- Germany

- /

- Healthcare Services

- /

- DB:MAK

Introducing Maternus-Kliniken (FRA:MAK), The Stock That Soared 498% In The Last Five Years

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

For many, the main point of investing in the stock market is to achieve spectacular returns. While the best companies are hard to find, but they can generate massive returns over long periods. For example, the Maternus-Kliniken Aktiengesellschaft (FRA:MAK) share price is up a whopping 498% in the last half decade, a handsome return for long term holders. If that doesn't get you thinking about long term investing, we don't know what will. Then again, the 9.2% share price decline hasn't been so fun for shareholders.

Check out our latest analysis for Maternus-Kliniken

Given that Maternus-Kliniken didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Shareholders of unprofitable companies usually expect strong revenue growth. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last 5 years Maternus-Kliniken saw its revenue grow at 2.2% per year. That's not a very high growth rate considering the bottom line. So shareholders should be pretty elated with the 43% increase per year, in that time. We'll tip our hats to that, any day, but the top-line growth isn't particularly impressive when you compare it to other pre-profit companies. It's not immediately obvious to us why the market has been so enthusiastic about the stock, but a more detailed look at revenue and profit trends might reveal why shareholders are optimistic.

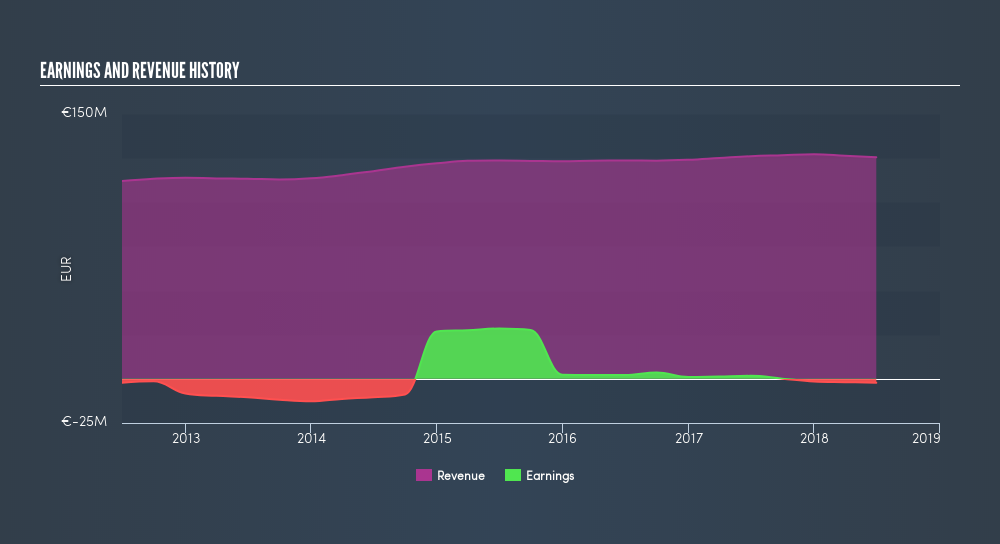

The graphic below shows how revenue and earnings have changed as management guided the business forward. If you want to see cashflow, you can click on the chart.

This free interactive report on Maternus-Kliniken's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We regret to report that Maternus-Kliniken shareholders are down 25% for the year. Unfortunately, that's worse than the broader market decline of 4.4%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. On the bright side, long term shareholders have made money, with a gain of 43% per year over half a decade. If the fundamental data continues to indicate long term sustainable growth, the current sell-off could be an opportunity worth considering. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

We will like Maternus-Kliniken better if we see some big insider buys. While we wait, check out this freelist of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on DE exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About DB:MAK

Maternus-Kliniken

Operates retirement and nursing homes, rehabilitation clinics, and various service companies that operate in the field of geriatric care and rehabilitation medicine.

Good value low.

Similar Companies

Market Insights

Community Narratives