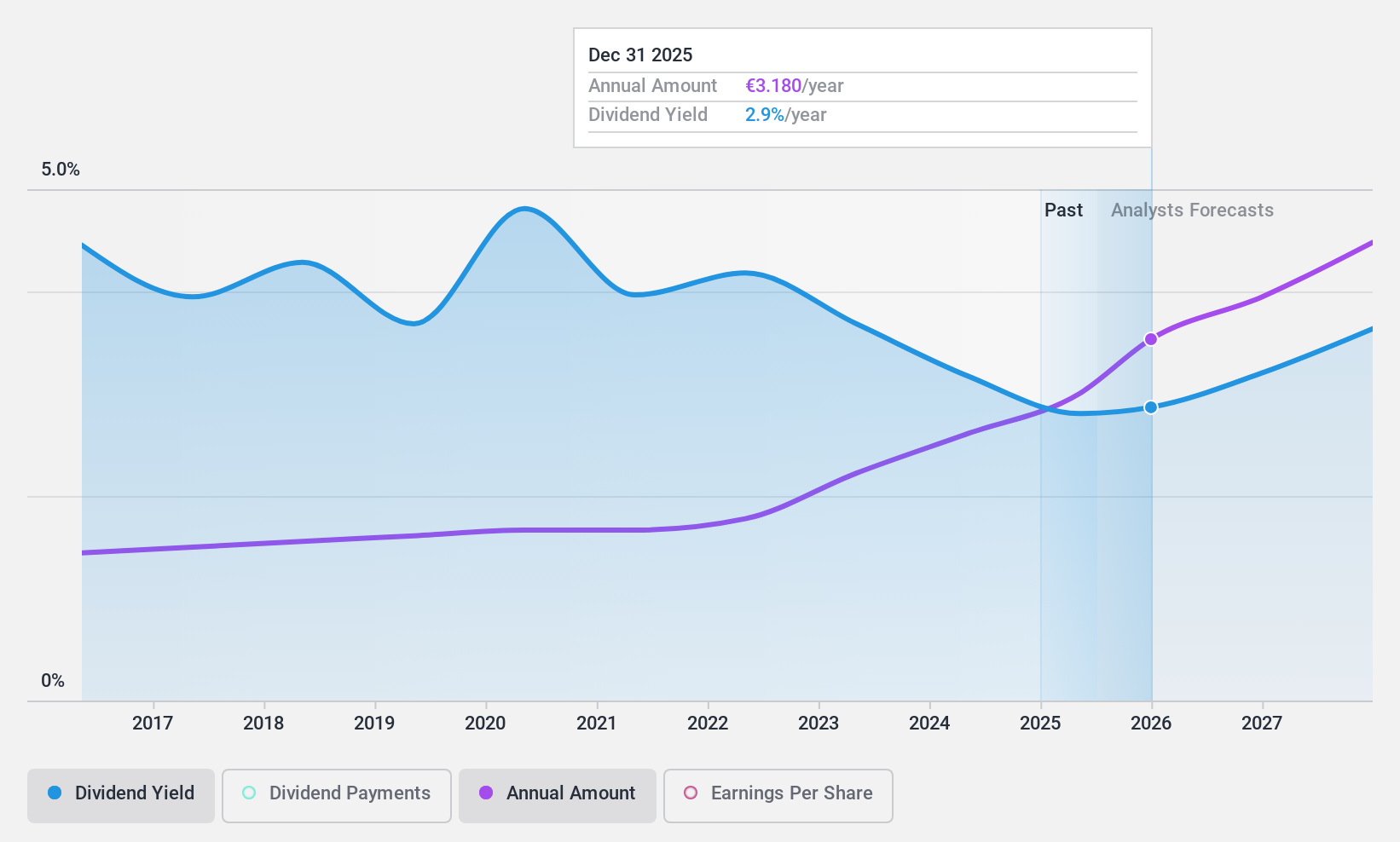

Dividend Yield: 3%

Talanx AG, with a dividend yield of €2.96%, offers investors a steady income stream, supported by a decade of dependable growth and stability in payouts. Earnings are projected to expand annually by 6.51%, ensuring dividends are comfortably covered by earnings (payout ratio: 33.2%) and cash flows (cash payout ratio: 7.8%). Although its yield falls below the top quartile in the German market, Talanx's robust financial health is underscored by trading at 63.4% under its fair value estimate and a strong past year earnings growth of 25.6%.

- Dive into the specifics of Talanx here with our thorough dividend report.

-

Upon reviewing our latest valuation report, Talanx's share price might be too pessimistic.

CEWE Stiftung KGaA (XTRA:CWC)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: CEWE Stiftung KGaA is a Germany-based provider of photo services and online printing, with an international presence and a market capitalization of approximately €712.36 million.

Operations: CEWE Stiftung KGaA generates its revenues primarily from offering photo services and online printing solutions across various international markets.

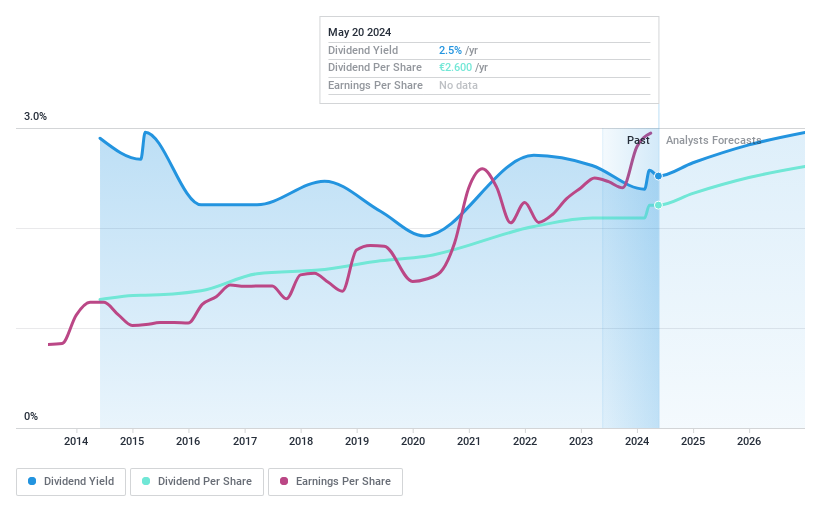

Dividend Yield: 2.4%

CEWE Stiftung KGaA maintains a secure dividend profile with its conservative payout ratios, both from earnings (33.2%) and cash flows (29.6%), indicating sustainability. The company's dividends have not only been consistent but also growing over the past decade, reflecting a commitment to shareholder returns despite a yield of 2.4% that lags behind Germany's top dividend payers. Analyst consensus suggests an upside potential in stock price, while earnings growth forecasts of 5.77% per year and recent appreciation by 10.2% signal a positive outlook for continued dividend support, even as the stock trades significantly below estimated fair value (58.7%).

- Click to explore a detailed breakdown of our findings in CEWE Stiftung KGaA's dividend report.

-

Our valuation report here indicates CEWE Stiftung KGaA may be undervalued.

Key Takeaways

- Click this link to deep-dive into the 23 companies within our Top Dividend Stocks screener.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St , where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore small companies with big growth potential before they take off.

- Fuel your portfolio with fast-growing stocks poised for rapid expansion .

- Play it safe and steady with these reliable blue chips that offer both stability and growth.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hannover Rück might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:HNR1

Hannover Rück

Provides reinsurance products and services in Germany, the United Kingdom, France, Europe, the United States, Asia, Australia, Africa, and internationally.

Solid track record established dividend payer.

Similar Companies

Market Insights

Community Narratives