Does Allianz Still Offer Value After a 25.8% Share Price Rally in 2025?

Reviewed by Bailey Pemberton

- Wondering if Allianz stock is still a great buy or if the price has run too far? You are not alone. Figuring out if a stock is undervalued or overvalued is crucial for making confident investment decisions.

- Allianz’s share price has been on a roll lately, climbing 3.9% over the past week and notching an impressive 25.8% gain since the start of the year.

- Recent headlines have highlighted Allianz’s continued sector leadership, driven by strong insurance demand and positive sentiment around its diversified business model. News of fresh regulatory clarity for the European insurance industry has also contributed to the stock’s upward momentum, with investors now taking a closer look at its growth plans.

- When it comes to valuation, Allianz currently scores 2 out of 6 on our value checks. This suggests there is still more to explore beneath the surface. In the next section, we will break down how different valuation methods stack up and share a smarter approach to truly understanding what Allianz is worth.

Allianz scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Allianz Excess Returns Analysis

The Excess Returns Model examines how much profit a company generates over and above what shareholders require as compensation for their capital. In other words, it focuses on the return Allianz earns on its invested equity versus its cost of equity, giving investors a clear view of value creation beyond just growth.

For Allianz, the numbers indicate strong performance. The company’s book value is €158.34 per share, with a projected stable book value of €178.68 per share based on estimates from six analysts. Its stable earnings per share (EPS), calculated using a weighted average of future Return on Equity from seven analysts, is €33.08. The cost of equity is €8.81 per share, implying that every year, Allianz creates an excess return of €24.27 per share for its investors. The long-run average Return on Equity is 18.51%, reflecting a robust capacity to consistently outpace its cost of capital.

The model estimates Allianz’s intrinsic value to be roughly 58.5% above the current market price, which suggests the stock is undervalued at present. Put simply, Allianz’s fundamental return metrics are compelling and may signal value for long-term investors.

Result: UNDERVALUED

Our Excess Returns analysis suggests Allianz is undervalued by 58.5%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

Approach 2: Allianz Price vs Earnings

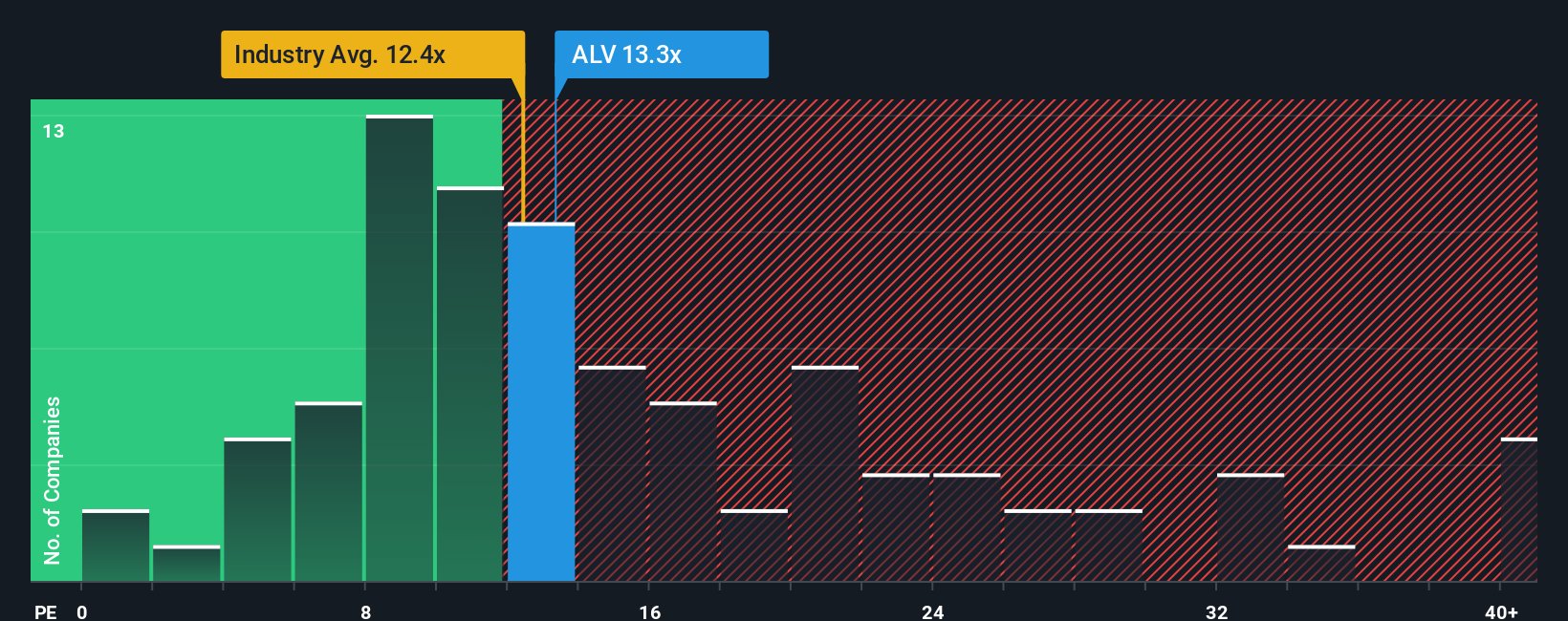

The Price-to-Earnings (PE) ratio is a widely used valuation metric for profitable companies like Allianz because it reflects how much investors are willing to pay today for each euro of earnings. This makes the PE ratio especially useful for stable, established businesses where profits are a key measure of value.

