Top German Dividend Stocks: Allianz And 2 More Yielding Investments

Reviewed by Simply Wall St

The German market has shown robust performance recently, with the DAX climbing 3.38% amid growing hopes for interest rate cuts. In this favorable economic environment, dividend stocks can offer a reliable income stream and potential for capital appreciation. When selecting dividend stocks, it is crucial to consider factors such as the company's financial health, consistent earnings growth, and a solid track record of paying dividends. With these criteria in mind, let's explore three top German dividend stocks: Allianz and two other yielding investments that stand out in today's market conditions.

Top 10 Dividend Stocks In Germany

| Name | Dividend Yield | Dividend Rating |

| Allianz (XTRA:ALV) | 5.12% | ★★★★★★ |

| Deutsche Post (XTRA:DHL) | 4.84% | ★★★★★★ |

| All for One Group (XTRA:A1OS) | 3.08% | ★★★★★☆ |

| MLP (XTRA:MLP) | 5.11% | ★★★★★☆ |

| OVB Holding (XTRA:O4B) | 4.76% | ★★★★★☆ |

| Mercedes-Benz Group (XTRA:MBG) | 8.73% | ★★★★★☆ |

| Südzucker (XTRA:SZU) | 7.43% | ★★★★★☆ |

| Uzin Utz (XTRA:UZU) | 3.36% | ★★★★★☆ |

| MVV Energie (XTRA:MVV1) | 3.78% | ★★★★★☆ |

| FRoSTA (DB:NLM) | 3.28% | ★★★★★☆ |

Click here to see the full list of 31 stocks from our Top German Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

