- Germany

- /

- Healthcare Services

- /

- DB:EIF

Investors Still Aren't Entirely Convinced By MedNation AG's (FRA:EIF) Revenues Despite 31% Price Jump

MedNation AG (FRA:EIF) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 22% in the last twelve months.

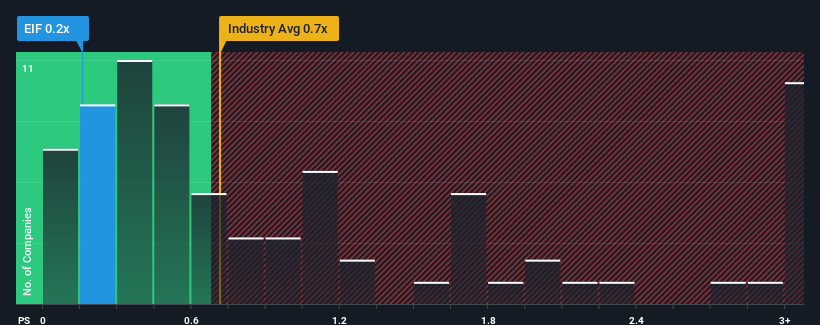

Even after such a large jump in price, there still wouldn't be many who think MedNation's price-to-sales (or "P/S") ratio of 0.2x is worth a mention when the median P/S in Germany's Healthcare industry is similar at about 0.5x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for MedNation

What Does MedNation's Recent Performance Look Like?

It looks like revenue growth has deserted MedNation recently, which is not something to boast about. Perhaps the market believes the recent run-of-the-mill revenue performance isn't enough to outperform the industry, which has kept the P/S muted. If not, then existing shareholders may be feeling hopeful about the future direction of the share price.

We don't have analyst forecasts, but you can see how recent trends are setting up the company for the future by checking out our free report on MedNation's earnings, revenue and cash flow.What Are Revenue Growth Metrics Telling Us About The P/S?

MedNation's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

If we review the last year of revenue, the company posted a result that saw barely any deviation from a year ago. Whilst it's an improvement, it wasn't enough to get the company out of the hole it was in, with revenue down 5.4% overall from three years ago. So unfortunately, we have to acknowledge that the company has not done a great job of growing revenue over that time.

Weighing that medium-term revenue trajectory against the broader industry's one-year forecast for a contraction of 22% shows the industry is even less attractive on an annualised basis.

With this information, it's perhaps curious but not a major surprise that MedNation is trading at a fairly similar P/S in comparison. There's no guarantee the P/S has found a floor yet with recent revenue going backwards, despite the industry heading down even harder. It's conceivable that the P/S falls to lower levels if the company doesn't improve its top-line growth, which would be difficult to do with the current industry outlook.

The Final Word

MedNation appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

We've established that MedNation currently trades on a slightly lower than expected P/S if you consider its recent three-year revenues aren't as bad as the forecasts for a struggling industry. The fact that the company's P/S is on par with the industry despite the fact that it outperformed it could be an indication of some unobserved threats to future revenues. Perhaps investors have reservations about the company's ability to sustain this level of performance amidst the challenging industry conditions. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

Before you settle on your opinion, we've discovered 3 warning signs for MedNation that you should be aware of.

If these risks are making you reconsider your opinion on MedNation, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About DB:EIF

MedNation

Operates facilities for outpatient and inpatient orthopedics, geriatrics, and internal medicine in Germany.

Good value slight.

Market Insights

Community Narratives