A fair or “normal” PE ratio is shaped by several factors, including the company’s expected growth rate and overall risk profile. Fast-growing or less risky companies typically command higher PE multiples, while those with slower growth or greater risk are priced more conservatively by the market.

At present, Allianz trades at a PE ratio of 13.6x. This is above the insurance industry average of 11.7x and in line with the average of its direct peers at 13.3x. To drill deeper, Simply Wall St’s proprietary “Fair Ratio” for Allianz is 13.0x. The Fair Ratio adjusts for a company’s growth prospects, profit margins, risks, market capitalization, and industry context, giving a more tailored benchmark than simple peer or industry averages.

Because the Fair Ratio considers more company-specific details than broader averages, it offers a sharper lens for investors seeking a complete valuation assessment. Allianz’s current PE multiple is only marginally above its Fair Ratio, with a difference of less than 0.10. This indicates the stock is likely trading at a fair price when considering its fundamentals.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1433 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Allianz Narrative

Earlier we mentioned there is an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is a simple, user-driven story that ties together your expectations, assumptions, and personal perspective about a company’s future, connecting its business outlook, financial forecast, and what you believe is a fair value for the stock.

Rather than focusing solely on ratios and models, Narratives let you tell the story behind the numbers. For example, you can develop your own estimates for Allianz’s future revenue, earnings, and profit margins based on how you see the business evolving over time. Narratives bring these assumptions to life by linking your outlook directly to a fair value and comparing it to the current share price, which makes it easier to evaluate your investment thesis as the story unfolds.

Narratives are easy to create and update on Simply Wall St’s Community page, where millions of investors discuss and share their outlooks. When new news or results come in, your Narrative and its fair value adjust automatically to help you stay informed with minimal effort.

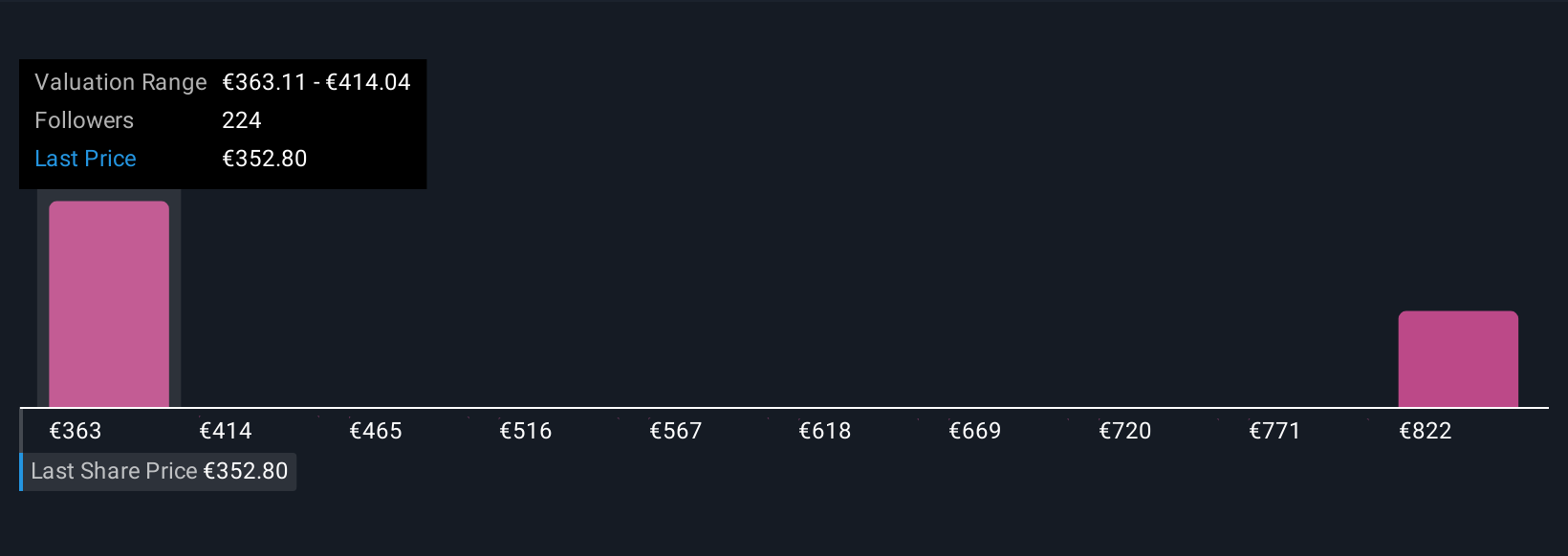

For example, some Allianz investors use bullish Narratives, assuming revenues reach €198 billion and margins remain stable, giving fair values near €431 per share. Others, concerned about shrinking margins or macro risks, see fair value closer to €311. Whichever Narrative fits your perspective, you remain in control of the story and decision process.

Do you think there's more to the story for Allianz? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About XTRA:ALV

Allianz

Provides property-casualty insurance, life/health insurance, and asset management products and services Internationally.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success