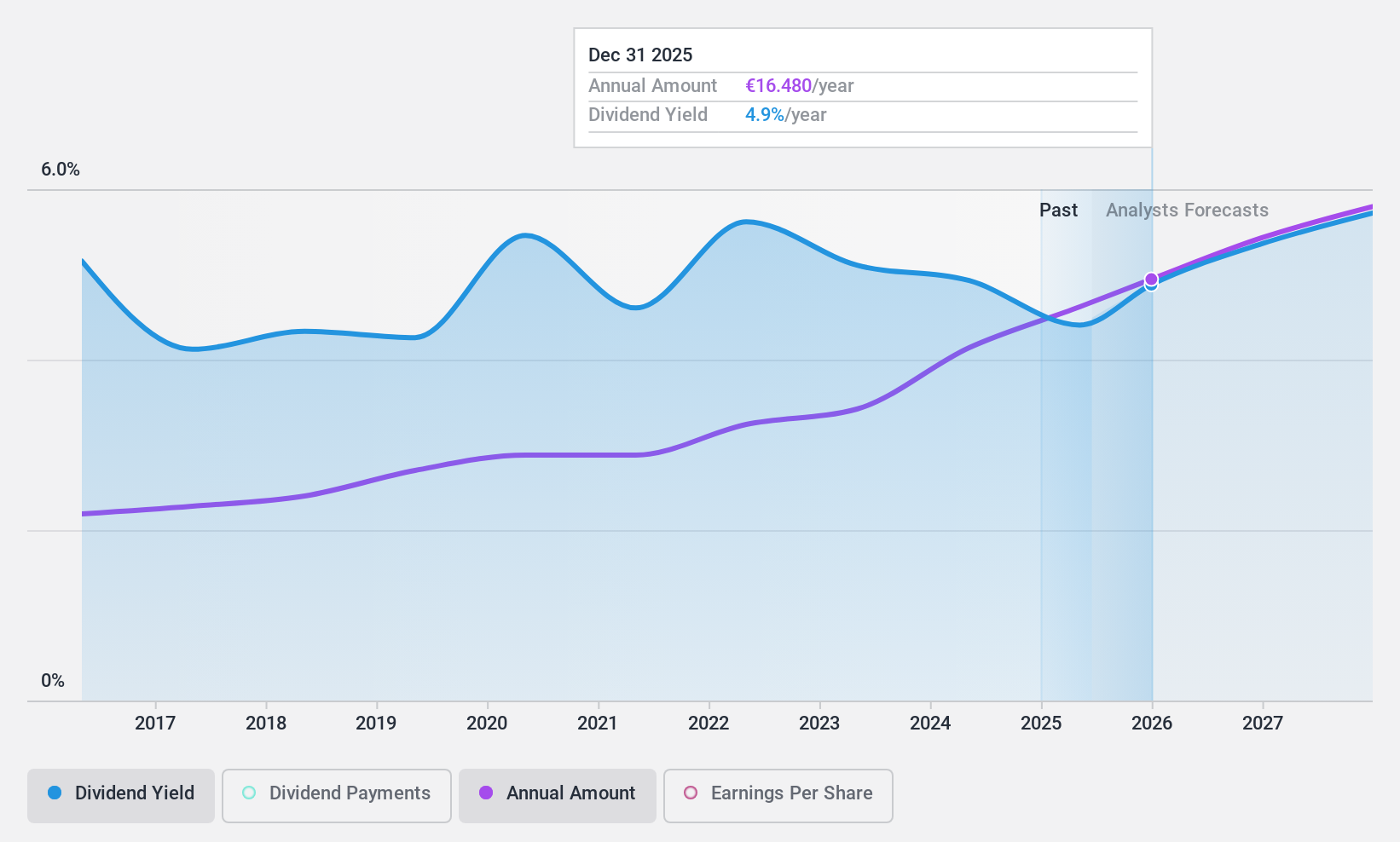

Allianz (XTRA:ALV)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Allianz SE, along with its subsidiaries, offers property-casualty insurance, life/health insurance, and asset management services globally, with a market cap of approximately €104.55 billion.

Operations: Allianz SE generates revenue from property-casualty insurance (€74.95 billion), life/health insurance (€45.52 billion), and asset management (€3.34 billion) services worldwide.

Dividend Yield: 5.1%

Allianz SE's dividend payments are well-covered by both earnings (60% payout ratio) and free cash flows (23.1% cash payout ratio), ensuring sustainability. Dividends have been stable and growing over the past 10 years, with a current yield of 5.12%, placing it among the top 25% of German dividend payers. Recent news includes a new partnership with Jetty and Fortegra, reaffirmed earnings guidance for 2024, and robust half-year financial results showing net income growth to €4.99 billion from €4.37 billion last year.

- Get an in-depth perspective on Allianz's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that Allianz is trading behind its estimated value.

