- Germany

- /

- Healthtech

- /

- XTRA:M3V

Most Shareholders Will Probably Find That The CEO Compensation For MeVis Medical Solutions AG (ETR:M3V) Is Reasonable

Despite MeVis Medical Solutions AG's (ETR:M3V) share price growing positively in the past few years, the per-share earnings growth has not grown to investors' expectations, suggesting that there could be other factors at play driving the share price. The upcoming AGM on 23 March 2022 may be an opportunity for shareholders to bring up any concerns they may have for the board’s attention. It would also be an opportunity for them to influence management through exercising their voting power on company resolutions, including CEO and executive remuneration, which could impact on firm performance in the future. From the data that we gathered, we think that shareholders should hold off on a raise on CEO compensation until performance starts to show some improvement.

See our latest analysis for MeVis Medical Solutions

Comparing MeVis Medical Solutions AG's CEO Compensation With the industry

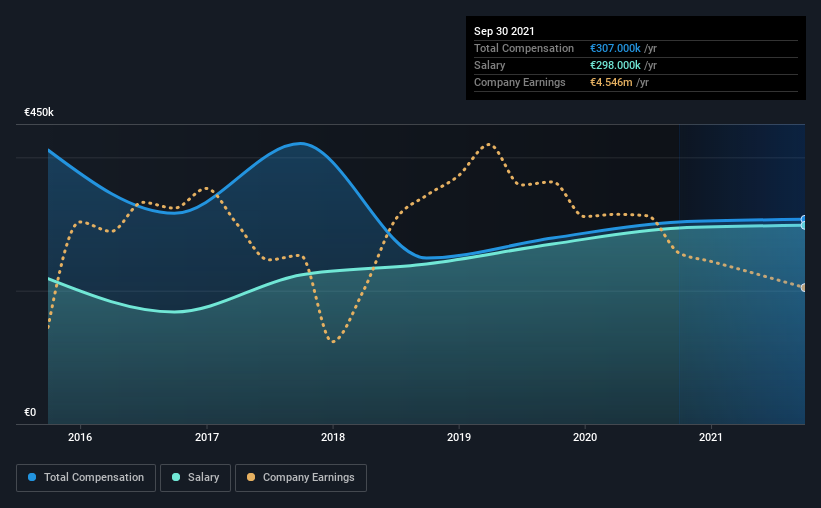

At the time of writing, our data shows that MeVis Medical Solutions AG has a market capitalization of €58m, and reported total annual CEO compensation of €307k for the year to September 2021. This means that the compensation hasn't changed much from last year. Notably, the salary which is €298.0k, represents most of the total compensation being paid.

For comparison, other companies in the industry with market capitalizations below €182m, reported a median total CEO compensation of €258k. From this we gather that Marcus Kirchhoff is paid around the median for CEOs in the industry.

| Component | 2021 | 2020 | Proportion (2021) |

| Salary | €298k | €294k | 97% |

| Other | €9.0k | €9.0k | 3% |

| Total Compensation | €307k | €303k | 100% |

Speaking on an industry level, nearly 74% of total compensation represents salary, while the remainder of 26% is other remuneration. MeVis Medical Solutions is focused on going down a more traditional approach and is paying a higher portion of compensation through salary, as compared to non-salary benefits. If total compensation veers towards salary, it suggests that the variable portion - which is generally tied to performance, is lower.

A Look at MeVis Medical Solutions AG's Growth Numbers

Over the last three years, MeVis Medical Solutions AG has shrunk its earnings per share by 16% per year. Its revenue is down 5.4% over the previous year.

Overall this is not a very positive result for shareholders. This is compounded by the fact revenue is actually down on last year. It's hard to argue the company is firing on all cylinders, so shareholders might be averse to high CEO remuneration. Although we don't have analyst forecasts, you might want to assess this data-rich visualization of earnings, revenue and cash flow.

Has MeVis Medical Solutions AG Been A Good Investment?

MeVis Medical Solutions AG has generated a total shareholder return of 9.7% over three years, so most shareholders wouldn't be too disappointed. Although, there's always room to improve. In light of that, investors might probably want to see an improvement on their returns before they feel generous about increasing the CEO remuneration.

In Summary...

Marcus receives almost all of their compensation through a salary. Despite the positive returns on shareholders' investments, the fact that earnings have failed to grow makes us skeptical about whether these returns will continue. Shareholders should make the most of the coming opportunity to question the board on key concerns they may have and revisit their investment thesis with regards to the company.

CEO compensation is an important area to keep your eyes on, but we've also need to pay attention to other attributes of the company. We identified 2 warning signs for MeVis Medical Solutions (1 is a bit unpleasant!) that you should be aware of before investing here.

Of course, you might find a fantastic investment by looking at a different set of stocks. So take a peek at this free list of interesting companies.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About XTRA:M3V

MeVis Medical Solutions

Develops, markets, and sells software for recording, analyzing, and evaluating image data to manufacturers of medical devices, providers of medical IT platforms, and clinical end customers in the United States and Europe.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives