- Germany

- /

- Healthcare Services

- /

- XTRA:V3V

VITA 34 AG's (ETR:V3V) CEO Compensation Looks Acceptable To Us And Here's Why

Despite strong share price growth of 39% for VITA 34 AG (ETR:V3V) over the last few years, earnings growth has been disappointing, which suggests something is amiss. Some of these issues will occupy shareholders' minds as the AGM rolls around on 15 December 2021. One way that shareholders can influence managerial decisions is through voting on CEO and executive remuneration packages, which studies show could impact company performance. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

View our latest analysis for VITA 34

Comparing VITA 34 AG's CEO Compensation With the industry

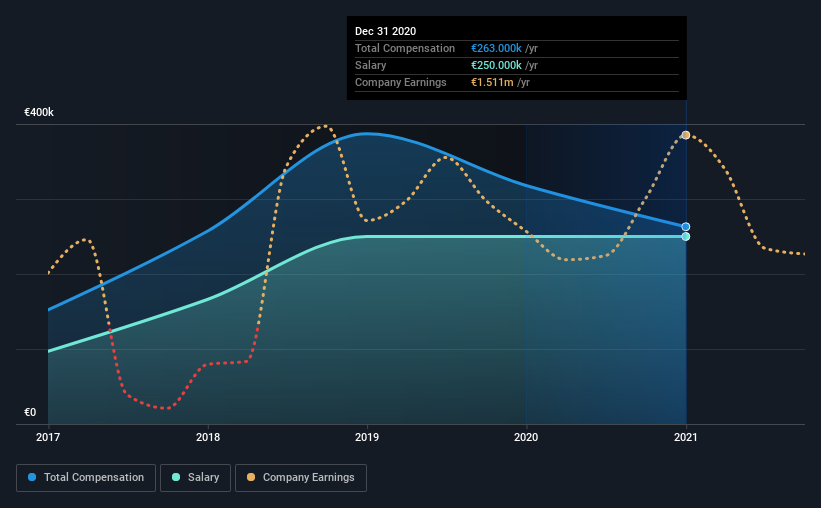

Our data indicates that VITA 34 AG has a market capitalization of €262m, and total annual CEO compensation was reported as €263k for the year to December 2020. Notably, that's a decrease of 17% over the year before. In particular, the salary of €250.0k, makes up a huge portion of the total compensation being paid to the CEO.

For comparison, other companies in the same industry with market capitalizations ranging between €89m and €356m had a median total CEO compensation of €263k. This suggests that VITA 34 remunerates its CEO largely in line with the industry average.

| Component | 2020 | 2019 | Proportion (2020) |

| Salary | €250k | €250k | 95% |

| Other | €13k | €68k | 5% |

| Total Compensation | €263k | €318k | 100% |

Talking in terms of the industry, salary represented approximately 30% of total compensation out of all the companies we analyzed, while other remuneration made up 70% of the pie. VITA 34 has gone down a largely traditional route, paying Wolfgang Knirsch a high salary, giving it preference over non-salary benefits. If salary dominates total compensation, it suggests that CEO compensation is leaning less towards the variable component, which is usually linked with performance.

VITA 34 AG's Growth

Over the last three years, VITA 34 AG has shrunk its earnings per share by 54% per year. In the last year, its revenue is up 11%.

The decline in EPS is a bit concerning. While the revenue growth is good to see, it is outweighed by the fact that EPS are down, over three years. So given this relatively weak performance, shareholders would probably not want to see high compensation for the CEO. Looking ahead, you might want to check this free visual report on analyst forecasts for the company's future earnings..

Has VITA 34 AG Been A Good Investment?

We think that the total shareholder return of 39%, over three years, would leave most VITA 34 AG shareholders smiling. So they may not be at all concerned if the CEO were to be paid more than is normal for companies around the same size.

To Conclude...

VITA 34 pays its CEO a majority of compensation through a salary. While the return to shareholders does look promising, it's hard to ignore the lack of earnings growth and this makes us question whether these strong returns will continue. In the upcoming AGM, shareholders will get the opportunity to discuss any concerns with the board, including those related to CEO remuneration and assess if the board's plan will likely improve performance in the future.

We can learn a lot about a company by studying its CEO compensation trends, along with looking at other aspects of the business. In our study, we found 2 warning signs for VITA 34 you should be aware of, and 1 of them can't be ignored.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:V3V

FamiCord

Engages in the collection, processing, cryopreservation, and storage of stem cells from umbilical cord blood and tissue and postnatal tissue in Germany, Poland, Portugal, and internationally.

Moderate growth potential and slightly overvalued.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success