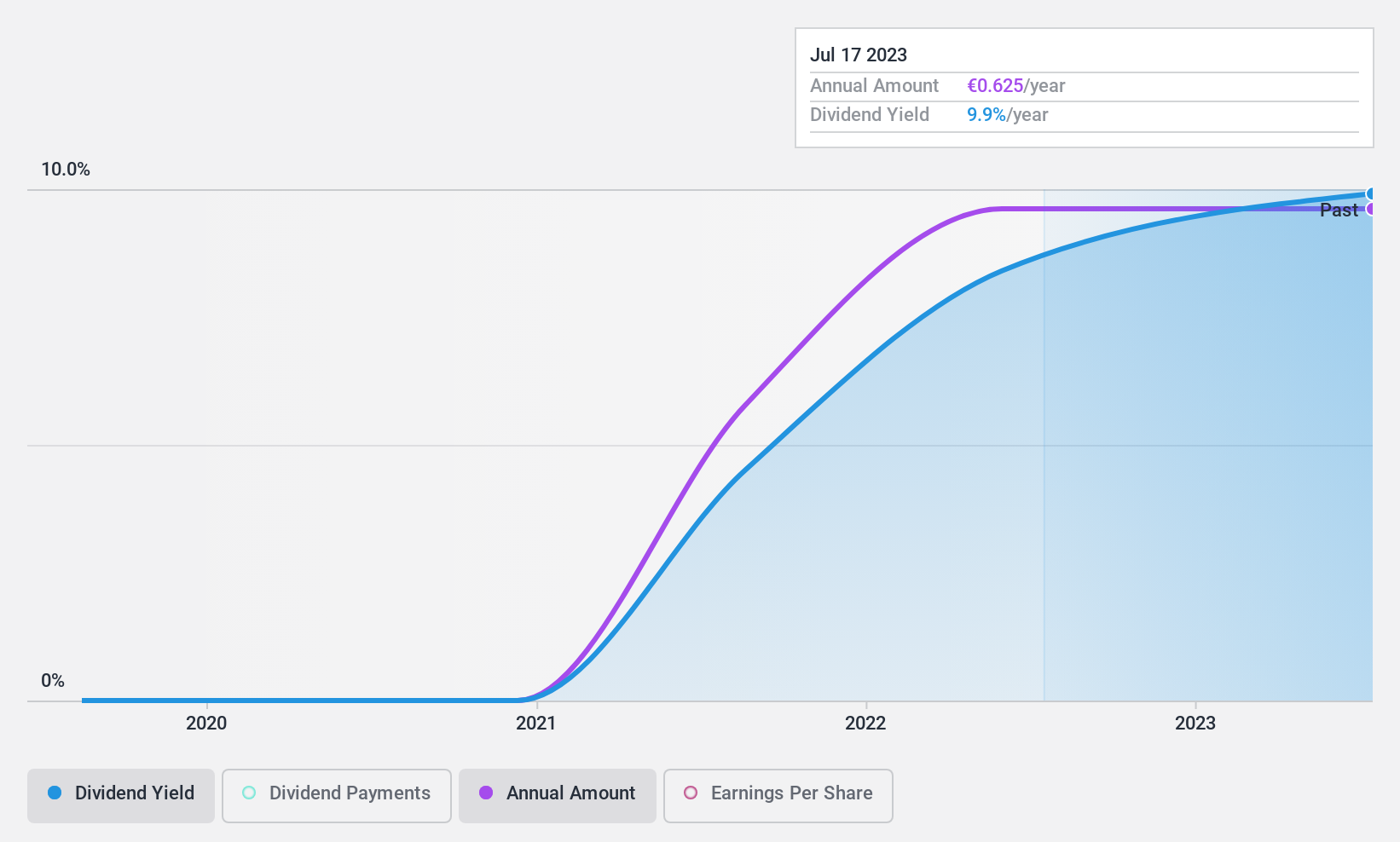

CR Energy (XTRA:CRZK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CR Energy AG is an investment company focused on investing in technology companies in Germany, with a market cap of €151.47 million.

Operations: CR Energy AG generates revenue primarily from its Real Estate - Rental segment, which amounts to €68.57 million.

Dividend Yield: 9.7%

CR Energy AG's dividend yield of 9.71% places it in the top 25% of German dividend payers, though the company has only paid dividends for seven years. Despite recent revenue and net income declines to €68.64 million and €65.78 million respectively, dividends remain well-covered by earnings (22.4% payout ratio) and cash flows (62.6% cash payout ratio). Shareholder dilution over the past year is a concern, but overall value remains attractive at 49.9% below fair value estimates.

- Click here to discover the nuances of CR Energy with our detailed analytical dividend report.

- Our valuation report here indicates CR Energy may be undervalued.

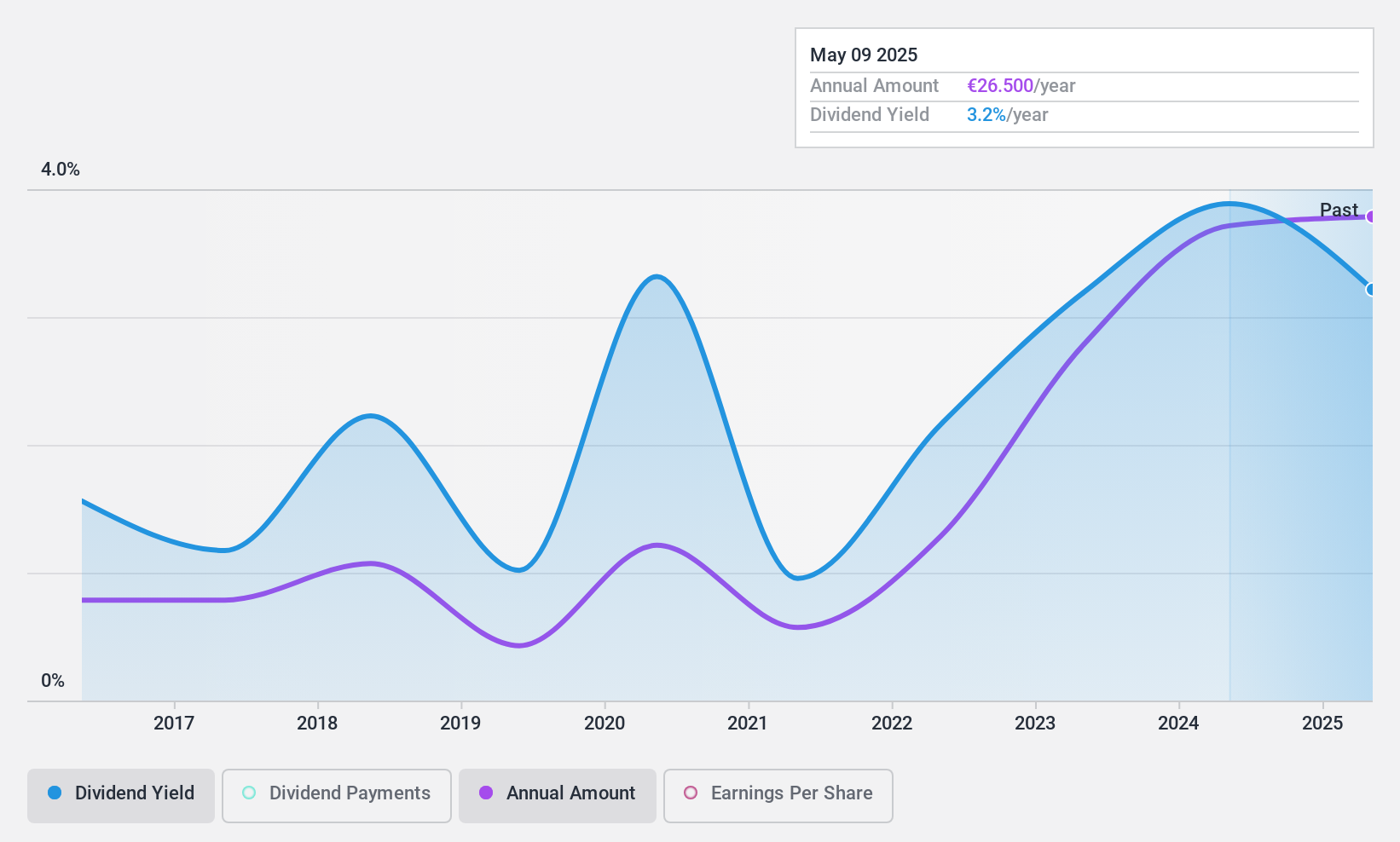

KSB SE KGaA (XTRA:KSB)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: KSB SE & Co. KGaA, with a market cap of €1.13 billion, manufactures and supplies pumps, valves, and related services globally through its subsidiaries.

Operations: KSB SE & Co. KGaA generates revenue from three primary segments: €1.52 billion from Pumps, €370.94 million from Fittings, and €978.20 million from KSB Supremeserv.

Dividend Yield: 3.9%

KSB SE KGaA's dividend payments are well-covered by earnings (29.9% payout ratio) and cash flows (24.2% cash payout ratio). However, its 3.88% dividend yield is lower than the top 25% of German dividend payers. Despite a volatile dividend track record, KSB has increased dividends over the past decade and trades at a significant discount to estimated fair value (77.2%). Recent half-year earnings showed sales of €1.44 billion with net income slightly down to €58.2 million from €62 million last year.

- Delve into the full analysis dividend report here for a deeper understanding of KSB SE KGaA.

- Insights from our recent valuation report point to the potential undervaluation of KSB SE KGaA shares in the market.

Key Takeaways

- Navigate through the entire inventory of 31 Top German Dividend Stocks here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ALV

Allianz

Provides property-casualty insurance, life/health insurance, and asset management products and services Internationally.

6 star dividend payer and undervalued.

Similar Companies

Market Insights

Community Narratives